Binance.US CEO Brian Shroder has left his position amidst a series of significant changes at the company, including a workforce reduction of over 100 employees. This move follows a previous round of layoffs in June and the company’s shift toward becoming a crypto-only exchange. Binance.US has attributed its challenges to the ongoing regulatory scrutiny by the Securities and Exchange Commission (SEC) in the United States.

JUST IN: 🇺🇸 Binance US CEO resigns.

— Watcher.Guru (@WatcherGuru) September 13, 2023

In a statement, Binance.US expressed its concerns about the SEC’s regulatory actions, stating, “The SEC’s aggressive attempts to cripple our industry and the resulting impacts on our business have real-world consequences for American jobs and innovation, and this is an unfortunate example of that.” However, the company remains committed to serving its customers and ensuring its longevity as a crypto-only exchange, emphasizing its ability to sustain operations for over seven years.

This development is part of a broader context where Binance, the world’s largest cryptocurrency exchange, has faced significant hurdles in the United States. In June, the SEC filed a lawsuit against Binance, alleging violations of securities laws. Additionally, in March, the US Commodity Futures Trading Commission charged Binance and its CEO, Changpeng Zhao, with “willful evasion of federal law.”

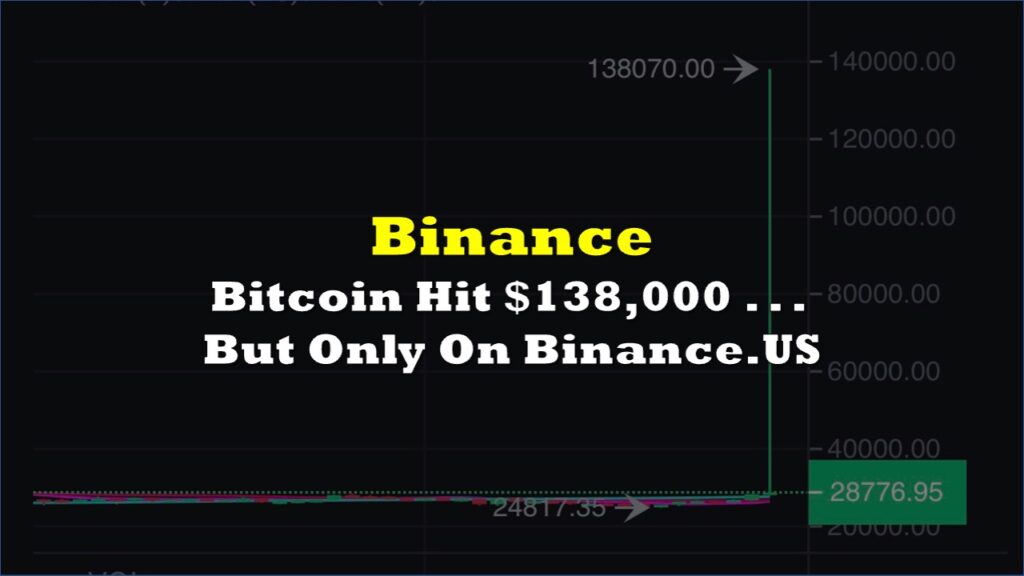

Consequently, Binance.US has experienced a steep decline in revenue, plummeting from $10.6 billion in January to just $70 million this month, according to The Block.

The departures of Shroder and the workforce reductions in the US are also occurring alongside a global exodus of Binance staff. Since July, eleven high-ranking executives have left the company, with four of them departing just last week. Reports suggest that internal concerns about Zhao’s handling of the US Department of Justice’s investigation into the exchange may have contributed to these departures.

In response to reports about staff departures, market withdrawal rumors, and product closures, Zhao has dismissed them as “FUD” (Fear, Uncertainty, and Doubt). Furthermore, Binance has sought to dispel comparisons with the now-bankrupt crypto exchange FTX by emphasizing that its assets are “backed one-to-one” and asserting that it faces no liquidity issues.

Saw some debates in the community. When you do the right thing, and there is FUD, you don't have to do anything. The community defends you.

— CZ 🔶 Binance (@cz_binance) September 7, 2023

Let me summarize. There have been a lot of negative news/rumors, bank runs, lawsuits, closing of fiat channels, product wind downs,…

Norman Reed, formerly Chief Legal Officer at Binance.US, will be taking over the CEO role following Brian Shroder’s departure. Binance.US, established in 2019, was specifically created to cater to American users, as they were initially unable to access Binance Holdings’ services. While Binance Holdings expanded globally, its US branch encountered regulatory challenges, culminating in the SEC’s accusations against the company and its leadership for various regulatory violations, customer fund mishandling, and deceptive practices towards investors and regulators.

Information for this briefing was found via Inside Bitcoins, Watcher.Guru, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.