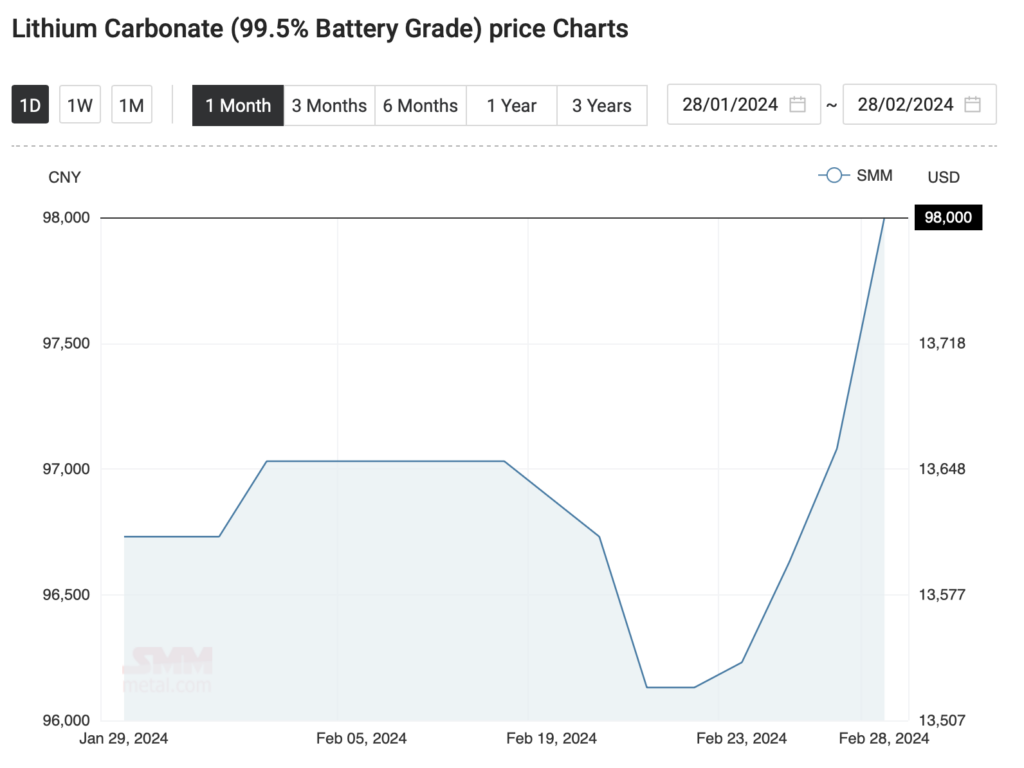

Lithium prices are making significant gains today after a sustained plateau year-to-date. Battery grade lithium carbonate surged to CNY 98,000, a high not seen since December 2023.

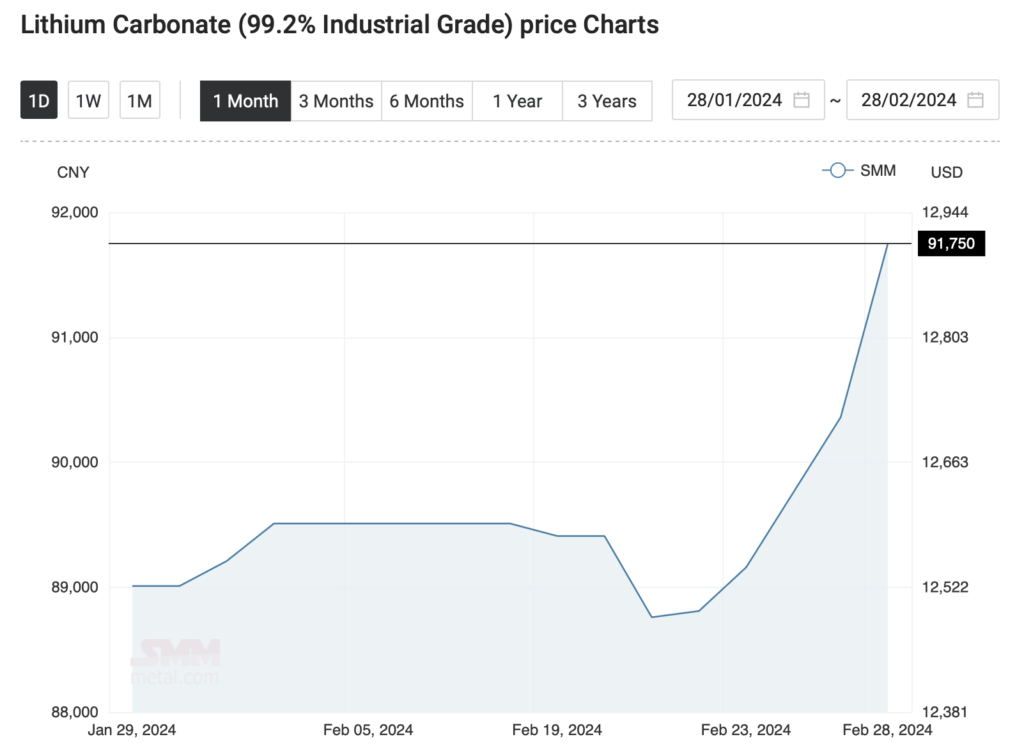

Similarly, industrial grade lithium carbonate rose to CNY 91,750, gaining strides from the recent three-month plateau.

