Following guidance reductions from uranium mining major Kazatomprom, at least one analyst is calling for continued momentum in the price of uranium.

Cantor Fitzgerald yesterday issued a uranium macro update, increasing its uranium price forecast. Previously set at $90 – $120 per pound of U3O8, the firm is now calling for prices to be in the range of $120 – $150 per pound, with this range estimated to hold through 2028 and beyond.

“Given the KAP news, the supply/demand picture has fundamentally changed in a definitively more bullish direction for uranium spot and term pricing. We are raising our uranium price forecast curve to $120-150/lb U3O8 (2024-2028+) from $90-120/lb U3O8, previously. This price forecast has considerable bias to the upside,” reads the note.

Kazatomprom on Thursday cut its 2024 production estimate to 55 – 59 million pounds of U3O8, a decline of 14% at the midpoint, while also stating that it will likely fail to hit its target of 79 – 82 million pounds of U3O8 production in 2025 as well. The world’s largest uranium miner, Kazatomprom is estimated to account for 40% of primary uranium production post guidance cut. Furthermore, it’s unclear how long production challenges will exist, with the miner citing construction delays at new deposits and shortages in sulphuric acid supply as the reasoning being the cuts.

With reduced production and commentary suggesting that Kazatomprom remains committed to sales contracts, Cantor estimates that the miner will be required to purchase uranium on the spot market to fill gaps, saying they expect the producer to be a “net buyer of size in the uranium spot market in 2024 and 2025.”

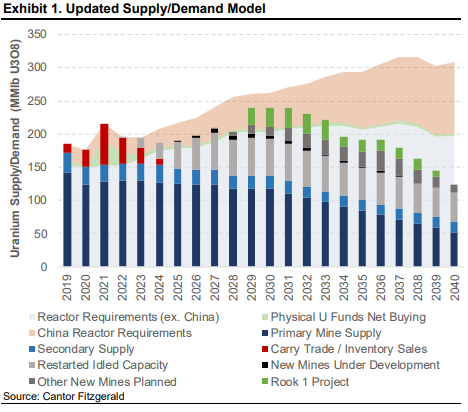

Spot market volumes typically average 40-50 MMlb U3O8/year, so a 9 MMlb U3O8 guidance reduction this year is extremely material.

-Cantor Fitzgerald on Kazatomprom guided production shortfalls

And for those of whom are concerned about the impact of potential mine restarts coming online, Cantor is unphased by this. Referencing recent restart announcements by domestic US producers, Cantor stated they effectively amount to having minimal impact on supply.

“While these restarts are welcome and much needed for the industry, cumulatively they are still insufficient to bridge the fundamental supply deficit in the uranium market with demand increasing at the rate of 3-4% per year. The next cohort of new large-scale uranium mine builds are not expected to come on-line until the 2028-2030 time period. This schedule is permitting/construction-timeline dependent and cannot be pulled forward regardless of uranium price. As such, fundamentally, spot and term uranium prices have considerable upside runway in terms of both price level and duration.”

In a nod to the higher-risk nature of retail investors, Cantor also suggested that capital will begin to flow up the risk curve in the near term, stating “we expect trading flows over the balance 2024 to move down cap into the uranium developers and restarts in a significant way.”

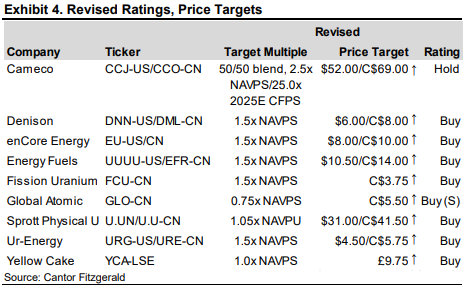

“We continue to believe the better value proposition for new investment capital entering the sector, and for investors who have enjoyed substantial gains in Cameco, is to rotate down-cap into the physical uranium funds (both of which are trading at a NAV discount), the higher-quality uranium developers, and the near-term cash flowing U.S. domestic uranium restarts.”

This commentary was followed by an average increase in price targets of the uranium names Cantor covers by an average of 20%.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.