Lordstown Motors’ (OTC: RIDEQ) Steve Burns has reached a settlement with the U.S. Securities and Exchange Commission (SEC) following allegations of misleading investors regarding the demand for the company’s flagship electric pickup truck, the Endurance.

According to documents filed with the U.S. District Court for the District of Columbia, Burns has agreed to pay a civil fine of $175,000 and is barred from serving as an officer or director of a public company for a period of two years. The settlement also includes a permanent injunction, with Burns neither admitting nor denying the SEC’s allegations.

The SEC had charged Lordstown Motors in February 2024 with misleading investors about the sales prospects of the Endurance electric pickup truck. The company had previously agreed to a settlement of $25.5 million. However, the involvement of Burns in the SEC’s investigation was not initially clear.

Lordstown Motors, founded in April 2019 as a subsidiary of Burns’ company Workhorse Group, went public the following year through a merger with a special purpose acquisition company, DiamondPeak Holdings Corp., with a market value of $1.6 billion. The company received significant investments, totaling $780 million, from investors during and after the merger.

Amid a surge in electric vehicle startups going public via mergers in 2020, Lordstown Motors attracted attention and investment from major players, including General Motors. The company even acquired a massive assembly plant in Lordstown, Ohio, from GM.

However, troubles began to surface when doubts arose about the accuracy of Lordstown’s claims regarding pre-orders for the Endurance pickup truck. Burns had announced receiving 20,000 pre-orders during a high-profile event in June 2020, later stating the company had received 100,000 nonbinding pre-orders from commercial fleet customers.

These claims were disputed by short seller research firm Hindenburg Research, leading to Burns’ resignation, alongside other executives, by June 2021. The SEC’s subsequent investigation found that Lordstown Motors and Burns had misrepresented the nature of the pre-orders.

Despite efforts to navigate these challenges, Lordstown Motors eventually filed for Chapter 11 bankruptcy protection. The company emerged from bankruptcy under a new name, Nu Ride Inc., with a renewed focus on litigation against iPhone-maker Foxconn.

