SSR Mining Inc. (TSX: SSRM) released its consolidated financial results for the fourth quarter and full-year ending December 31, 2023 this past week. However, the spotlight is on a recent tragic incident that has led to the suspension of operations at its Çöpler mine.

On February 13, 2024, a significant slip on the heap leach pad, termed the “Çöpler Incident,” prompted the suspension of operations at the mine. Nine individuals are currently unaccounted for. The company, grappling with the aftermath, expressed its inability to estimate when operations will resume at Çöpler.

Rod Antal, Executive Chairman of SSR Mining, expressed condolences, stating, “Our attention is focused at Çöpler. The events of February 13, 2024, were tragic and overshadow today’s results. We are heartbroken and sympathize with what we know is an extraordinarily stressful time for the families, friends, and colleagues of the nine missing personnel.”

The Turkish government is actively involved in environmental monitoring of the region, particularly regarding potential contamination. The company is also cooperating with government directives, with a primary focus on containment and remediation efforts. Discussions are underway to determine a permanent storage location for displaced heap leach material.

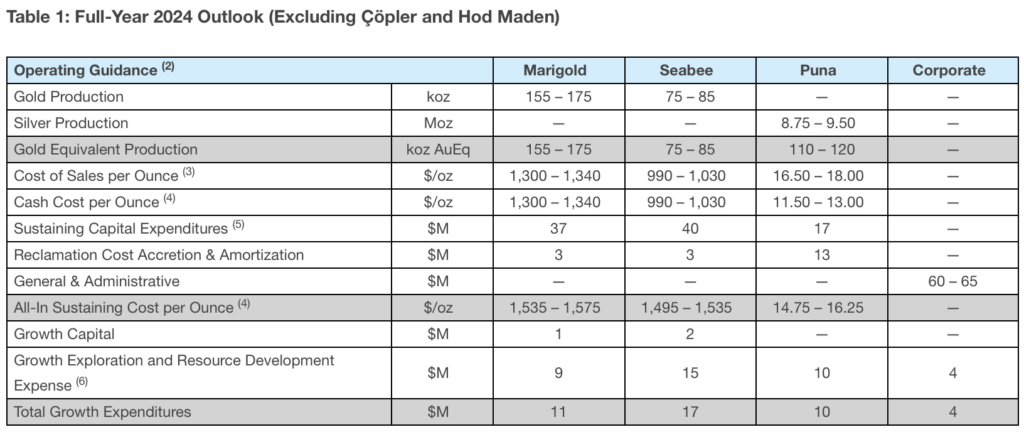

Due to the evolving situation at Çöpler mine, SSR Mining is retracting its previously issued 2024 and long-term guidance forecasts for Çöpler and projects in Türkiye.

As of December 31, 2023, the Çöpler mine’s leach pad inventory amounted to $73.3 million, constituting 19% of the mine’s total inventory and 10% of the company’s total inventory. Additionally, the mineral, properties, plant, and equipment (MPP&E) related to the leach pad were valued at $33.1 million, representing 1.0% of Çöpler’s total MPP&E and 0.8% of the company’s total MPP&E.

In light of the Çöpler incident, Michael Anglin, Lead Independent Director, is expected to postpone retirement and stand for re-election at the company’s 2024 annual shareholders’ meeting, given the exigencies.

Higher revenue, wider loss

In the fourth quarter of 2023, SSR Mining achieved production of 211,226 gold equivalent ounces, with cost of sales standing at $1,064 per gold equivalent ounce and all-in sustaining costs (AISC) at $1,326 per gold equivalent ounce. For the entire twelve months of 2023, the company reported production of 706,894 gold equivalent ounces, maintaining cost of sales of $1,141 per gold equivalent ounce and AISC of $1,461 per gold equivalent ounce.

Revenue for the quarter ended at $425.9 million up from last year’s $306.4 million. For full-year, revenue came in at $1.43 billion, also an increase from 2022’s $1.15 billion.

However, the quarter also saw an attributable net loss of $217.8 million, amounting to $1.07 per diluted share. This loss was primarily attributed to a non-cash impairment related to the removal of C2 Mineral Resources from the consolidated Mineral Reserves and Mineral Resources statement at the Çöpler mine.

Adjusted attributable net income for the same period was reported at $127.1 million, or $0.59 per diluted share. The operating cash flow for Q4 2023 stood at $203.2 million, or $218.4 million before working capital adjustments, while free cash flow amounted to $144.4 million, or $159.6 million before changes in working capital.

For the twelve months ending December 31, 2023, the company reported an attributable net loss of $98.0 million, equating to $0.48 per diluted share, alongside an adjusted attributable net income of $276.5 million, or $1.29 per diluted share. Operating cash flow for the same period was $421.7 million, or $555.9 million before working capital adjustments, and free cash flow was $198.3 million, or $332.5 million before changes in working capital.

Moreover, SSR Mining returned $114.0 million to shareholders over the twelve months ending December 31, 2023, representing a capital returns yield of approximately 5.0%. This return was comprised of $57.7 million in quarterly cash dividend payments and $56.3 million in share repurchases.

However, as a result of the Çöpler Incident, the company is suspending quarterly dividend payments and the automatic share purchase plan.

As of December 31, 2023, SSR Mining maintained a cash and cash equivalent balance of $492.4 million and a non-GAAP net cash position of $261.6 million.

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.