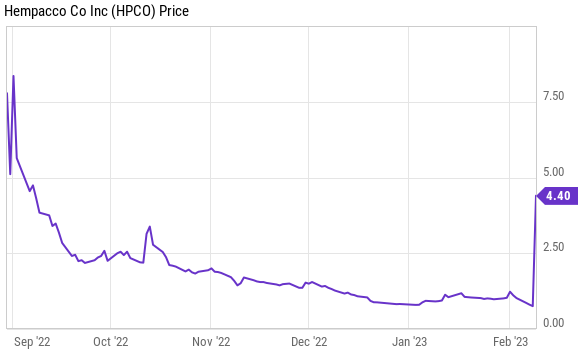

Hempacco Co Ltd (NASDAQ: HPCO) is taking shareholders for a wild ride, after rising from a $1.35 open yesterday to close at $4.40 on the Nasdaq, a massive move of 483%.

The run yesterday appears to be related to a partnership announced earlier in the week with Snoop Dogg. Hempacco, who manufactures “herb and hemp-based alternatives to nicotine cigarettes,” revealed on February 2 that it would be forming a joint venture with Snoop Dogg, under the name HPDG, LLC.

The venture is to create a consumer packaged goods line of smokable hemp products, as well as hemp paper, blunts, vapes, and edibles, and is assumed to capitalize on Snoop’s celebrity status.

“I’ve been looking for the best team out there to produce hemp products with me, and this team has it all – the science, innovation, and the reach. I am excited to offer my Snoop Dogg products to my fans across the country through this partnership … and this is just the beginning,” said Snoop at the time of announcement.

Days later, it was announced that Hempacco would be sharing a booth with Death Row Vapes at the Champs Trade Show in Las Vegas, where they would be pre-launching the brands it has developed under the partnership.

The launch of the trade show was evidently enough for the market to catch wind of the Snoop Dogg development, with the equity beginning to run yesterday after not reacting to the news previously.

After the outstanding run on the equity however, the company is looking to take a dump on investors by upsizing a previously announced financing. The company intends to sell 4.2 million shares at a price of $1.50 per share – just shy of a 66% discount to yesterdays close. An over-allotment option has also been issued, which would see the sale of 630,000 additional shares if exercised.

Proceeds of the offering are expected to amount to $6.3 million, which is to be used for sales and marketing, potential acquisitions, manufacturing upgrades, working capital, and other corporate purposes.

Understandably, the markets have reacted harshly to the offering, with the equity selling off 63% in pre-market trading to a current price of $1.60. Investor reactions on Twitter are effectively matching this energy.

Lmao pump and dumps are getting faster and faster $HPCO https://t.co/eM4hEIdJbN

— Vicious (@ViciousTrading) February 10, 2023

$HPCO Offering – This is the current trend. They run their stock (In this case 400%+) and then throw an offering. Isn't new, but definitely seems very common right now. With this being said, you can try and predict this and can try and play both sides (Long & Short).

— Mitch Picks (@Mitch___Picks) February 10, 2023

$HPCO Who Got Dumped On?

— Stock PlayMaker 🌐 (@stockplaymaker1) February 10, 2023

I’m Here Now Down 63%

Halt @ Open? pic.twitter.com/FOYuV19Gx9

Information for this briefing was found via Edgar, Seeking Alpha and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.