FULL DISCLOSURE: This is sponsored content for Rua Gold.

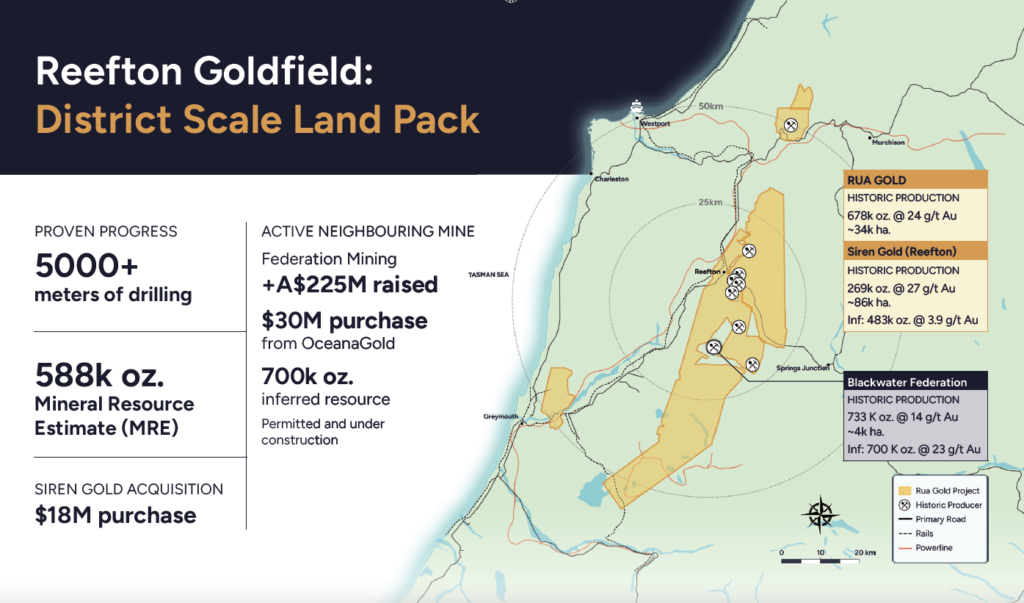

Vancouver-based mining firm Rua Gold (TSXV: RUA) has announced its move to acquire Reefton Resources from ASX-listed Siren Gold, marking a pivotal expansion in New Zealand’s Reefton Goldfield. This acquisition signifies not only a significant growth in Rua Gold’s asset base but also a broader trend of increased investment and focus on New Zealand’s gold mining sector.

The acquisition, expected to close in Q4 2024, will establish Rua Gold as the primary goldfield explorer in the Reefton area.

Upon completion, Rua Gold will control around 120,000 hectares of mining tenements in the South Island’s Reefton Goldfield, effectively increasing its holdings from a previous 34,000 hectares. The district, which has historically produced over two million ounces of gold at grades ranging from 9 to 50 grams per ton, is now seeing renewed interest, driven by the push to explore one of the world’s least-explored, high-grade gold regions.

Under the terms of the deal, Siren Gold will receive a total of A$20 million in value: A$2 million in cash and around 84 million shares of Rua Gold, representing A$18 million. Post-transaction, Siren will hold approximately a 26% equity interest in Rua Gold, allowing it to maintain a significant role in the combined entity’s strategic direction.

The Rua Gold acquisition is expected to close in the near term, marking a major milestone in the company’s evolution. Rua Gold’s increased exposure to the highly prospective Reefton Goldfield, supported by a pro-mining government and strong investor interest, bodes well for its future success.

The expanded portfolio provides an opportunity to discover new mineral resources while scaling historic high-grade gold mines. The merger with Siren Gold’s assets will likely lead to significant operational synergies, streamlined permitting processes, and enhanced target generation.

New Zealand’s mining prospects

New Zealand’s gold mining landscape is currently one of the safest jurisdictions globally. The country’s stable political environment, transparent legal framework, and commitment to sustainable mining make it an attractive destination for gold mining companies.

The current political climate in New Zealand is favorable for the mining sector. Resources Minister Shane Jones has been vocal in his support for resource extraction as a driver of regional and national economic growth. The government has made efforts to streamline mining operations, introducing a new fast-track approval process aimed at facilitating the development of major projects.

“New Zealand is open again for business,” he announced earlier this year, while signaling a new era for the country’s resource industry.

During a speech in parliament, Jones articulated a vision of a New Zealand unencumbered by excessive environmental restrictions, characterizing the country’s new fast-track approval processes as a step towards “turbocharging” mining operations. This shift is aimed at providing expedited permitting and facilitating the delivery of significant development projects.

“In another 20, 30 years, people will look back to this bill as the day that New Zealand moved from cancel economics to can-do economics. This bill is to provide a fast-track decision-making process that facilitates the delivery of infrastructure and development projects with significant regional and national benefits. Regions need to benefit from their resource endowment… There are veins of wealth throughout the South Island, and with this legislation, mining will be turbocharged,” Jones said.

The government’s Mineral Mining Strategy, announced earlier in 2024, aims to double the export value of the mining sector to $2 billion by 2035 and increase mining-related jobs from 5,000 to 7,000. In Reefton specifically, gold and antimony are seen as valuable resources, with critical minerals like rare earths also playing a role in the country’s broader economic strategy.

