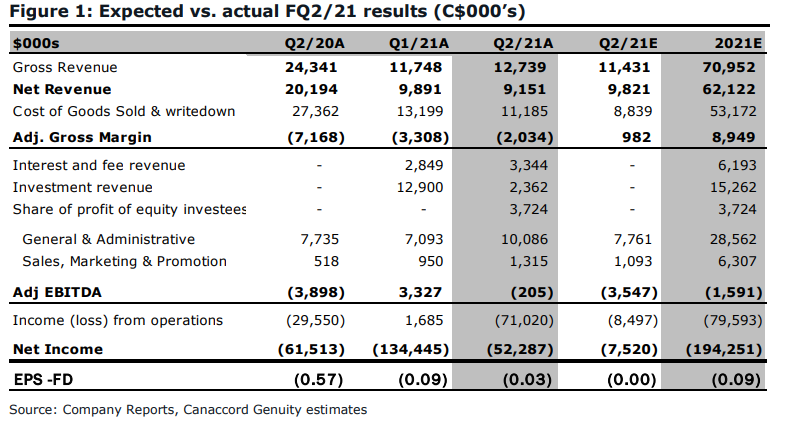

Sundial Growers (NASDAQ: SNDL) reported its second quarter financial results on August 12. The company announced net revenues of $9.15 million, slightly lower than their $9.89 million first quarter revenue. The company, once again, had negative gross margins as the company’s cost of sales was $9.5 million. The company had a flat Adjusted EBITDA number, down from the $3.3 million in the first quarter but they did postan improved net loss.

One of the 5 analysts that cover the firm increased their 12-month price target on Sundial, bringing the consensus average up to $0.69, from $0.60. Out of the 5 analysts, 4 have hold ratings and 1 has a sell rating. The street high sits at $0.80 from ATB Capital Markets, while the lowest comes in at $0.45.

Canaccord Genuity was the single firm to raise its 12-month price target. They raised it to $0.75 from $0.70 and reiterated their hold rating on the name saying that the cannabis operations remained flat while its investments are starting to bear fruit.

For the second quarter, Sundial’s top-line game was in line with Canaccord’s estimates while everything else basically missed. For the top-line, Canaccord says that this shows that Canada is still in a challenging operating environment but the revenue beat shows that Sundial is making headway into transitioning to higher-margin products rather than the value segment.

For specific revenue segments, Sundial’s oil segment grew 60%, while its vape segment dropped 70%. Management has reiterated their plan of grabbing core/premium segments with a new 22%+ THC strain releasing by the end of the year. Canaccord says, “We continue to believe that management’s decision to limit discount offerings (a segment that continues to capture a majority of the market) will negatively impact brand awareness in the short term.”

The company ended the quarter with $760 million in total cash and equivalents. This sets the company up to keep on finding attractive investments, which has earned the company $3.7 million of net profits.

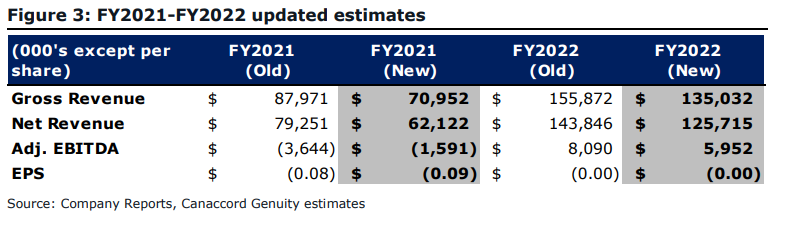

Below you can see Canaccord’s updated full year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.