GoldMining (TSX: GOLD) is apparently jumping on the uranium train, and intends to advance a uranium property it has held since 2013. The property, located in the western Athabasca Basin, is jointly owned with Orano Canada.

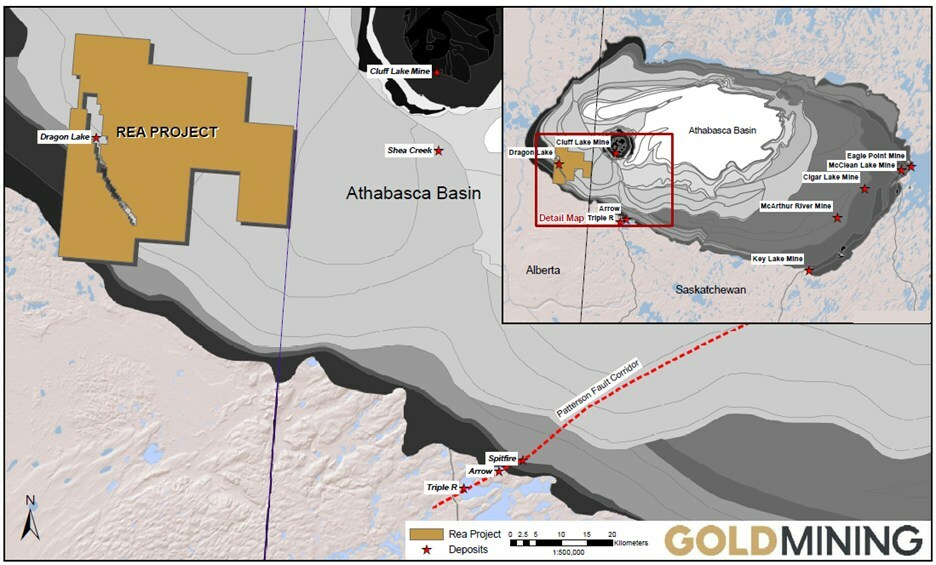

Referred to as the Rea Project, the project amounts to 125,328 hectares of prospective claims that surround Orano’s Dragon Lake deposit at the Maybelle River project. The asset was acquired in 2013 as part of the acquisition of Brazilian Gold Corporation, before several major discoveries were made in the region. GoldMining currently owns a 75% stake in the project, with the remainder owned by Orano.

“With GoldMining’s portfolio of gold and gold-copper projects located throughout the Americas, it may come as a surprise to some that the Company owns the large and prospective Rea uranium project located in the Western Athabasca Basin, Canada. We are working to reactivate our exploration efforts and plan to work with local stakeholders as we develop a phased approach to daylight value from this largely unrecognized asset,” commented CEO Alastair Still.

Historic exploration is said to have occurred mostly on the property in the mid-1970’s to the late 1990’s, which included geochemical surveys, prospecting, airborne geophysics, and diamond drilling. That exploration resulted in the discovered of the Dragon Lake deposit in 1988, after which Orano retained a number of claims for itself as it continued to develop the project.

Post 2005, when the large land package was acquired by Brazilian Gold, TDEM surveys, as well as gravity and ground geophysics were conducted, along with an 8 hole drill program amounting to 1,908 metres. Those surveys reported that the conductor associated with the Dragon Lake deposit extends on to the Rea Project claims, while several parallel conductors were also identified to the east and west.

WATCH: ATHA Energy: Exploration In Saskatchewan’s Athabasca Basin

Exploration targets as a result are currently being refined, with exploration plans expected to be released in the coming months by GoldMining.

“In the coming months, we will make further announcements on our plans to target a major regional shear zone 9 kilometers along strike of the high-grade, near-surface uranium mineralization at the Dragon Lake deposit. Given that NexGen’s Arrow and Purepoint Uranium Group’s Spitfire discoveries are hosted within a similar regional shear zone approximately 7 and 13 km northeast of Fission’s Triple R deposit, we believe that there is good potential to find additional deposits along the MRSZ,” continued Still.

GoldMining last traded at $1.25 on the TSX.

Information for this story was found via Sedar and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.