Just one day after going public, Florida Canyon Gold (TSXV: FCGV) has entered into an arrangement to sell its Mexican business unit, which includes the sale of one of its principal assets. The sale follows a strategic review of its operations in an effort to leverage the value of its assets and manage risk.

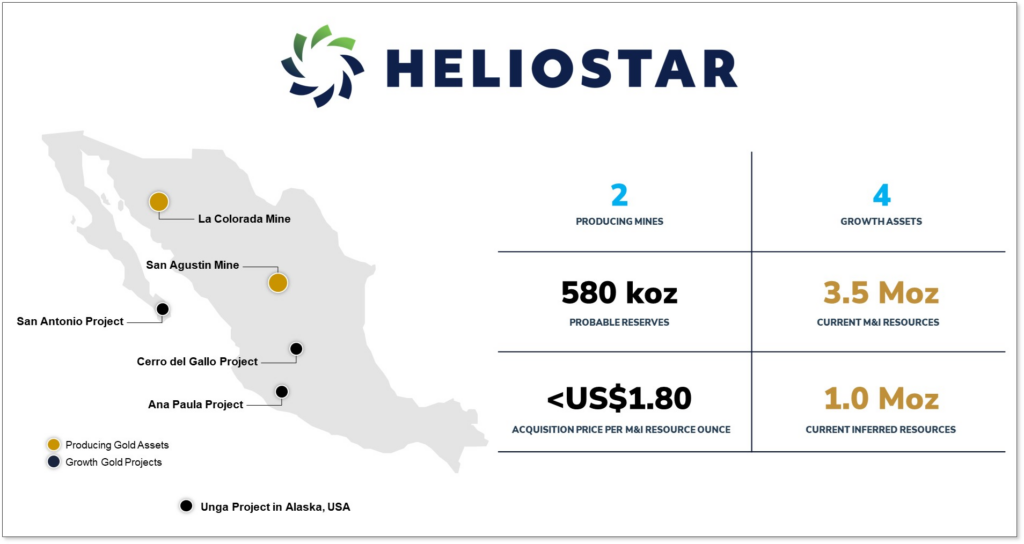

The arrangement will see the sale of the San Agustin, El Castillo, and La Colorada mines, as well as the Cerro del Gallo and San Antonio projects, to that of Heliostar Metals (TSXV: HSTR).

Both the San Agustin and La Colorada mines are currently in production, with San Agustin producing 7,568 ounces of gold and 39,319 ounces of silver in the first quarter. The open-pit operation is capable of processing approximately 30,000 tonnes per day, with remaining probable reserves of 197k gold ounces and 6.7 million silver ounces. La Colorada meanwhile is currently re-leaching, producing 3,922 ounces of gold and 6,848 ounces of silver in the first quarter.

Consideration for the assets meanwhile amounts to just US$5.0 million in cash, while the purchase will also remove US$20.0 million in contingent payments that Heliostar owed on its Ana Paula project to the Mexican business unit. Florida Canyon is also entitled to cash generated by the business through to July 11, and US$5.0 million of cash generated from cash flow after July 16.

“This acquisition is transformative for Heliostar. The Company transitions from single asset developer to a multi-asset producer. The addition of the two producing gold mines provides cash flow to bring new production online. In addition, this transaction eliminates up to US$20 million in contingent payments on the Ana Paula project, freeing that capital for its development, which remains the Company’s focus. Further it cancels up to US$150 million in conditional option payments on San Antonio. All in exchange for a total acquisition price of US$5 million,” commented Heliostar CEO Charles Funk.

Florida Canyon, whom originally listed on the TSX Venture with its operations consisting of the assets of Argonaut Gold prior to its acquisition by Alamos Gold, save for the Magino Mine in Ontario, on a go forward basis will own just the Florida Canyon mine in Nevada.

The transaction is slated to close in the third quarter.

Florida Canyon Gold last traded at $0.75 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.