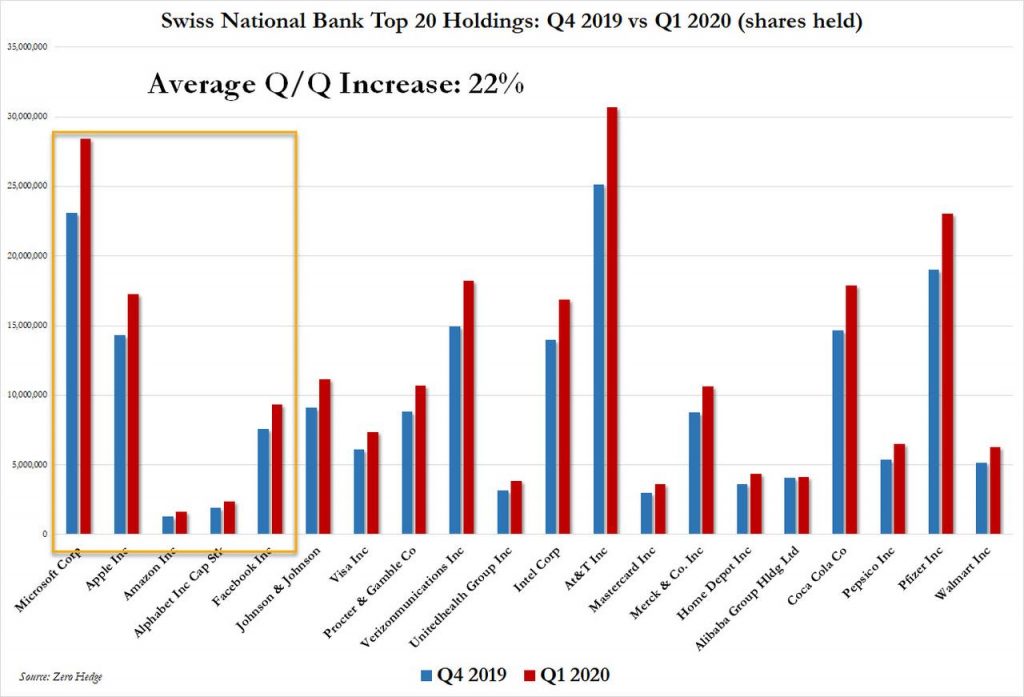

As the stock market crashed by nearly 30% in March amid the coronavirus pandemic, there have been several US-based conglomerate stocks faring quite well in the aftermath. According to form filed with the Securities and Exchange Commission, the Swiss National Bank (SNB) went on a wild spending spree, increasing its top 20 holdings by nearly 22%.

In the US, the Fed has been obscurely purchasing ETF’s as a means of artificially propping up the market and increasing investor confidence- however, that is not quite the case with the SNB, which has chosen to take a slightly different path. All through the fourth quarter 2019 and first quarter 2020, the SNB’s stock holdings remained stagnant; then, when the stock market crashed by over 30% in March, the national bank went on a shopping spree, buying up billions of dollars worth of FAAMG stocks.

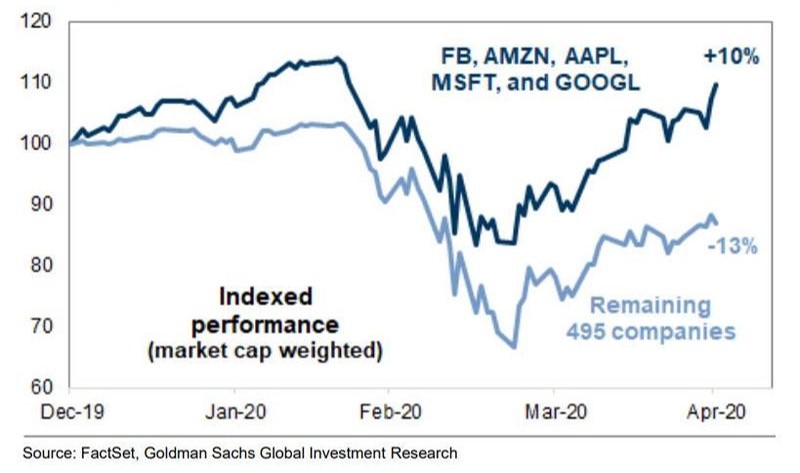

By the end of March, the SNB was the proud owner of Facebook, Apple, Amazon, Microsoft, and Google shares, worth $1.6 billion, $4.4 billion, $3.2 billion, $4.5 billion, and $2.7 billion respectively. This finally solves the current mystery of why the S&P 500 is still down by 13%, while the 5 companies which account for over 20% of S&P’s market cap have increased by 10% YTD.

Information for this briefing was found via the Securities and Exchange Commission, Barrons, and Zero Hedge. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.