Despite signals the economy may be slowing, including a persistently inverted Treasury yield curve and disappointing recent sales trends at major retailers like Walmart Inc. (NYSE: WMT), Target Corporation (NYSE: TGT) and Dollar General Corporation (NYSE: DG), the US$1.4 trillion high yield bond market does not see a recession on the horizon.

More specifically, the premium, or credit spread, that junk-rated companies pay to borrow on top of the interest rate on government debt is around 4.65%, according to ICE/Bank of America data. This represents the approximate historical average for junk bond spreads during non-recessionary periods. High yield spreads can reach 10% or more in a recession, per the investment firm Lehmann Livian Fridson Advisors.

The importance of all this is that junk bond prices and spreads have a good track record of forecasting economic downturns.

Interestingly, spreads have declined since late March when the collapses of the large regional banks Silicon Valley Bank and Signature Bank rattled the markets. Spreads peaked then at around 500 basis points. Of course, an outgrowth of this banking crisis is that bank lending standards have tightened which would seem inconsistent with lower spreads on the risky high yield bonds.

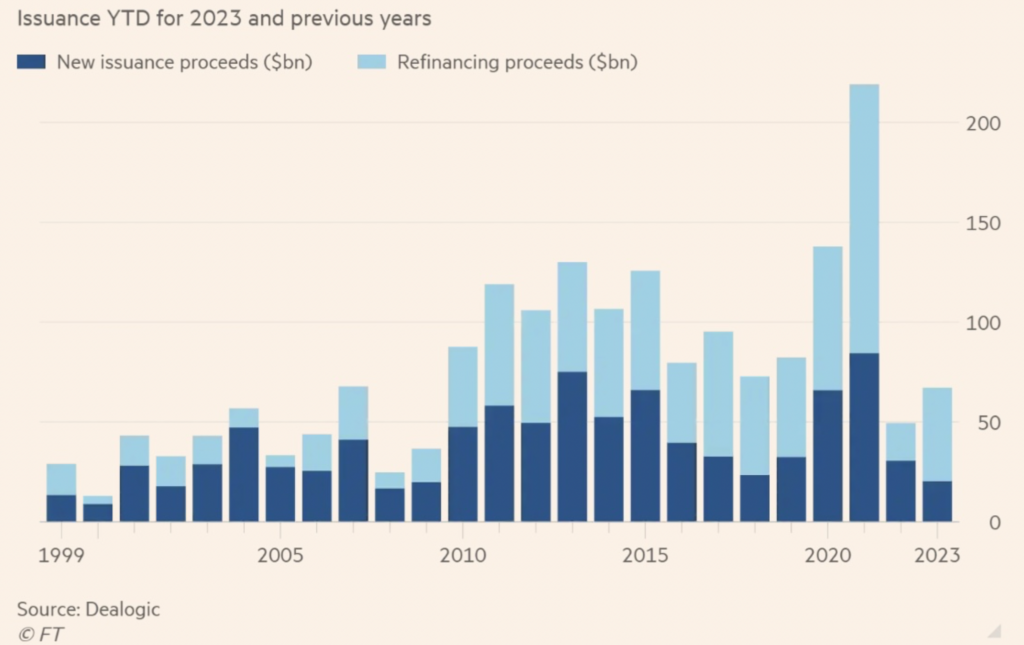

A factor which may be playing a role in firmer junk bond pricing is the limited supply of new junk bonds in 2022 and so far in 2023. Many low-rated companies took advantage of friendly, ultra-low interest rate bond markets to issue significant debt in 2020 and 2021. Such companies don’t need to refinance those bonds for a few years. Indeed, only about US$50 billion of high-yield debt was issued in all of 2022 and around US$67 billion to this point in 2023 versus around US$230 billion in 2021, according to Dealogic.

Two other considerations have bolstered the high yield market: 1) bond ratings agencies have upgraded the ratings of some high yield issuers to investment grade ratings; and 2) a consistently strong jobs market has seemed to trump other economic concerns regarding bond spreads. The strong U.S. jobs report for May of course underscores this trend.

A further constructive element for junk bond pricing has been the relatively low 2.1% current default rate for high yield bonds. However, one high profile investment research firm believes that could change. In its annual default report dated May 31, Deutsche Bank expects the default rate for U.S. high yield debt to peak at 9% in the fourth quarter of 2024.

Information for this story was found via the St Louis Federal Reserve and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Bond Junkies: Federal Reserve to Start Buying High Yield Corporate Bonds