Beyond Meat, Inc. (Nasdaq: BYND) recently reported its third quarter results for the period ending October 1, 2022. The company announced revenues dropped 44% sequentially and 22.5% year over year to $82.5 million. This comes as every revenue segment outside of U.S Foodservice saw a high double-digit sequential decline.

Beyond Meat’s gross profits came in negative for the second quarter in a row; this quarter’s gross profits were -$14.84 million, worse than the -$6.16 million it reported last quarter. Operating expenses came down almost 30% this quarter to $165.25 million, helping the company’s operating profit stay almost flat sequentially. At the same time, the company reported net income dropping 5% to -$101.68 million.

The company ended the quarter with $390.2 million in cash and cash equivalents, while the total outstanding debt was $1.1 billion. Operating cash flow for the quarter was 50% better than last quarter, at -$34.66 million. Free cash flow for the quarter was -$52.64 million.

Beyond Meat provided an outlook, saying that operating conditions continued to be affected by a number of items, such as inflation, rising interest rates, increased probability of a recession, COVID-19, challenges to labor availability and supply chain disruptions, recent geopolitical tensions, and increased competition – effectively everything under the sun.

As a result, the company expects revenues to come in the range of $400 to $425 million for the full year, a decrease of between 9% and 14%. The company also said that the reduction in workforce will lead to a one-time $4 million cash charge, but is expected to save $27 million in cash over the next twelve months.

Several analysts lowered their 12-month price target on Beyond Meat after the results. The new long-term price target is US$15.35, down from US$19.40 last month. There are currently 20 analysts covering the stock, with 15 having hold ratings and five having sell ratings on the stock. The street-high price target is US$45, representing an upside of about 190%.

In Canaccord Genuity Capital Markets’ note on the results, they reiterate their hold rating but lower their 12-month price target from US$14 to US$13, saying that all of Beyond Meat’s revenue segments continue to remain under pressure and that they will wait to see evidence of demand recovery before raising their price target again.

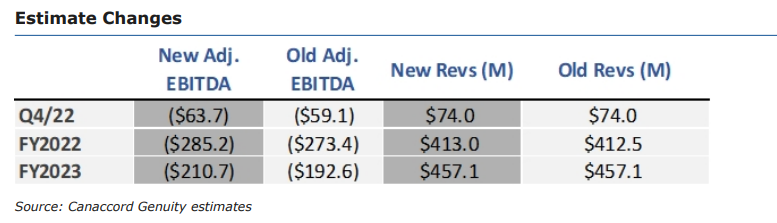

On the results, Canaccord said they are in line with the pre-announcement and their estimates other than EBITDA, which came in at -$73.8 million, worse than the expected -$66.6 million expectation.

Canaccord commented that the bottom line remains that key preconditions are needed to increase demand for plant-based meat, which includes “innovation to broaden the appeal and bring down costs and an ebbing to the rate of food inflation currently pressuring the consumer.”

Below you can see Canaccord’s updated estimates.

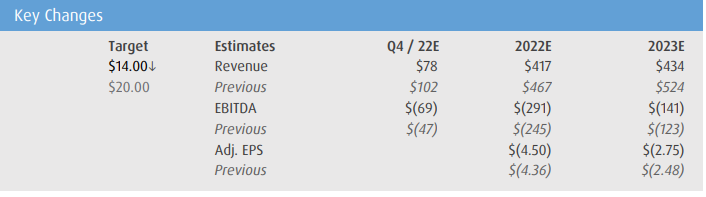

In BMO Capital Markets’ note on the results, they reiterated their market perform rating and lowered their 12-month price target on Beyond Meat to $14 from $20, saying that they remain on the sidelines, “given the litany of headwinds faced by BYND,” which include “significant secular and sustained pricing headwind, the lingering effects associated with its profit-dilutive growth strategy and an exceedingly challenging retail environment that intertwines subdued consumer demand for plant-based.”

On the results, Beyond Meat’s bottom line EPS of -$1.60 was way below the consensus estimate of -$1.15. BMO believes the main contributor to this was a worse-than-expected gross margin percent.

They commend Beyond Meat for “making the tough decision” to pivot from a money-losing growth business to a “focused cost-conscious growth strategy.” However, BMO warns that the business is not out of the woods just yet and will continue to experience a number of headwinds over the coming quarters. They believe that Beyond Meat’s new launch of new expensive jerky products will continue to bear headwinds for the company, and the business will see “a significant secular and sustained pricing headwind over the next few years.”

Lastly, BMO believes that the move to lean operating principles will eventually help the business in the long run but notes that the company is “not operating from a position of strength.” They expect Beyond Meat to start to wind down the majority of its sales and marketing campaigns, but to keep advertising to its core demographic is young consumers worried about the climate.

Below you can see BMO’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.