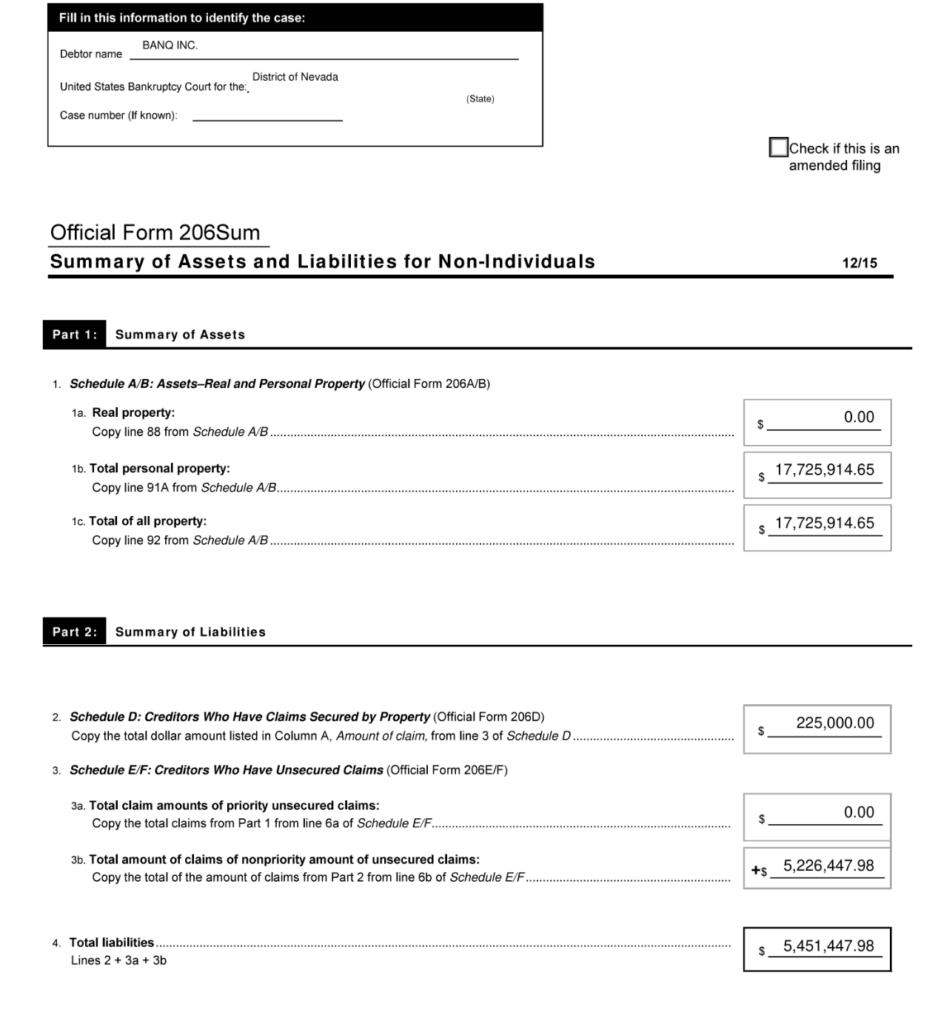

In a major development within the cryptocurrency industry, Banq, a subsidiary of the embattled crypto custodian Prime Trust, has filed for bankruptcy in a U.S. bankruptcy court located in the district of Nevada. The filing highlights approximately $17.72 million in assets against $5.4 million in liabilities.

This bankruptcy filing follows Prime Trust’s ongoing efforts to finalize an acquisition deal with BitGo, which became necessary due to a financial crisis stemming from the Celsius bankruptcy. As the parent company grapples with its own challenges, Banq finds itself entangled in a web of complications.

TrueUSD, a stablecoin with a banking relationship with Prime Trust, recently announced a temporary halt to stablecoin mints and redemptions, citing “Prime Trust’s bandwidth issues” as the cause.

Meanwhile, South Korean crypto yield firm Haru Invest also faced operational disruptions, citing difficulties with an unnamed service provider, potentially linked to Banq or Prime Trust.

@DataFinnovation and @Patrick_TanKT of @chainargos and @Cryptadamist have some good insights as to what's on with $TUSD.

— Parrot Capital 🦜(Read the pinned 🧵) (@ParrotCapital) June 14, 2023

I posted the phone number of #PrimeTrust yesterday and haven't heard of anyone able to get through to find out what's going on. Ditto for Telegram channels. https://t.co/6GW4C0Hebv pic.twitter.com/uWxOa0do3F

Moreover, the bankruptcy filing reveals that Banq alleges an “unauthorized transfer” of $17.5 million in assets by former officers, who reportedly absconded with trade secrets, proprietary information, and technology, directing them to Fortress NFT Group.

Of the ~$18 million in assets claimed by the company, $17.5 million are for "breach of fiduciary duty, fraud, misappropriation" claims against former officers and related entities (some add'l assets listed at "unknown" values)

— Randall G. Reese (@Chapter11Cases) June 13, 2023

The very founders of Banq, including the former CEO, CTO, and CPO, established Fortress NFT Group, which now faces a lawsuit from Banq. The suit alleges that the trio stole trade secret information to launch rival NFT platforms, Fortress NFT and Planet NFT, while engaging in fraudulent activities to conceal their actions.

According to Banq’s lawsuit, former CEO Scott Purcell attempted to shift Banq’s focus toward NFTs, but facing resistance from the board and shareholders, he founded Fortress NFT.

“Their theft of Banq’s corporate assets even included taking the company’s seat licenses for Las Vegas Raiders’ games at Allegiant Stadium, all without Board approval or knowledge. Specifically, Defendant Purcell transferred the seat licenses owned by Banq to himself,” the suit read.

Taking a quick look at Scott Purcell,

— Congregant of the Mighty-Church of Demon-Rats (@ImDrinknWyn) June 14, 2023

CEO and Chief Trust Officer at Prime Trust 2016-21

He had been founder of https://t.co/tQK2JVBNA6https://t.co/Va7swZT5Be pic.twitter.com/4tdVi2hwQZ

In early 2023, a judge ruled for the case to proceed to arbitration, as Purcell and the other defendants in the case had signed arbitration clauses, marking a new chapter in this convoluted legal battle.

Information for this briefing was found via CoinDesk and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.