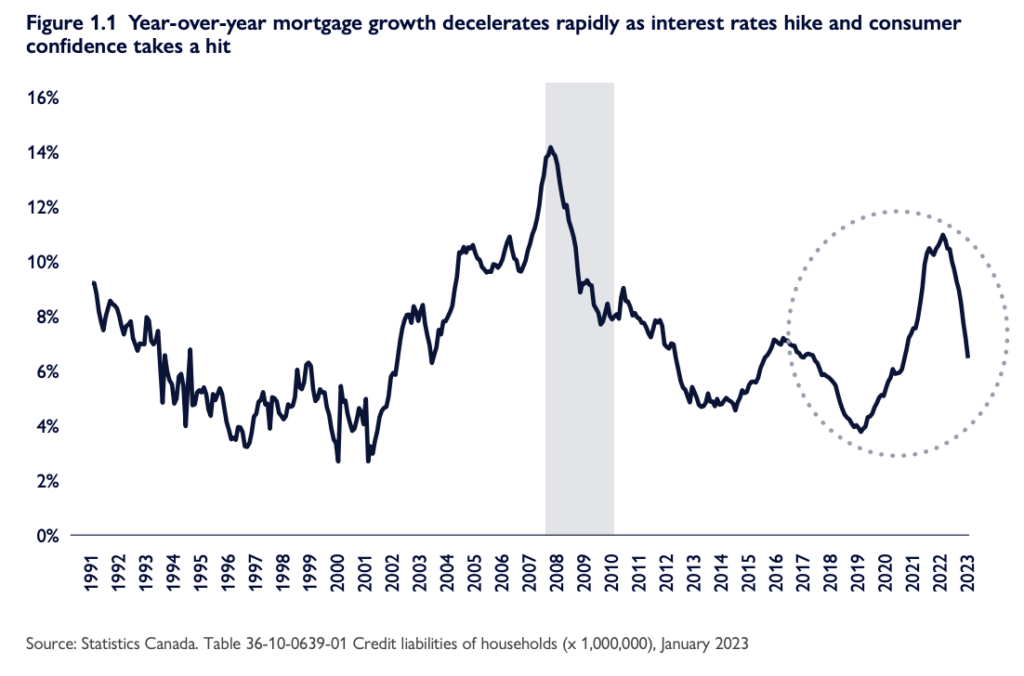

According to the CMHC’s Residential Mortgage Industry Report, Canada’s residential mortgage debt rose by 6% to $2.08 trillion in January 2023. Although this marked an increase, the growth rate was slower than in prior years due to inflation, surging interest rates, and a cooling housing market, which collectively dented consumer confidence and subsequently sent potential homebuyers to the sidelines.

Notwithstanding the moderated mortgage growth, Canadian households are grappling with record mortgage debt levels. CMHC Senior Specialist of Housing Research Tania Bourassa-Ochoa voiced concerns over the ability of Canadian households to make monthly debt payments in the face of elevated mortgage debt and the increasing cost of living.

“Although mortgages in arrears remain low, they are a lagged indicator and in challenging financial situations, consumers will typically be delinquent on credit cards, lines of credit, or auto loans before mortgages. Increasing delinquencies for these credit products indicate a larger number of consumers are having difficulties with their debt payments,” she explained.

