It may just be the shortest amount of time that a company has been public. Less than two weeks after going public, Florida Canyon Gold (TSXV: FCGV) is set to be acquired by Integra Resources (TSXV: ITR) in a transaction that is expected to establish a Great-Basin focused gold and silver production.

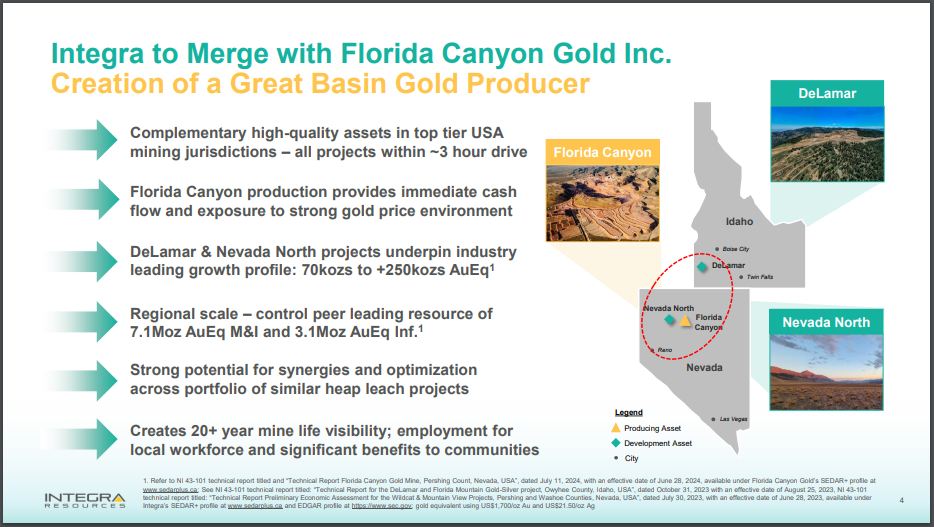

The transaction will see the production from the Florida Canyon Gold Mine in Nevada brought together with Integra’s Nevada North and DeLamar projects, resulting in an operator with annual production of 70,000 gold equivalent ounces. The merger is said to be the first step in establishing Integra as a US-based mid-tier gold and silver producer, with the company having an eye towards growing production to over 250,000 gold equivalent ounces per year.

On a post-combination basis, Integra is expected to boast total mineral reserves of 2.0 million ounces of gold and 51.3 million ounces of silver proven and probable, as well as an estimated 5.2 million ounces of gold and 152.5 million ounces of silver in the measured and indicated resource categories, all of which are contained within oxide heap leach projects in the Great Basin region.

Under the terms of the transaction, Florida Canyon shareholders are toi receive 0.467 of a common share of Integra for each share held, with Florida Canyon shareholders to own 40% of the resulting company. The ratio translates to $0.69 per share in consideration for Florida Canyon shareholders, valuing the company at $95 million.

As part of the transaction, Integra is also expected to raise $20 million under a subscription receipt financing, the net proceeds of which are to be used to optimize mine operations at Florida Canyon and to advance the DeLamar and Nevada North projects.

“Post Transaction Integra will benefit from the currently cash flowing Florida Canyon mine, which provides investors immediate exposure to strong metal prices. DeLamar and Nevada North provide an unmatched growth pipeline that create a pathway to grow Integra from a junior to mid-tier producer in the coming years. As DeLamar is advanced through permitting and toward production, it will greatly benefit from the existing operational and technical capabilities of the team operating Florida Canyon,” commented Integra CEO Jason Kosec on the transaction.

The transaction remains subject to a termination fee of US$2.25 million, as well as the approval by Florida Canyon shareholders and regulators. The transaction is currently expected to close in November 2024.

Integra Resources last traded at $1.47 on the TSX Venture.

Information for this story was found via the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.