The Canadian finance landscape was rocked last month by the sudden death of 30 year old hedge fund founder Chris Callahan. According to a touching and anguished obituary Callahan founded Toronto based hedge fund Traynor Ridge Capital in 2020, making him one of the youngest hedge fund managers in Canada.

The plot thickened in late October when the Canadian Investment Regulatory Organization (CIRO), and the Ontario Securities Commission (OSC), froze Traynor Ridge, and successfully petitioned an Ontario court to put the firm in receivership. Ernst and Young has been appointed receiver amidst parallel lawsuits from various different brokers and clearing houses to recover payment for securities they’d bought at Traynor Ridge’s direction that hadn’t been paid for at the time of Callahan’s death.

With no official ruling on the cause of death, it isn’t clear if Callahan killed himself amid pressure from trades he couldn’t pay for, or if he killed himself at all. For all we know, Mr. Callahan could have been trying to take the edge off, and become a victim of Canada’s poison drug crisis before he got a chance to call in the settlement orders. He wouldn’t have been the first trader to punch his own ticket in a bad market, and this market is terrible, but it’s falling apart in a uniquely Canadian way, under some very questionable oversight.

Who’s in charge of this mess?

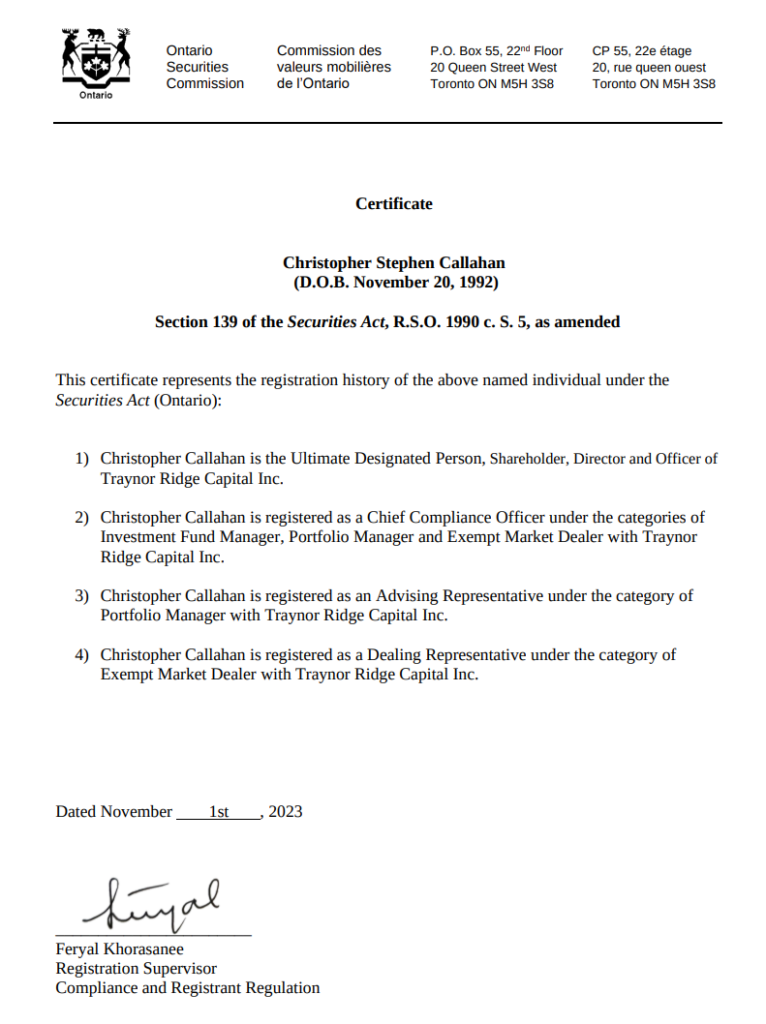

At the time of Callahan’s death, he and Traynor Ridge “Managing Director” William J. Chyz (who wasn’t technically a director) were the only people on the three person Traynor Ridge team registered as securities professionals with the Canadian Securities Administrators[1]. Callahan is on record in literally all of the positions that the OSC requires to be filled at Ontario-based hedge funds, and was also Traynor Ridge’s sole director and shareholder. His company bio lists him as lead Portfolio Manager. Callahan appears to have served in all of those capacities since he started the fund in 2020.