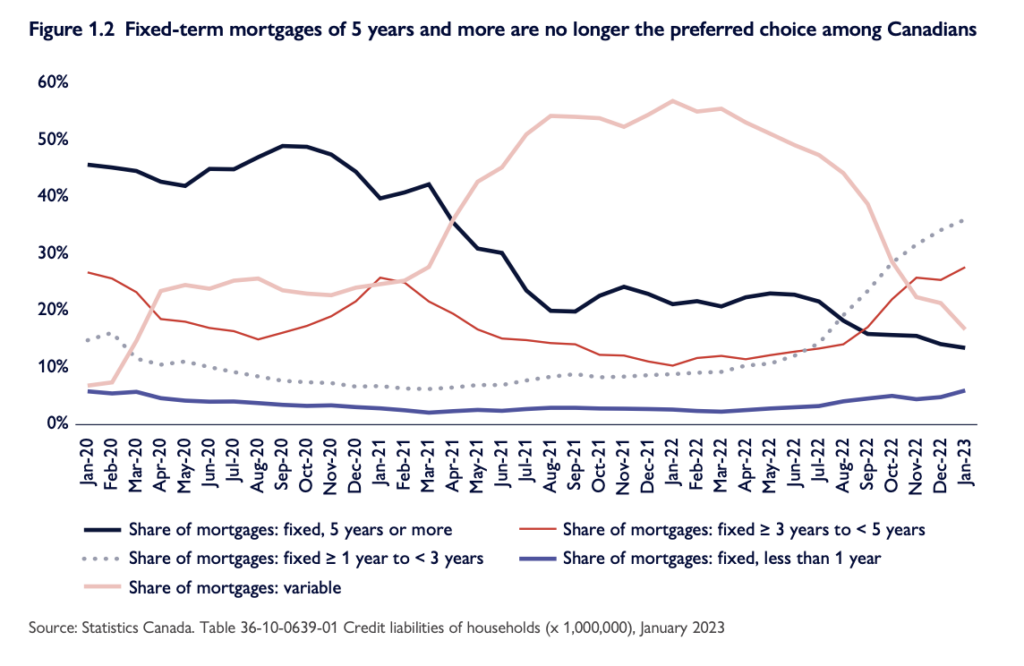

Reacting to the escalating interest rates, consumers are opting for strategies to lower their monthly debt servicing costs. A notable shift is towards shorter-term fixed-rate mortgages in anticipation of declining interest rates. The share of fixed-rate 5-year mortgages fell below 15% of new mortgages while variable-rate mortgages dropped under 20%.

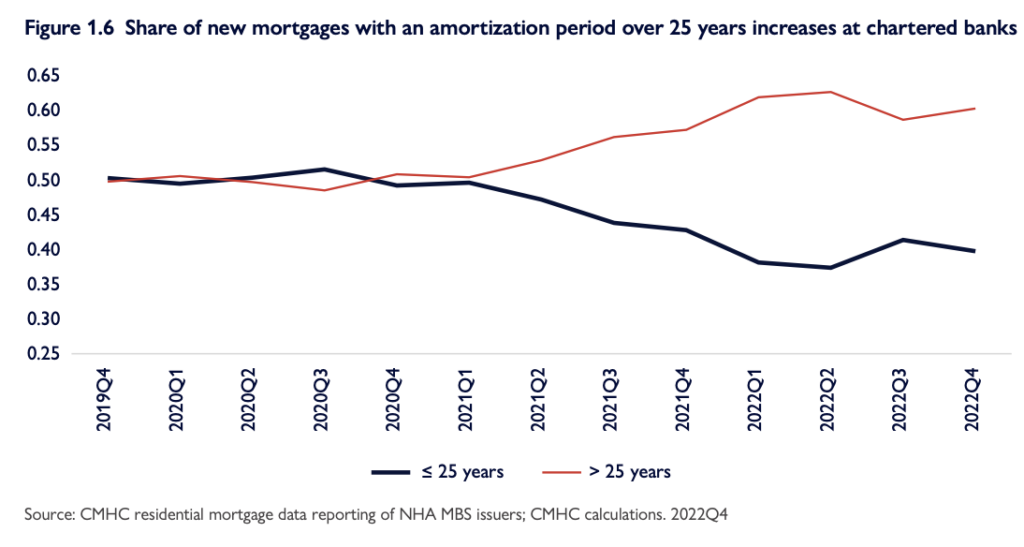

Furthermore, the number of borrowers applying for refinancing plunged by 32% due to the higher cost of debt. More borrowers are also selecting longer amortization periods, which lowers short-term mortgage payments but extends the repayment timeframe.

Information for this briefing was found via the CMHC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.