Neo Performance Materials (TSX: NEO) is set to undergo a strategic review. The company has formed a special committee of independent directors which will aim to “consider opportunities to maximize shareholder value.”

The committee is expected to review the current strategy of the company, along with its assets, operations, and capital structure to consider strategic alternatives. The review is said to include the potential sale of business units or seeking strategic investments or other such measures to provide value for shareholders.

“Neo’s business continues to perform well, with a strong balance sheet, and solid bottom line performance. While the Board believes the Company’s valuation will, in time, reflect the true value of its business, a thorough review of strategic alternatives is a prudent step to enhance that process,” commented Claire Kennedy, board chair.

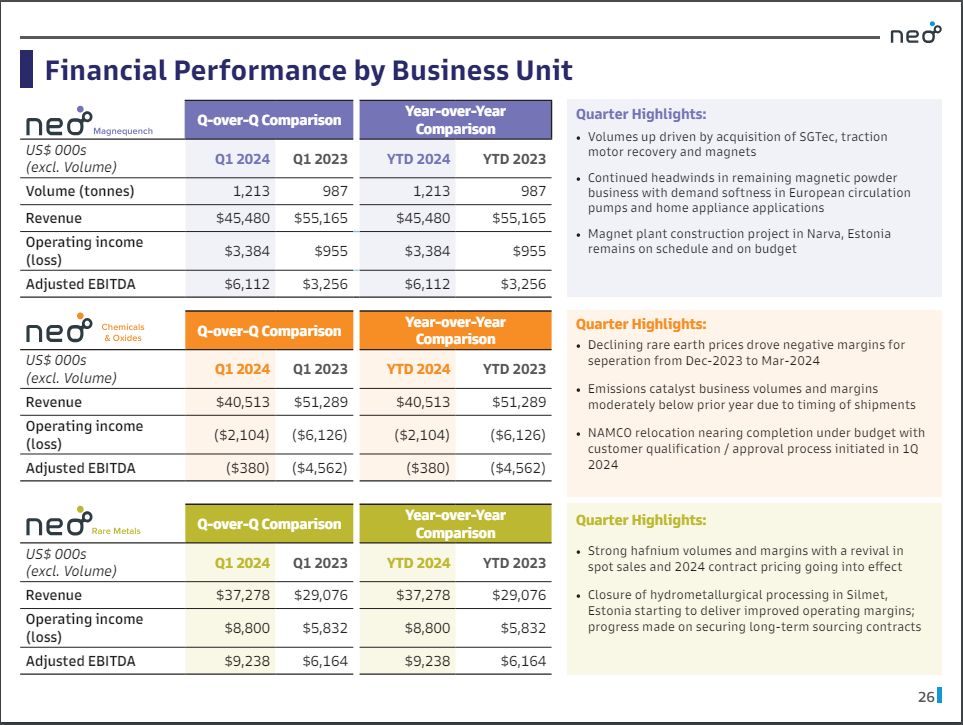

The review follows the company posting declining revenue in two of its three major business units in the most recent quarter, which was blamed on declining rare earth prices and headwinds in the magnetic powder business.

The review is said to not have been at the request of Hastings Technology Metals, a significant shareholder of the company.

Despite the review, the company has elected to appoint Dr John McGarva to the firms board. McGarva is said to be a leader in product development, having recently retired as Head of Engineering from Dyson, where he led the firms haircare product line, evolving it from a single product to an entire business unit.

Neo Performance Materials last traded at $7.38 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.