FULL DISCLOSURE: This is sponsored content for Rua Gold.

After multiple delays to the shareholder meeting, Rua Gold (TSXV: RUA) has finally seen Siren Gold (ASX: SNG) shareholders approve the acquisition of Siren’s Reefton assets in New Zealand by Rua.

The vote, which was held earlier today, followed a last minute attempt by Federation Mining on Friday. Federation is said to have proposed indicative but incomplete terms that would have seen the developer acquire all of Siren Gold, rather than just the Reefton assets. Siren’s board however viewed the offer as being inferior to Rua’s offer for the Reefton assets, enabling the shareholder vote to proceed earlier today.

With the purchase of the Reefton assets now approved by Siren shareholders, Rua Gold is expected to close on the purchase in November 2024, subject to regulator approvals.

“Recognizing the strategic rationale to create a district scale exploration opportunity covering some of the highest-grade gold and antimony assets in the world, Siren’s shareholders overwhelmingly voted in favor of this transformational transaction. The combined Company benefits from having both the local Reefton teams working together and Brian Rodan, Chairman of Siren joining the RUA GOLD board,” commented Robert Eckford, CEO of Rua Gold.

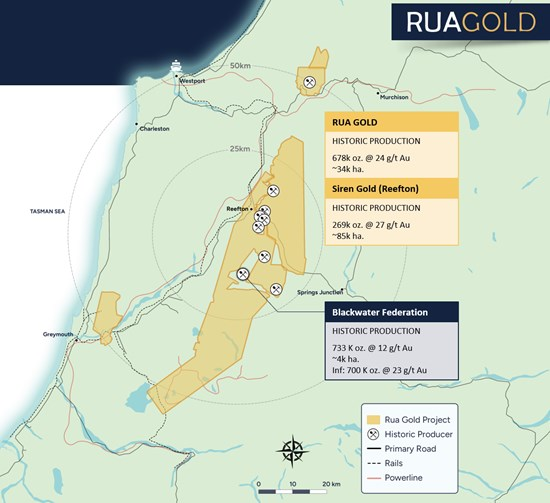

On a combined, go-forward basis, Rua’s assets in the Reefton region are said to represent one of the least-explored high-grade gold districts in the world. The combination will bring together Rua’s assets in the region, which boast historic production of 678,000 ounces of gold at an average grade of 24 g/t, with the Reefton assets, which boast historic production of 269,000 ounces of gold at an average grade of 27 g/t.

Rua’s tenements meanwhile will nearly triple in the size, from 34,000 hectares to 120,000 hectares, covering all past producing camps in the region, except for the Blackwater mine, which was recently obtained by Federation Mining and features historic production of 733,000 ounces of gold at an average grade of 12 g/t, and the Globe Progress mine, which is owned by OceanaGold. Permits, access, and consents are said to be in hand by Rua for an aggressive drilling campaign on the land package following a district-wide reassessment of targets.

READ: Rua Gold Sweetens Deal to A$22 Million For Siren Gold’s Reefton Assets

“Seeing the competing offer from Federation Mining made on October 14, 2024 only confirms our thesis on the high grade potential of this district and we are excited to deliver results,” continued Eckford.

Under the terms of the transaction, Rua Gold is to pay $1.8 million in cash for the assets, while also subscribing to $1.8 million in shares of Siren Gold, and issuing shares worth $16.6 million to Siren, which are subject to resale restrictions. As part of the transaction Brian Rodan, Chairman of Siren, will join Rua’s board.

Rua Gold last traded at $0.19 on the TSX Venture.

FULL DISCLOSURE: Rua Gold is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Rua Gold on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.