Red White & Bloom Brands (CSE: RWB) has nearly acquired the former assets of Aleafia Health (TSX: AH) following a court-approved sale and investment solicitation process. The process was conducted as part of Aleafia’s filing for creditor protection under the Companies’ Creditors Arrangement Act in July.

RWB will acquire the assets by way of a stalking horse bid, following the company lending funds to Aleafia in relation to a failed merger that was initially announced in early June. That transaction would have seen shareholders receive 0.35 of a RWB share for each share of Aleafia held, equating to a value of just $0.0245 per share at the time of announcement.

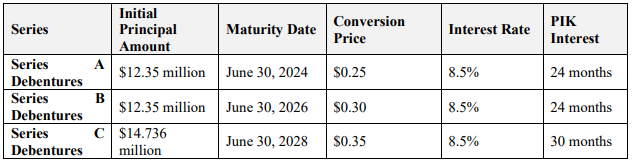

The transaction at the time appeared to be a means of meeting creditor demands, with RWB agreeing to a $30 million credit facility to fund the Canadian cannabis operator, while taking assignment of certain notes. The deal ultimately failed to close as a result of debentureholders refusing to accept $6.0 million in cash to settle a total of $37 million in outstanding principal.

Over a third of debtholders had refused to accept the transaction, ending acquisition discussions with RWB. Days later, RWB called in overdue debt, forcing Aleafia into creditor protection.

The assets to be acquired by Red White & Bloom include the IP of Aleafia Health, along with the assets of its subsidiaries Emblem Cannabis, Canabo, Aleafia Farms, and Aleafia Retail. The purchase notably does not include the Grimsby facility, which has been sold to a third party purchaser.

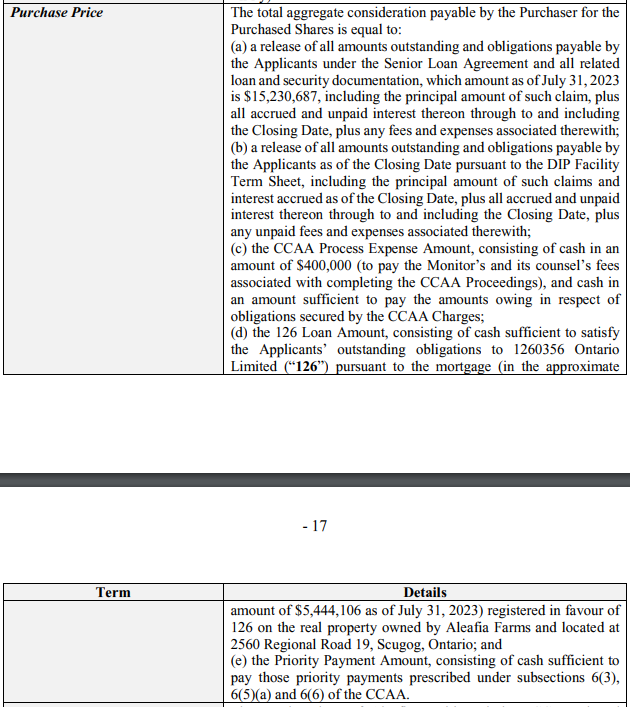

To acquire the assets, RWB will be release all amounts outstanding under a senior loan agreement, which amounts to $15.2 million, as well as the release of all amounts owed under a DIP Facility that the company provided to Aleafia as part of its creditor protection filing. RWB will also pay $400,000 to settle the CCAA process expenses, settle a mortgage valued at $5.4 million as of July 31, and settle any “priority payment amount,” which relates to funds owed to pension plans, employees, and the Crown.

Notably debentureholders, who under the merger arrangement were to receive $6.0 million to settle outstanding debt, will receive nothing. Shareholders are to also receive nothing.

Aleafia will now seek court approval to have the stalking horse offer approved at a hearing on October 27. If approved, the transaction is slated to close before November 22, 2023.

Red White & Bloom Brands last traded at $0.06 on the CSE.

Information for this briefing was found via Aleafia Health, Red White & Bloom, KSA Advisory, and the sources mentioned. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.