Earnings from stock options

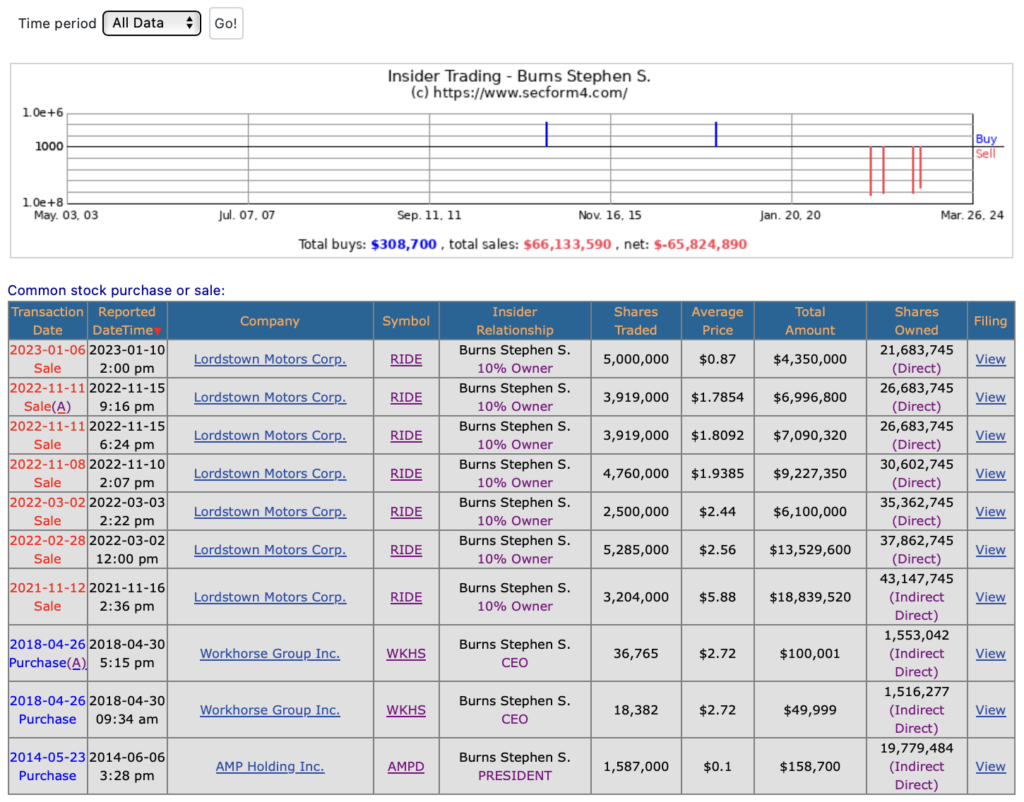

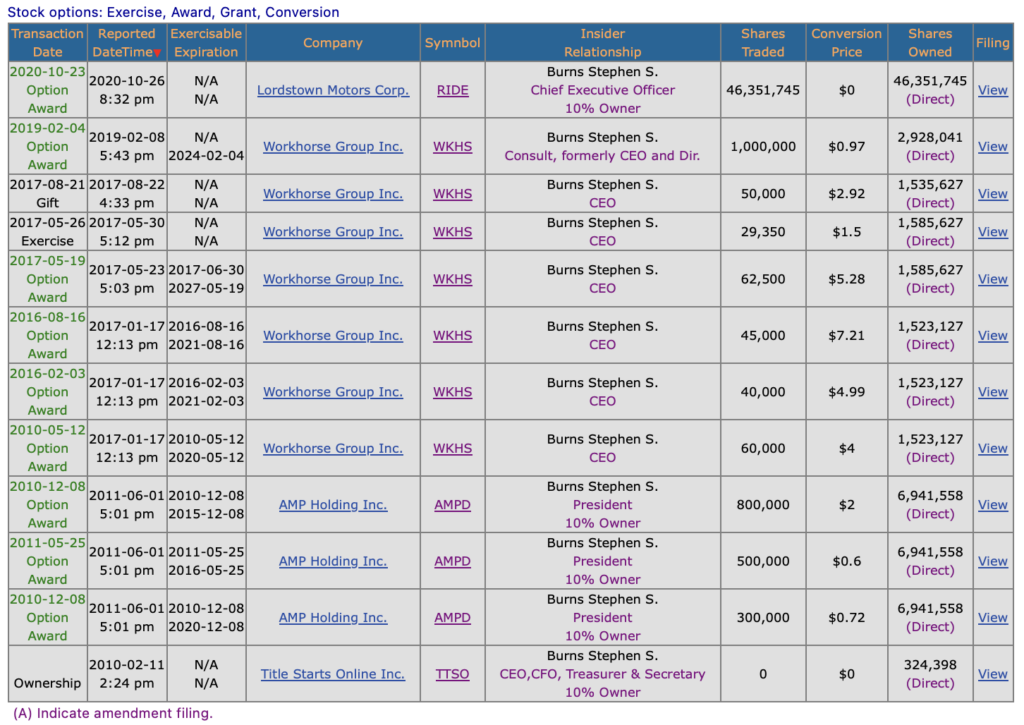

In a period of little over a year, Burns sold over 28 million shares, earning more than $66 million in gross proceeds. This, despite him only buying a total of $308k worth of shares in the company since its inception.

A big chunk of his shares came from stock options awarded to him in October 2020 by the company, amounting to more than 46 million shares.

In early 2023, the company halted production and shipments of Endurance electric trucks to address quality issues. They also issued a voluntary recall for 19 of their 37 pickups delivered to date, due to a specific electrical connection issue.

While original estimates had called for 2022 top line revenue to exceed $1.7 billion, the reality was the company saw a paltry $194,000 in sales that full year.

Following his departure from Lordstown Motors, Burns launched a new venture called LandX Motors in January.

Information for this briefing was found via TechCrunch and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.