Earlier this week, Tilray (NASDAQ: TLRY) finalized their merger with Aphria (NASDAQ: APHA) (TSX: APHA), with Aphria shares getting converted into Tilray shares, and now all trade under the one symbol “TLRY.” Many analysts have come out and updated their 12-month price targets on Tilray, with Stifel cutting their price target to C$16 from C$21 and CIBC raising their price target to C$25 from C$23

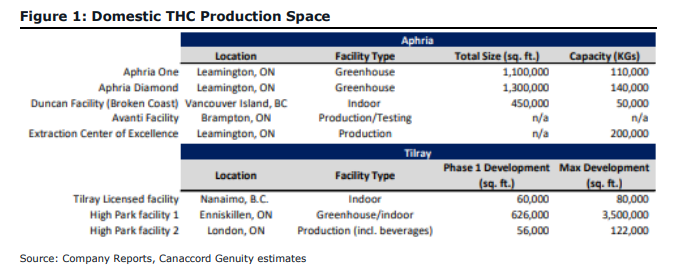

Canaccord has reissued their coverage on Tilray with a hold rating and C$17 price target. They now expect Tilray to have a 23% market share in Canada, with combined revenues of C$847 million. One of the main selling points with this merger is the utilization of Aphria’s low-cost greenhouses for Tilray brands and products while Tilray provides additional 2.0 capacity to help bolster their 2.0 market share.

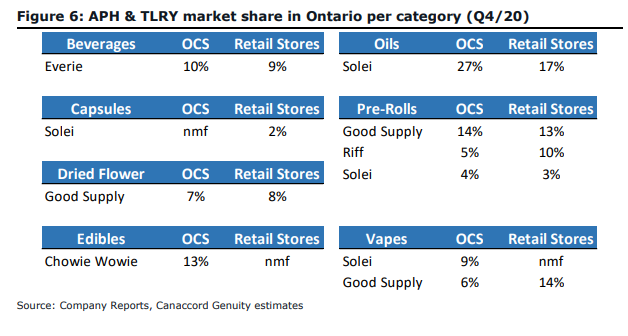

Tilray now has ~3.6 million sq ft of greenhouse space and 13 different brands, spanning from value-oriented products to premium products as well as niche products. Bottomley writes, “we believe the entity is well equipped to maintain a leading position in the adult-use market and expect the company to develop additional medical-use products to gain incremental market share.” Below you can see Canaccord’s estimates for the combined market share in Ontario for each of the companies brands, this is based off of the FY20 OCS report.

The new entity has a large international presence with Aphria bringing its CC Pharma business to the table, while Tilray has a small German footprint and a large Portugal footprint of 2.7 million sq ft of cultivation and production space.

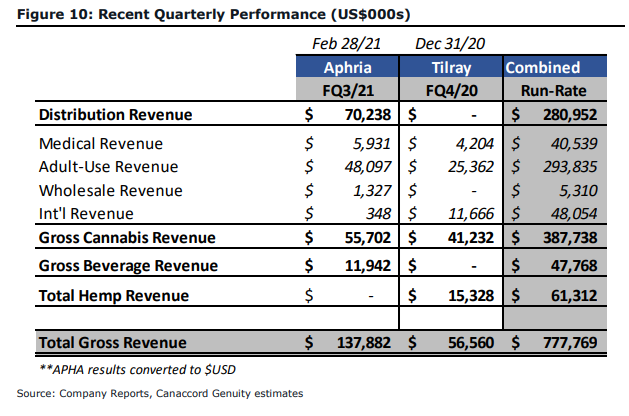

Below you can see the proforma revenue run rate for the new entity, which Canaccord calculates out to a U$777.77 million total gross revenue run rate, with U$387.74 million coming from cannabis.

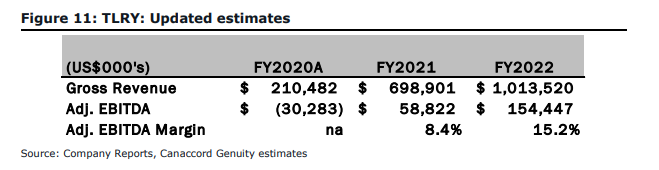

Additionally, you can Canaccord’s 2021-2022 estimates for the new combined entity below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.