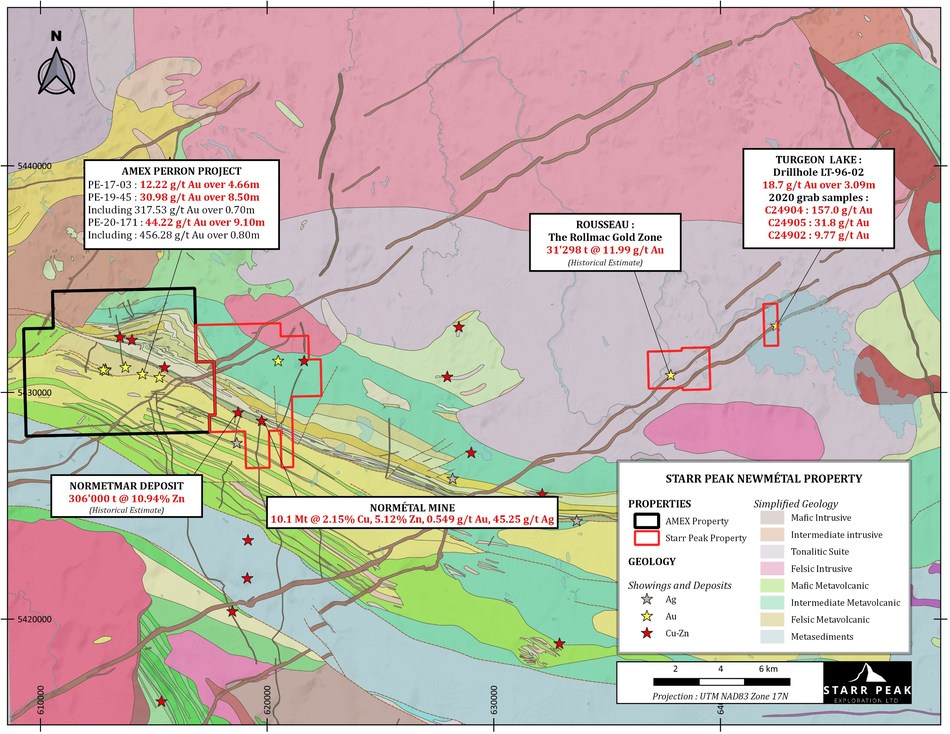

Starr Peak Exploration (TSXV: STE) is stepping up its current drill program. The company this morning announced that it will be adding a second drill rig to its current exploration program at its flagship NewMetal Property.

The drill rig, which is anticipated to arrive on site next week, is set to focus on high priority BHEM anomalies that lead into the Normetmar deposit from the Normetal Mine. Normetal is a historic mine on the firms property that saw 10.1 million tonnes of ore removed at grades of 2.15% copper, 5.12% zinc, 0.549 g/t gold and 45.25 g/t silver.

The anomalies being focused on are the positive results of a geophysical survey conducted on the Main bloc of its NewMetal property. Surveying came from a historical hole that was reopened to allow for a geophysical borehole electromagnetic survey, with an additional two holes then surveyed thereafter. The survey resulted in the discovery of three anomalies, with the area of conductance being untested to date.

“With a second rig now coming on the property, we are now able to test with more efficiency highly prospective geophysics and newly defined targets. We have been thrilled with the drilling to date and this will speed up our current drill program on our highly-prospective Newmétal property, neighbouring Amex Exploration’s Perron project. We look forward to providing shareholders with an update on the drill program in the very near future.”

Johnathan More, Chairman and CEO of Starr Peak

Initial targets for the drill program have been historically drilled and known mineralization showing trend at depth.

Starr Peak Exploration last traded at $1.86 on the TSX Venture.

FULL DISCLOSURE: Starr Peak Exploration is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Starr Peak Exploration on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.