FULL DISCLOSURE: This is sponsored content for ATHA Energy.

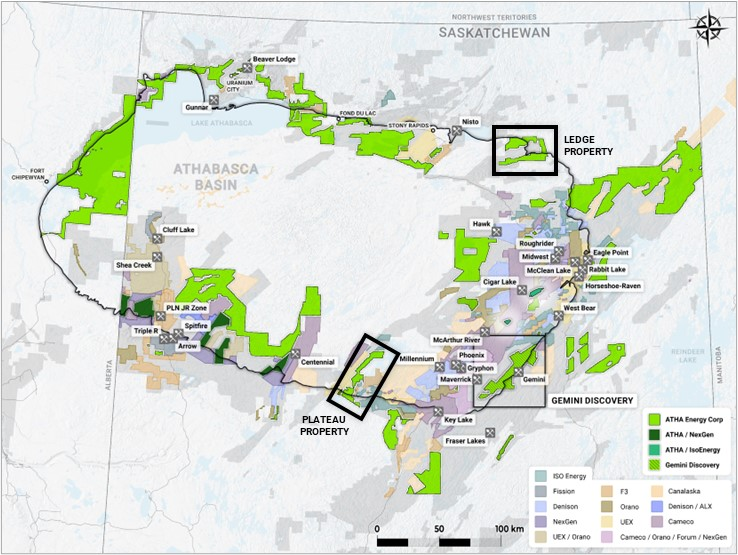

Atha Energy (CSE: SASK) has begun the process of optioning out portions of its massive land package in the Athabasca Basin. The company this morning announced an arrangement with Inspiration Energy (CSE: ISP), whereby Inspiration is to option out two separate properties from Atha.

Under the agreement, Inspiration can acquire a 70% undivided interest in the Plateau and Ledge properties upon meeting certain work commitments, and issuing shares in the company to Atha.

The Plateau property, found in the southern region of the Athabasca Basin, is an early-stage, 27,252 hectare property. To acquire a 70% interest in the property, Inspiration must issue 2.17 million shares to Atha and incur a total of $3.8 million in exploration expenses by September 1, 2028.

Ledge, found in the northeast of the region, meanwhile consists of 37,784 hectares of prospective claims. For a 70% interest, 2.17 million shares of Inspiration must be issued to Atha, while $4.2 million in exploration expenses must be incurred by September 2028.

Collectively, the agreement calls for 4.33 million common shares of Inspiration to be issued to Atha, while anti-dilution requirements stipulate that Atha is entitled to hold a 9.0% interest in Inspiration until the conclusion of the option agreements. Should Inspiration dilute itself, it must provide Atha with such number of common shares to maintain its ownership. Exploration expenditures meanwhile total $8.0 million on a combined basis, while a 2% NSR will also be applied to each property.

READ: ATHA Energy To Drill 8,000 Metres At Gemini Under Three Phase Program

“With 4.8 million acres of exploration land in the high-grade Athabasca Basin and over 8 million total acres in ATHA’s uranium exploration portfolio, our team has been deliberate in evaluating ways to drive shareholder value from our leading position in two high-grade uranium basins. The size and optionality of our portfolio allows our team to make significant investments into the high-discovery potential of our advanced, flagship exploration projects at Angilak (Nunavut) and Gemini (Saskatchewan), while partnering with other experienced exploration teams to advance projects from ATHA’s high volume of generative projects in our portfolio – allowing us to maintain the strength of our balance sheet while simultaneously advancing and retaining upside on early-stage assets,” commented CEO Troy Boisjoli.

Atha Energy last traded at $0.73 on the CSE.

FULL DISCLOSURE: ATHA Energy is a client of Canacom Group, the parent company of The Deep Dive. Canacom Group is currently long the equity of ATHA Energy. The author has been compensated to cover ATHA Energy on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.