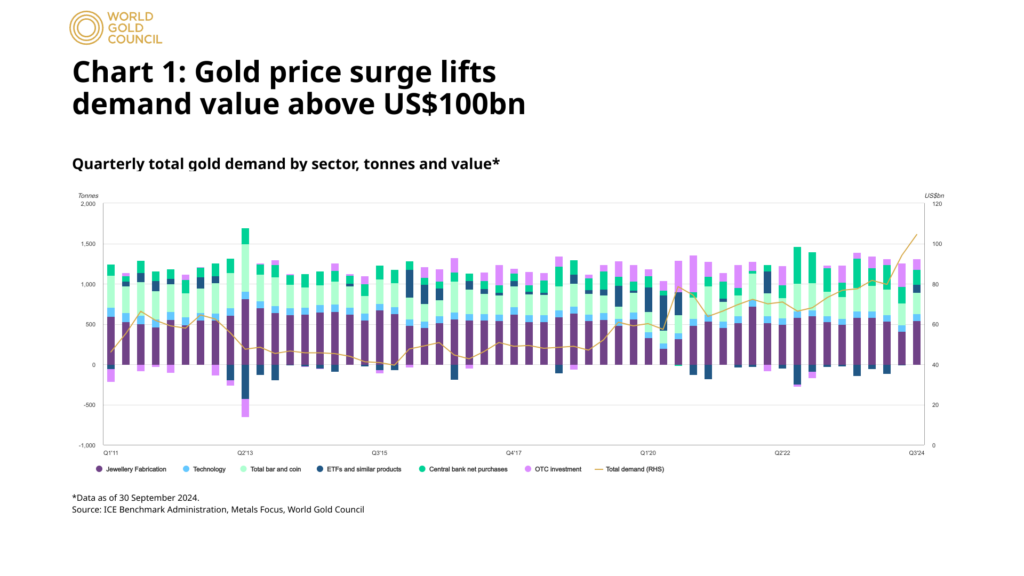

Total gold demand reached unprecedented levels in the third quarter of 2024, surpassing US$100 billion in value for the first time as prices climbed to successive record highs, according to the World Gold Council’s latest Gold Demand Trends report. The quarter saw demand of 1,313 tonnes, marking a 5% increase compared to the same period last year.

The World Gold Council’s data shows investment flows played a crucial role in driving demand, with global gold ETFs recording their first positive quarter since Q1 2022, adding 95 tonnes. This represents a significant turnaround from Q3 2023, which saw outflows of 139 tonnes.

Despite record prices averaging $2,474 per ounce during the quarter, consumer demand faced headwinds. The report indicates jewelry consumption declined 12% year-over-year to 459 tonnes, though the higher prices meant the value of jewelry purchases increased by 13% to over $36 billion. India proved an exception to this trend, with jewelry demand rising 10% following a reduction in import duties.

Central bank purchasing, while remaining substantial at 186 tonnes, showed a marked slowdown of 49% compared to the same quarter last year. The World Gold Council reports the National Bank of Poland emerged as the quarter’s largest buyer, adding 42 tonnes to its reserves.

On the supply side, mine production grew 6% year-over-year to a quarterly record of 989.8 tonnes, contributing to a 5% increase in total gold supply of 1,313 tonnes. Recycling volumes rose 11% year-over-year to 323 tonnes, though they declined compared to the previous quarter despite the higher prices.

Looking ahead, the Council’s analysts expect investment flows to remain strong, supported by geopolitical uncertainties, including Middle East tensions and the upcoming US presidential election. The anticipated shift in global interest rate policies could further boost investment interest as the opportunity cost of holding gold decreases.

The report also highlighted significant regional variations, with Chinese demand particularly affected by economic challenges and higher local prices. However, the overall outlook remains positive, with professional investment flows and solid bar and coin investment expected to offset weaker consumer demand and slower central bank purchases in the coming months.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.