ACT’s Resources spokesperson Simon Court echoed Jones’ pro-mining stance, highlighting the sector’s potential to address New Zealand’s energy needs and support a high-wage economy.

Furthermore, gold remains a stable, safe-haven asset for investors seeking protection against global market volatility. The price of gold has consistently demonstrated resilience, which strengthens the viability of Rua Gold’s expanded exploration and mining activities in the Reefton Goldfield.

Gold traded near $2,636 per ounce on Thursday, close to record highs, as heightened geopolitical tensions fueled safe-haven demand.

Mining neighbors

While Rua Gold will be a significant player in New Zealand’s mining sector, the country remains relatively underexplored. Few other companies have a notable presence.

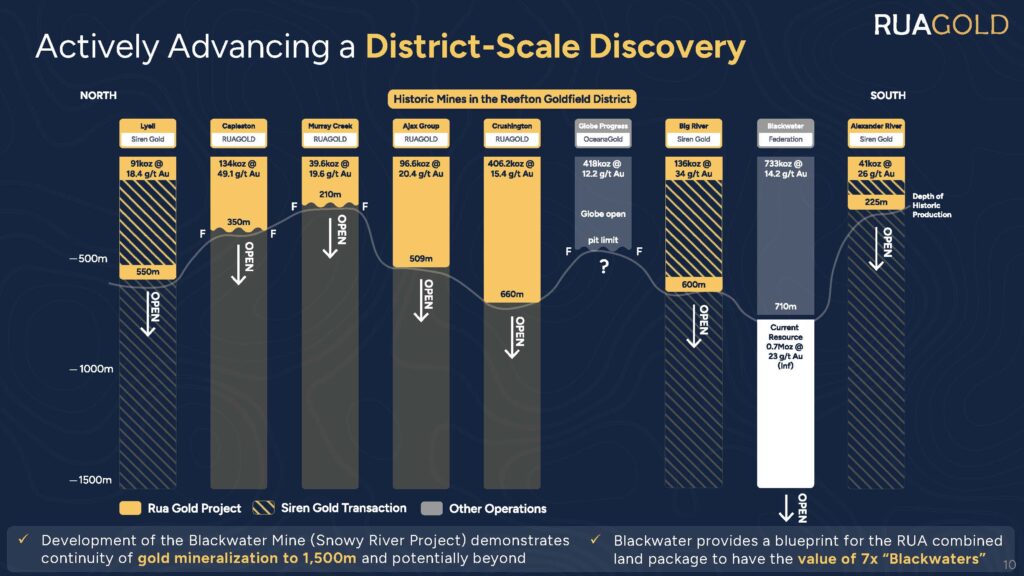

Federation Mining, an Australian company, is developing the Snowy River (formerly Blackwater) project in the Reefton Goldfield. The Snowy River project has an inferred resource of approximately 700,000 ounces of gold, with a grade of 23 grams per tonne. This fully permitted mine is projected to produce 70,000 ounces per year over a lifespan of more than a decade, demonstrating the significant potential of the Reefton Goldfield.

Federation Mining has already begun development of the project, with production anticipated by H1 2026.

Another prominent player in the New Zealand mining scene is OceanaGold, with operations centered on the North Island. OceanaGold’s Wharekirauponga (WKP) project has demonstrated strong resource potential, with a high-grade mineralization indicated resource of 1 million ounces at 15.9 grams per tonne.

READ: New Zealand Gold: West Coast Experiences Resurgence In Gold Mining & Exploration

OceanaGold has welcomed the New Zealand government’s new permitting processes, with the fast-track approval regime to support the development of its Waihi North Project, which includes WKP. The New Zealand government last week confirmed that the project would be included under the approval regime, which is expected to be passed into law later this year.

The presence of both Federation Mining and OceanaGold, alongside Rua Gold’s consolidated assets, positions New Zealand as a promising region for gold exploration and extraction. However, there remains significant untapped potential across the country, with Rua Gold well-placed to be the leading gold explorer and producer on the South Island.

Reefton Goldfield

The Reefton Goldfield holds a storied place in New Zealand’s mining history. Gold was first discovered in the area in the mid-19th century, and by the early 20th century, the region was producing substantial quantities of high-grade gold.

However, with many of the underground mines closing throughout the 1940s and 50s, large sections of the district have since remained relatively unexplored. This under exploration presents a significant opportunity for Rua Gold, which now holds the dominant land position across nearly all known historic production camps outside of the Blackwater and Globe Progress mines.

The acquisition places Rua Gold in a unique position to develop what remains one of the most prospective gold regions globally. It also enables the potential development of a central processing hub, which could lower overall project capital expenditures and support more efficient resource extraction across the tenements.

Additionally, the formation of a larger player in the New Zealand gold sector provides greater opportunity for engagement with governmental authorities and local stakeholders as Rua Gold assists in shaping the Minerals Strategy for New Zealand. The company’s robust position in a favorable jurisdiction, alongside notable neighbors like Federation Mining and OceanaGold, is set to contribute to the growth of New Zealand’s mining sector and the broader global demand for gold.

In an environment where gold remains a safe asset and New Zealand’s pro-mining policies encourage responsible development, Rua Gold stands on the brink of becoming a major player in one of the world’s most promising gold mining districts. This acquisition not only strengthens its market presence but also sets the stage for a resurgence in New Zealand’s gold mining industry.

FULL DISCLOSURE: Rua Gold is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Rua Gold on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.