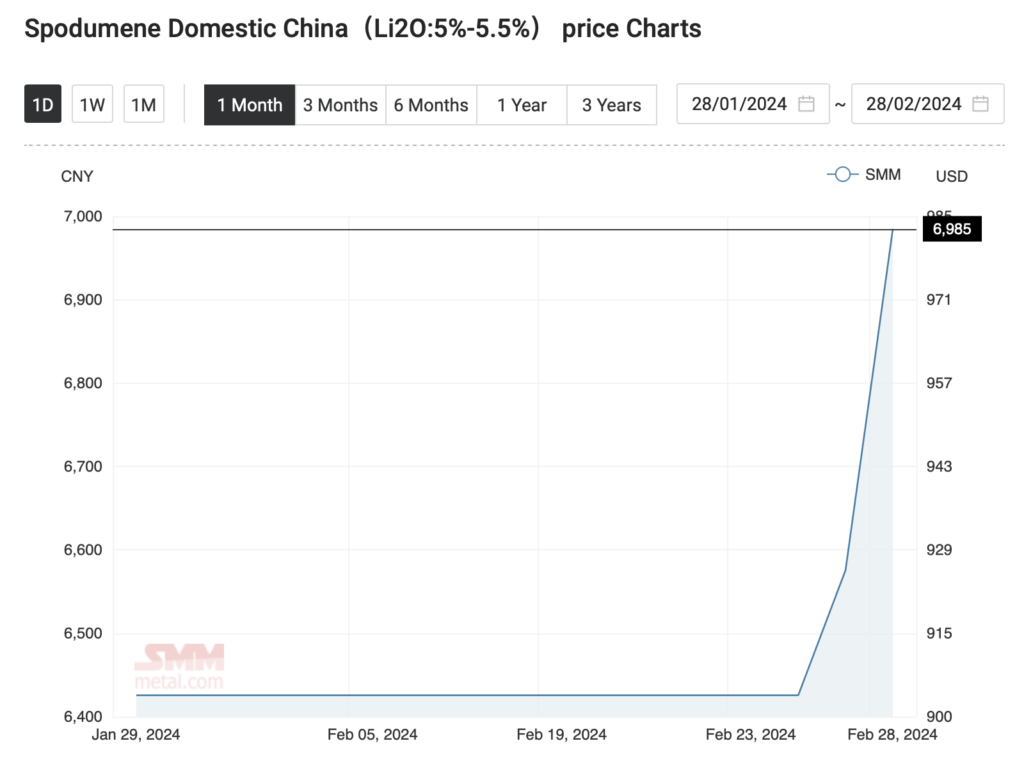

Spodumene prices soared by as much as 6% to CNY 6,985 as of the time of writing.

On the lithium prices surge, prices of leading industry names have also gained traction, like Lithium Americas (TSX: LAC) (up 4%), Sigma Lithium (TSXV: SGML) (up 5%), and Ganfeng Lithium (up 5%).

The #lithium futures market is going crazy right now. As a result, stock prices of mining companies in #China (https://t.co/WjhwFPl5QW, https://t.co/N3g5O2o63S) and in #Australia (https://t.co/twRHdFw7hy, https://t.co/qOcf7ur66K, https://t.co/r7gX0llPGa) are skyrocketing. pic.twitter.com/RILsSxeN3G

— Juan Carlos Zuleta (@jczuleta) February 28, 2024

In terms of market sentiment, the ongoing progress in market supply recovery appears to be relatively sluggish. Additionally, the impending maintenance schedules of some major companies and environmental concerns in the Chinese province of Jiangxi introduces a level of uncertainty regarding future supply, leading to apprehension in the market.

Certain factories are displaying a firm stance on maintaining prices, while some enterprises are adopting a strategy of hoarding goods. Given that downstream demand growth remains within anticipated levels, the current strategy is to prioritize long-term orders while making occasional spot purchases in small batches as needed. Despite an upward trend in the market’s center of gravity, resistance to price hikes persists, with limited capacity for acceptance. Therefore, while there is some upward movement in the market, it remains considerably constrained.

This follows after lithium carbonate prices reached the lowest point in over two years in mid-January, maintaining an 80% decline observed in 2023 due to a significant surplus in the market.

Recent data indicates a nearly 40% drop in new energy vehicle sales in China compared to the previous month, exacerbating the prevailing pessimism stemming from last year’s deceleration. This slowdown in Chinese electric vehicle sales has constrained lithium demand for battery producers, leading factories to forgo their usual restocking patterns.

Instead, businesses capitalized on elevated inventories resulting from the surplus caused by extensive subsidies from Beijing throughout 2022. These developments have prompted major market players to project that the next lithium deficit may not occur until 2028, a stark departure from earlier expectations of persistent shortages that drove lithium prices to CNY 600,000 in November 2022.

Information for this story was found via the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.