Despite a detailed factum filed by the OSC as part of the receivership, a statement of the receiver filed by Ernst & Young, a statement of claim filed to open a lawsuit by Virtu Financial, one of the brokers that claims to have been stiffed, and some excellent reporting by The Globe and Mail, The Toronto Star, and BNN, we still have no accounting of the specific securities that Traynor Ridge was holding at the time of Callahan’s death, or at any other time, paid for or not.

The Star‘s David Olive reports that Traynor Ridge held positions in “small and microcap stocks, including some tiny marijuana and energy firms, and shell companies with little to their name beside a stock market listing,” which got The Dive‘s attention, because that’s our beat.

BNN‘s anonymous sources say that the un-paid-for securities included Curaleaf Holdings Inc. (CSE:CURA), Cresco Labs Inc. (CSE:CL), Cannabist Company Holdings Inc. (NEO:CBST), and Trillion Energy International Inc. (CSE:TCF). The Deep Dive’s research team was able to confirm that Traynor Ridge was a Trillion Energy shareholder from Trillion’s public filings, but there’s nothing to look up that would tell us how much of anything the fund held, or when, and we consider that the larger point here.

De Facto Dark Pools

Any money manager that holds >US$100 million in securities registered for sale in the United States is required to file a form 13-F quarterly, showing the public what they own and how much. Failing to file means big trouble from the SEC, and there aren’t any exemptions available.

This is a reasonable and functional arrangement that works for everyone involved. In the internet era, the SEC’s requirement of standardized digital filing has spawned a cottage industry around aggregation and organization of the data generated by 13-F and related 13-D filings. Whale Wisdom, Insider Monkey and fintel.io are some of the more popular resources used by investors, journalists and the general public to keep track of what all sorts of different investment companies and pubco insiders are up to. The Dive has successfully used 13-F filings to report on CPP Investments obscuring their ownership of Russian securities, and more recently to ridicule David Baskin.

