The Ontario Teachers’ Pension Plan concluded 2023 with results falling short of expectations, citing challenges posed by economic uncertainties.

CEO Jo Taylor disclosed that the pension plan’s asset allocation strategy, geared towards anticipating a recession, did not yield desired outcomes. Despite this setback, Taylor emphasized a cautious approach towards increasing equity investments, citing concerns over the current market conditions perceived as overheated.

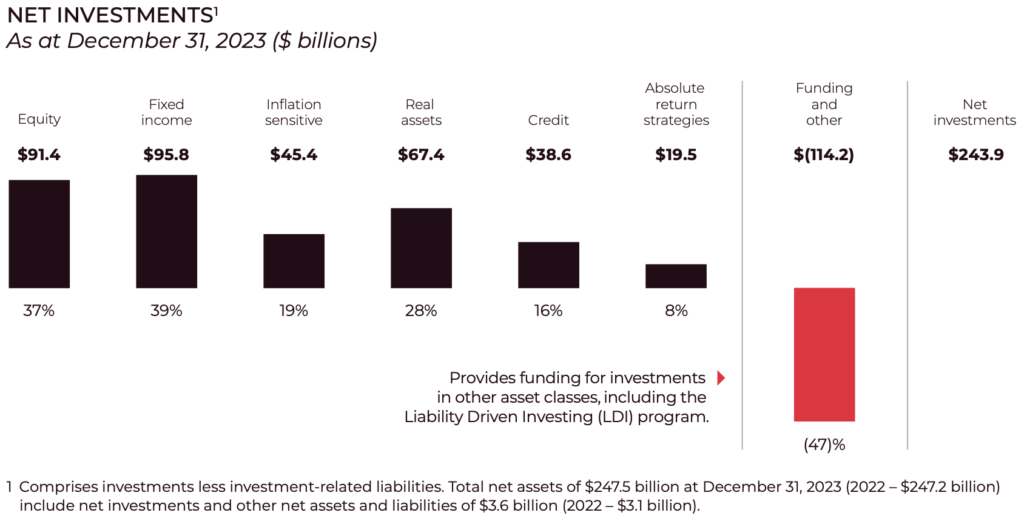

The pension plan reported a net return of 1.9 per cent, culminating in total assets amounting to $247.5 billion by the end of the year. Taylor highlighted factors contributing to the underperformance, including underexposure to listed equities and valuation adjustments within Teachers’ infrastructure and real estate portfolios, influenced by higher interest rates.

“We only have about 10 per cent of our portfolio invested in listed equities,” the chief executive said in an interview, noting the strong performance of the holdings as markets surged towards the end of last year.

Despite commendable performance in existing equity investments amid market surges, Taylor expressed reservations regarding the prevailing market valuations as they approached 2024.

“But you look at valuations as we go into 2024 — they look as challenging if not more challenging than they were when we entered 2023, and that’s going to be an interesting debate for us in terms of, if we want to blend the risk up a little bit, how we do that?” Taylor added.

Approximately 28 per cent of the fund is allocated to global real estate and infrastructure, both sectors facing valuation challenges due to the impact of higher interest rates. Taylor noted specific instances such as downtown retail struggles post-COVID-19 and regulatory changes affecting infrastructure projects in Europe, contributing to portfolio adjustments.

The real estate portfolio incurred a negative return of 5.9 per cent against a positive benchmark, while infrastructure returns stood at negative 2.8 per cent compared to a positive benchmark return. Taylor acknowledged the continued difficulty expected in the real estate sector for 2024 and possibly beyond, despite the relative stability observed in major Canadian cities like Toronto and Vancouver.

Addressing inquiries about increasing investments in the Canadian market, Taylor reaffirmed the pension plan’s commitment to its existing investment strategy. He cited substantial investments in Canada across various sectors, indicating a balanced approach to portfolio diversification.

Regarding Canadian infrastructure, Taylor expressed openness to projects brought forth by the newly established Ontario Infrastructure Bank. He emphasized the pension plan’s track record in managing critical assets and expressed interest in operating assets rather than those under development.

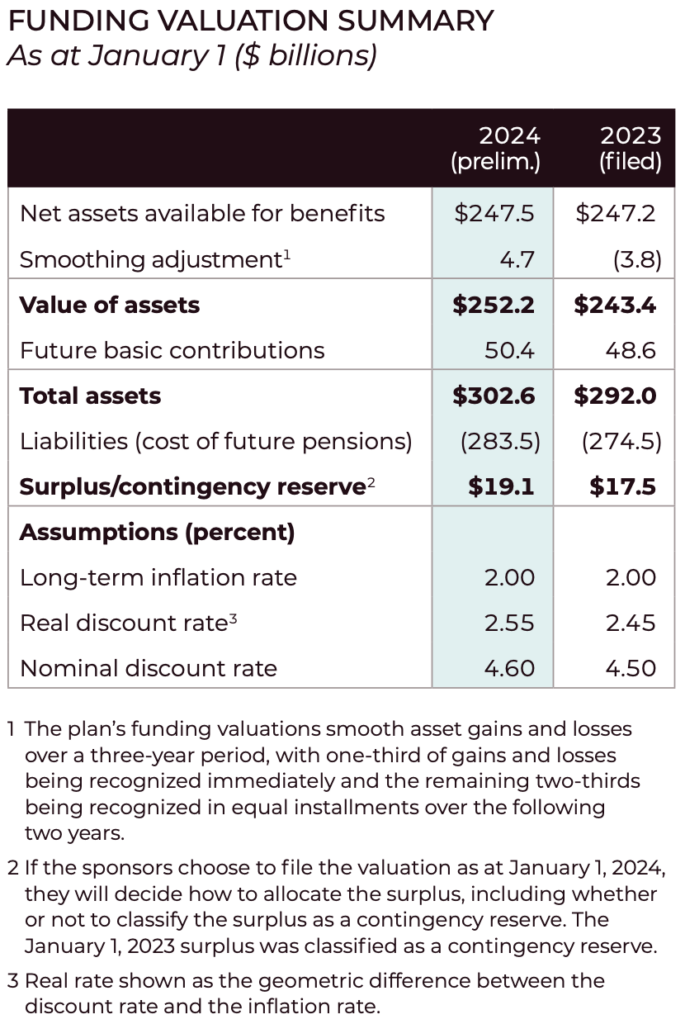

Ontario Teachers’ Pension Plan recorded a ten-year annualized total-fund net return of 7.6 per cent in 2023 and a 9.3 per cent return since inception. The pension plan maintained a preliminary funding surplus of $19.1 billion and achieved full funding for the eleventh consecutive year.

In 2022, the fund was in hot water after it invested $75 million into two now-bankrupt FTX entities as part of a $420 million fundraising round even after months of supposed due diligence.

Information for this briefing was found via Financial Post and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.