It appears that one of the strategic alternatives that iAnthus Capital Holdings (CSE: IAN) is considering for shareholders may be that of a potential management buyout offer. The Deep Dive has obtained documents that point to an offer for a management buyout being assembled by certain executives of the firm as a strategic alternative for the current liquidity crises faced by the company.

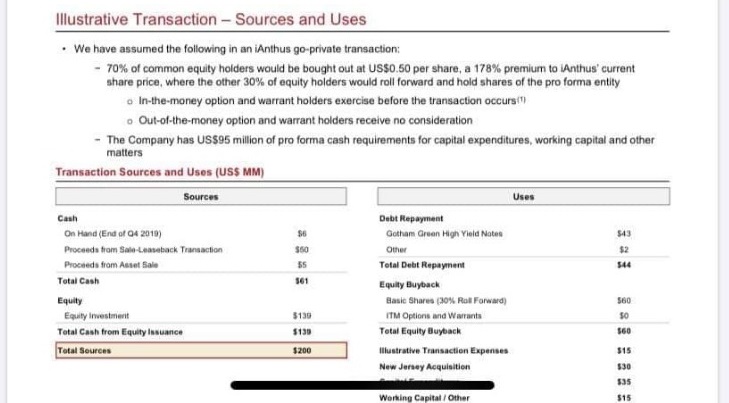

While the liquidity problem being faced by the company is no secret to long time shareholders, the proposal of a potential management buyout offer may come as a shock. While executives were unable to find further funds to support the operation in the current format, they may have now evidently found the capital needed to perform a go private transaction. The documents sourced indicate that a total equity investment of $139 million would be associated with the offer.

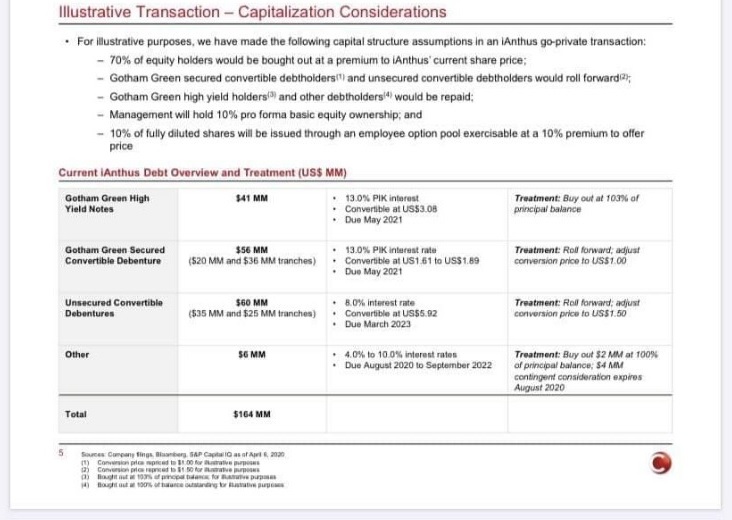

The proposal, which is allegedly being conducted by an entity referred to as “Saving Grace Capital, LLC,” consists of offering 70% of current shareholders a price per share of US$0.50 as per the documents sourced by The Deep Dive. Current in-the-money warrant and option holders would be eligible to exercise their units, however units that are not in the money would effectively expire worthless. Gotham Green meanwhile would see certain high yield holders and other debtholders repaid, while secured and unsecured convertible debenture holders would roll forward.

Included in the documents we received are management bio’s for that of Hadley Ford and Randy Maslow, whom are currently CEO and President of iAnthus respectively. No other bio’s were included within. The documents themselves identified that the presentation was a result of the need to raise $0.5 million to cover pre-closing fees of the potential transaction, and that they were intended only to “facilitate the discussions and negotiations between the parties of a possible business transaction.”

The documents are believed to be authentic, and The Deep Dive is currently working to further confirm the details on the matter.

iAnthus Capital Holdings last traded at $0.25 on the CSE.

Information for this briefing was found via Sedar and undisclosed sources. The author has no securities or affiliations related to any organization mentioned in this article. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.