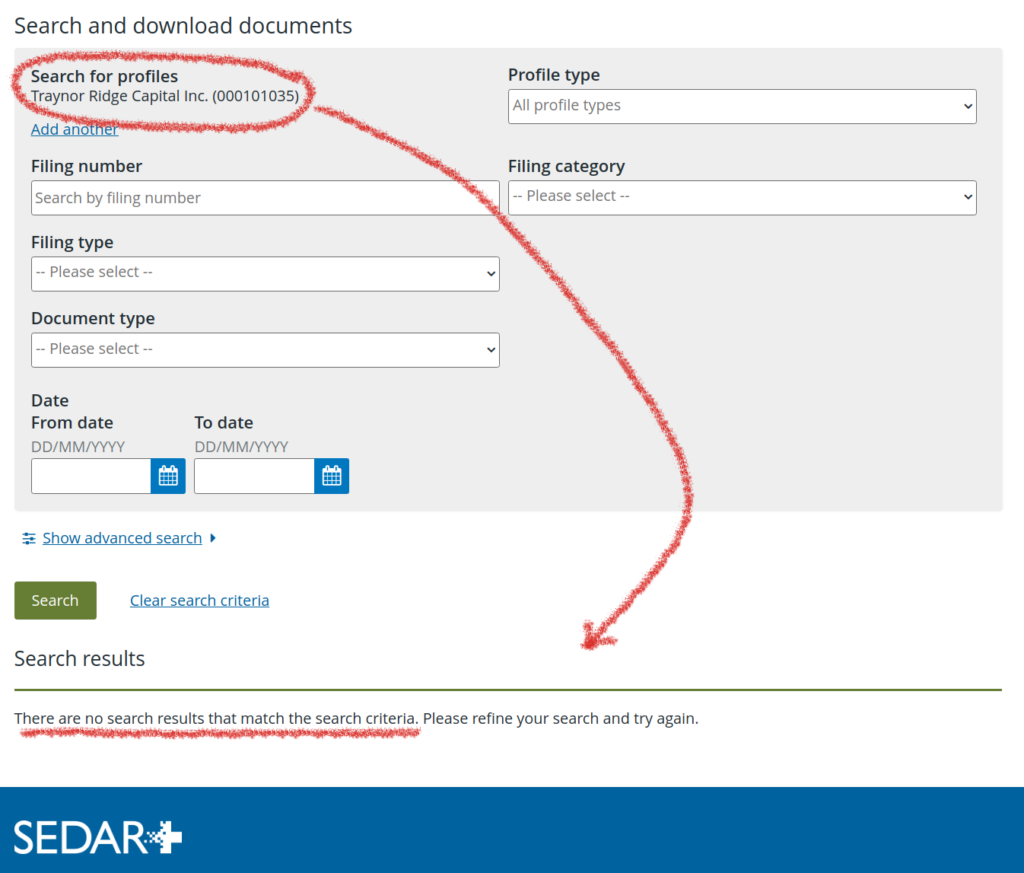

In Canada, investment funds like Traynor Ridge that hold any amount of Canadian securities are required by National Instrument 81-106 to disclose their securities holdings quarterly, along with their financial statements, in interim and annual reports that they’re required to file on SEDAR SEDAR+…

…unless they don’t want to, and have told the securities administrators that they aren’t going to.

This column’s opinion of SEDAR+ remains low.

Exemption Nation

Canada’s securities regulators grant exemptions to the public filing requirements under section 2.11 of National Instrument 81-106 to hedge funds that inform their shareholders and the various provincial securities regulators who govern them that they’re relying on that particular exemption, which Traynor Ridge did, and that’s not all they were exempt from.

The investors solicited by Traynor Ridge staked the company with an amount of money that we can’t nail down, because of the aforementioned disclosure exemptions, without even seeing a prospectus, which Traynor Ridge didn’t have to prepare or file, under a related exemption.

Canada’s patchwork of provincial securities regulators[1] allow various exemptions to their prospectus requirements for companies who are raising money by issuing securities. The most common exemption is the “accredited investor” exemption, which allowed Traynor Ridge to solicit investments from investors accredited by their personal wealth or institutional status, and use the money to deal in the securities of other companies who relied on the “accredited investor” exemption to solicit investments from investors accredited by their personal wealth or institutional status… like Traynor Ridge.

Traynor Ridge’s TR1 Fund[2] would then put its investors’ money to work in the market through any number of strategies involving small and micro-cap securities, off-market unlisted securities, arbitrage hunting, and a litany of strategies outlined in the offering memorandum that is so broad that it basically allowed Callahan to make it up as he went along.

