On Tuesday, Trillion Energy (CSE: TCF) announced that it will be expanding its well development program at the SASB gas field during 2023. The company said it had identified several additional opportunities for increased production.

Trillion Energy will add three side-track wells to its development program, bringing the total number of wells now contemplated in the development program to 20.

Out of 20 wells, 11 are anticipated to occur during 2023, “which will result in rapidly increased quantities of natural gas production during the year,” with two already completed and two currently slated to be completed in the first quarter.

READ: Trillion Energy Adds Three Wells To Multi-Well Development Program

With the development, Research Capital, provided their outlook on the stock while reiterating their C$1.35 12-month price target, or a projected upside of almost 250%. The C$1.35 price target is just a 3x multiple of the investment banks 2024 estimated debt-adjusted cash flow.

The analyst says the pullback in the stock due to unseasonably warm weather in Europe is a buying opportunity. They explain that the recent warm weather in Europe has caused supply fears to recede in the short term.

This has caused a pullback in the natural gas front-month contract since its highs highs in 2022, with Dutch TTF gas currently trading at EUR$64.81, after hitting highs of EUR$342.86 last August.

Analysts at Research Capital said that the natural gas sales price in January 2023 was US$27/mcf in Turkey, down from US$31/mcf in December. However, they point to continued concerns for European supply heading into the winter of 2023 as a potential tailwind for natural gas suppliers.

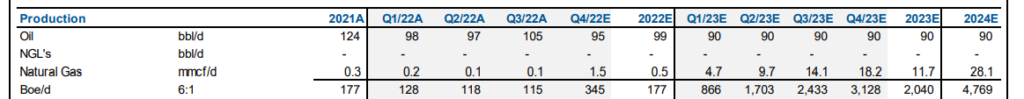

Research held their production estimates steady for Trillion Energy in their latest analyst note. They expect Trillion to go from producing 706 Boe/d in 2022 to 8,130 Boe/d in 2023.

FULL DISCLOSURE: Trillion Energy is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Trillion Energy on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.