On May 16, Medipharm Labs (TSX: LABS) reported its first quarter financial results. The company reported revenues of $4.87 million, down from $5.5 million last year. While gross profits still came in negative at ($403,000), it was better than the ($680,000) a year ago.

The company also reported a slightly better net loss and adjusted EBITDA compared to a year ago. Net losses came in at $7.46 million, an improvement over the $13.87 million it reported last year, and adjusted EBITDA came in at ($5.68) million for this quarter.

Lastly, the company ended the quarter with $28.3 million in cash as the CFO, Greg Hunter, says, “MediPharm is on solid financial footing,” as the company is “materially debt-free.”

MediPharm Labs currently has 4 analysts covering the stock with an average 12-month price target of C$0.l5, which is an upside of 100%. Out of the 4 analysts, 1 has a buy rating and the other 3 analysts have hold ratings. The street high price target sits at C$0.20, or an upside of 167%.

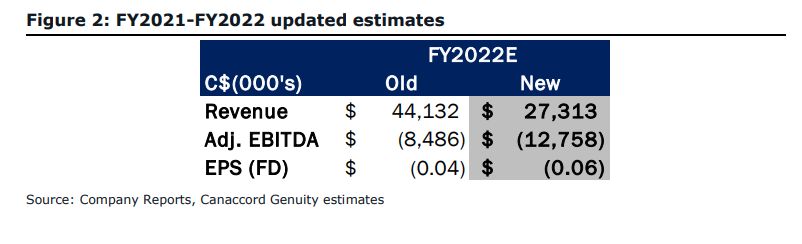

In Canaccord’s note on the results, they reiterate their hold rating but lower their 12-month price target from C$0.20 to C$0.10, saying that MediPharm saw “top-line deceleration across all segments.” As a result, the analysts have made a “material downward” revision to their estimates in both domestic and international markets.

On the results, MediPharm reported $4.87 million in revenue, below Canaccord’s $6.09 million estimates. Canaccord says that this miss was driven by weakness in all of MediPharm’s segments in both domestic and international markets. They say that MediPharm’s Canadian adult-use revenue once again saw softness, and that it’s product line, which is more medically focused, “contributes to its inability to secure lasting market share in the adult-use segment.” MediPharm’s recreational revenue dropped 20% quarter over quarter.

They add that MediPharm’s international segments did not fare much better, as the company saw international revenues drop 8% sequentially to $1.9 million. Canaccord also believes that the company’s international segment is its core opportunity but worries since the international market have seen a >30% decline from its highs, with slowdowns in Australia and Germany seeing double-digit sequential decreases.

Below you can see Canaccord’s updated estimates for MediPharm.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.