Canadian National Railway (TSX: CNR) last week released its third-quarter financial and operating results. The company reported quarterly revenues of C$4.5 billion, an increase of 26% off the back of higher fuel surcharges, freight rate increases, and a positive foreign exchange rate. As a result, the company’s operating income increased by 44% to C$1.93 billion.

Though the company’s net income saw a decrease year over year to $1.45 billion, or earnings per share of C$2.13, the company also noted that it increased the value of its buybacks during the quarter, repurchasing $1.2 billion of shares, and had free cash flows of about $1.36 billion for the quarter.

Additionally, the company noted that the freight revenue per revenue ton mile was $7.46, putting the revenue per carload at $2,972, an increase of about $300 from last year. Labor and fringe benefits per gross ton mile stayed at $0.67 cents. Most importantly, the average fuel price for the quarter increased to US$5.70 from US$3.33 a year ago.

Several analysts maintained their 12-month price target after the results keeping the average price target at C$160.93, suggesting that the stock is trading at fair value. Two of the 25 analysts covering the stock have strong buy ratings. Four have buy ratings, 18 analysts have hold ratings, and one analyst has a sell rating on the stock. The street-high price target sits at C$180, representing an upside of about 13%.

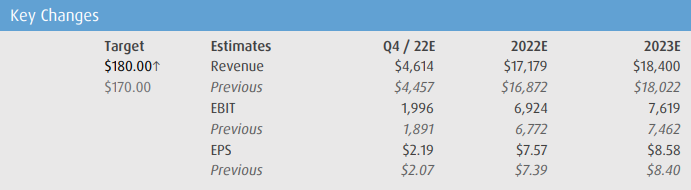

In BMO Capital Markets’ note on the results, they reiterate their outperform rating and raise their 12-month price target to C$180 from C$170, saying that the strong earnings coupled with higher revised guidance warranted the price target change.

Speaking to the guidance revision, they say that it’s a stand-out within the sector “where earnings/guidance have generally been less than inspiring so far this earnings season.”

The earnings beat primarily came from yield expansion, BMO says. They say that yield expansion was 6% greater than their forecast, which offset more than the $47 million one-time wage accruals. BMO also notes that average car miles per day hit a 6-year high of 212 car miles.

As a result of the guidance revisions, BMO believes that management is signaling that momentum will be sustained all the way through the first half of fiscal 2023. Management specifically pointed to international intermodal, lumber, and chemicals where they saw “signs of softness” as a potential headwind. Though BMO believes that any lost revenue from these sectors will be made up for in autos, domestic intermodal, and grain.

BMO writes, “We are encouraged by management’s execution on both the operational and marketing fronts, including recent EMP agreement and traction being made at the port of Halifax. We see further opportunity for the network.” Below you can see BMO’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.