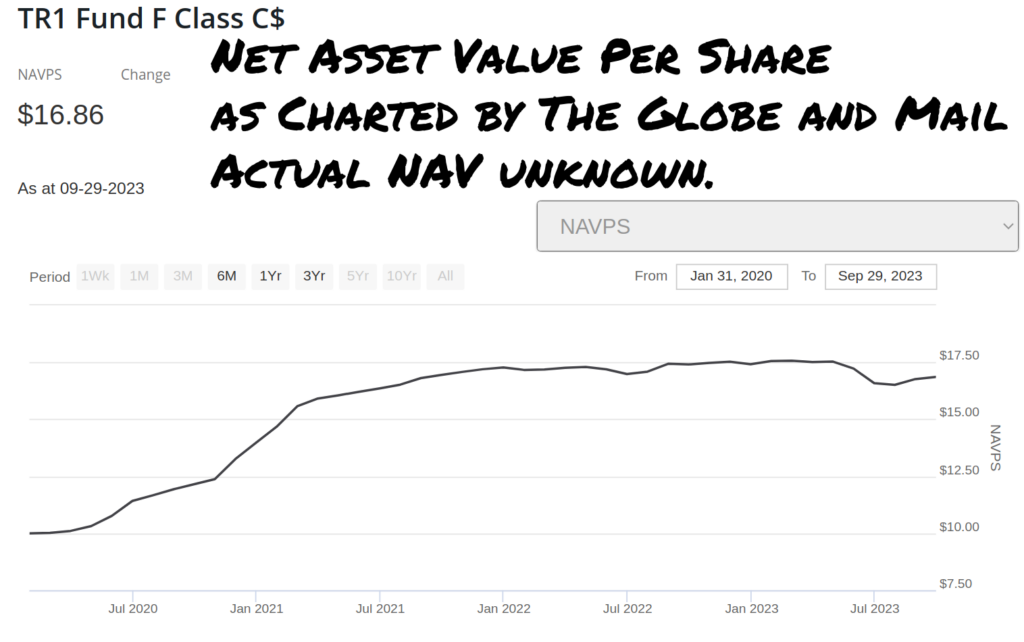

When unitholders wanted to cash out, they could give 30 days notice of their intention to redeem to Traynor Ridge, and become due to recieve their proportionate share of the TR1 Fund’s NAV on the last day of the month. The arrangement gave Traynor Ridge between 30 and 59 days to come up with the cash to satisfy any given redemption, depending on the day the redemption request came in.

A contractor called Apex Fund Services was tasked with calculating and certifying the TR1 Fund’s Net Asset Value monthly. Apex markets itself as a global full-service manager of hedge funds, capable of handling virtually every aspect of fund administration that doesn’t include the portfolio management that Callahan was responsible for, and the investor relations / funds solicitation tasks that appear to have been handled by Chyz.

Apex’s Toronto office isn’t returning our calls, so we can’t ask what particular services package Traynor Ridge had contracted them for, or if they calculated TR1’s net asset value monthly or not. The Globe and Mail‘s fund tracker shows no NAV value at all for the TR1 fund, though it does show the value of the units as $16.51 on July 31 / 23 and $16.86 on September 29, 2023, citing Barchart Solutions as its data provider.

The Ontario Securities Commission, whose exemptions kept TR1 from having to make public filings about its components, assets under management, and number of units outstanding, appears to have put itself in the same jam as the rest of us.

The potential losses Traynor’s brokerage firms are exposed to, according to the receivership order, are “approximately $85 million to $95 million,” which makes a neat echo with the best guess anyone has come up with about its NAV, pegged second-hand by a representative of Traynor’s Cayman Islands subsidiary at $95 million. Echelon Wealth Partners meanwhile has registered a security interest against the fund in the amount of $30 million.

The same exemption-filled rules that allow for Canada’s 30 year olds to head up the compliance department of their very own non-reporting hedge fund govern a venture-stage securities landscape where empty shells that don’t trade can become valuable, high-volume, liquid securities overnight.

That type of environment is a hustler’s dream, and a rookie manager pushing around $100 million (or was it $160 million? Who knows?) with no check on his judgement is a juicy mark. If a guy like that found himself in a jam, perhaps having a limited time to satisfy a large redemption, he’d be inclined to believe in all sorts of imminent special situations that might be able to pull him out of it.

[1] Each Canadian province and territory has its own securities commission, all of which are members of the Canadian Securities Administrators. The CSA isn’t technically a federation of all of those provincial and territorial securities commissions, and doesn’t oversee their operations or anything else. It’s an “umbrella organization” that tries to keep them all straight, and harmonize their filing and registration requirements. This complicated, byzantine, kafkaesque mess persists, in part, because Canada’s federal government doesn’t participate in securities regulation, preferring to leave the dirty work to the provinces, who always seem to be claiming they can’t address something because of limited means. It’s all very complicated.

[2] On paper, Traynor Ridge ran several different funds with several different tiers of units in each fund. They appear to have been tailored for sale to different types of accredited investors in different sorts of tax situations, and subject to different kinds of profit sharing etc. For practical purposes, all of the units of all of the funds ultimately amounted to claims on the net assets of the TR1 Fund, the only fund listed on Traynor Ridge’s website.

Information for this briefing was found via The Globe & Mail, The OSC, Ernst & Young, The Toronto Star, BNN Bloomberg, Sedar, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.