DraftKings Inc. (Nasdaq: DKNG) earlier this month announced its third-quarter financial results. The company announced revenues grew 136% year over year, or 7.7% sequentially, to $502 million. The revenue growth comes primarily through their “successful launches of its Sportsbook and iGaming products in additional jurisdictions.”

Though this increase in revenues didn’t exactly improve the firms overall results. Gross profits decreased 15.8% sequentially to $129.25 million, and operating losses ballooned almost 50% to -$455 million. Net income came in at -$450.49 million, double last quarter’s losses.

Additionally, the company announced that monthly unique players increased to 1.6 million, an increase of 22% year over year, with the average revenue per player being $100 during the quarter.

DraftKings raised their full-year revenue guidance, expecting revenue to come in between $2.16 and $2.19 billion, up from $2.08 to $2.18 billion. The company also expects adjusted EBITDA to come in slightly better than previously guided at -$800 and -$780 million versus the prior -$835 and -$765 million.

DraftKings has also introduced full-year 2023 guidance, in which they expect revenues to come in between $2.8 and $3 billion, while adjusted EBITDA is expected to come in between -$375 and -$475 million.

DraftKings currently has 32 analysts covering the stock with an average 12-month price target of US$21.57, or an upside of about 91%. Out of the 32 analysts, five have strong buy ratings, 12 have buy ratings, 14 have hold ratings, and one analyst has a sell rating on the stock. The street-high price target sits at US$48, representing an upside of almost 325%.

In Canaccord Genuity Capital Market’s note on the results, they reiterate their buy rating on the stock but lower their long-term price target from US$32 to US$28, saying that the growth formula remains intact, but the company sets high expectations. They note that revenue beat consensus estimates due to “a more rational promotional environment and favorable NFL outcomes.”

On the results, Canaccord was expecting revenues of $442.5 million, though gross profits came in below Canaccord’s estimates as gross profit was expected to be $137.8 million. Operating expenses came in at $459.2 million, better than the $500 million Canaccord expected.

Though monthly unique players came in below expectations, partly due to the timing of the recent NBA seasons, the average revenue per player of $100 did beat Canaccord’s estimates. They say that DraftKings slowed down promotion activity “amid a more rational industry backdrop,” but was negated by favourable NFL outcomes.

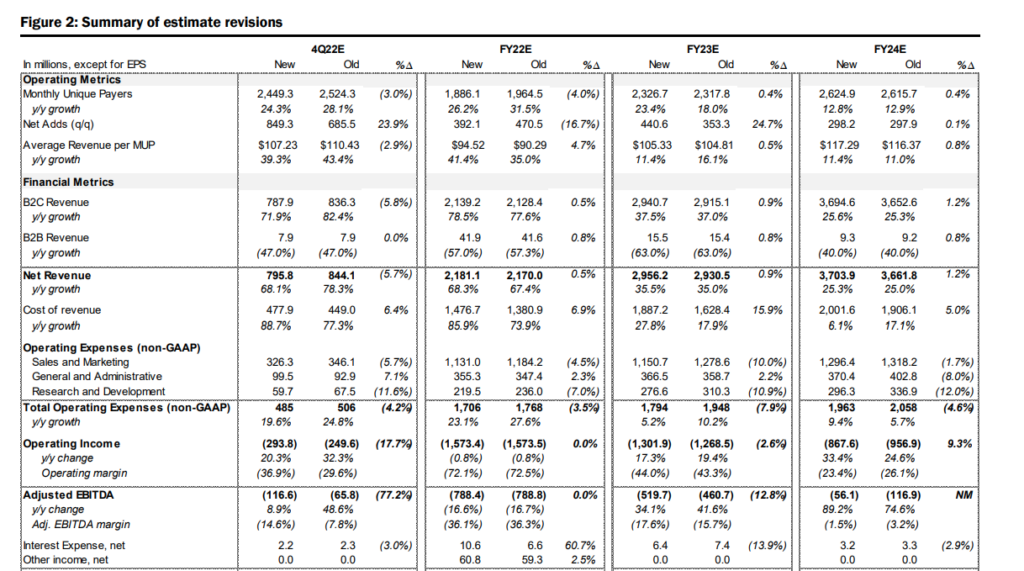

On the company’s updated full year 2022 and new 2023 guidance, Canaccord says that it’s solid. However, the company lowers its fourth-quarter revenue estimates based on “the planned reinvestment of Q3 top-line outperformance into promotions for users impacted by adverse outcomes.” They also lower their fourth quarter and full year 2023 profitability for the same reason. Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.