Love him or hate him, but stock broker and gold proponent Peter Schiff does make a very compelling observation: consumers are paying for huge government via the inflation tax, and the only way to slow down runaway consumer prices is to aggressively hike rates and strongly cut back on fiscal spending.

Schiff took to his blog to express grievances with the state of the US economy, and the detrimental impact of soaring inflation on Americans’ incomes. “I think we’re not in recession, which was something that I had been predicting. So, inflation got stronger as the economy got weaker. And I think this recession is just getting started, and it’s going to last a long time,” he reiterated following an appearance on Rob Schmitt Tonight.

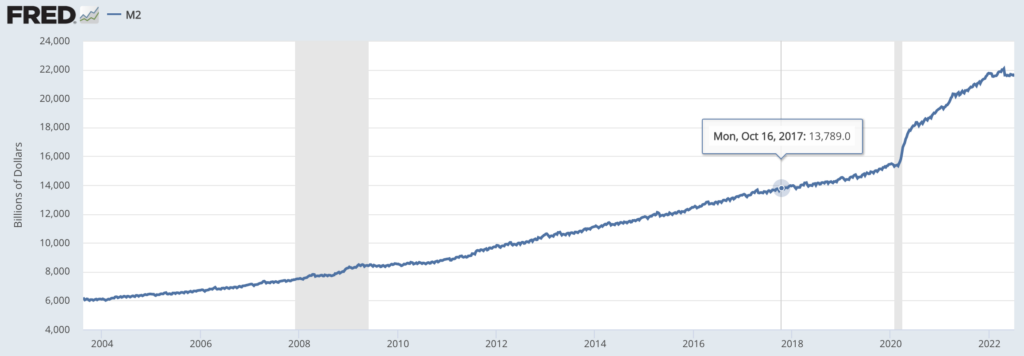

According to Schiff, when it comes to the battle with inflation, it’s actually a battle with big government. “Inflation is a tax. It’s the way government finances deficit spending.” Put shortly, when the government doesn’t collect enough revenue from taxes, its deficits must be monetized by the Federal Reserve in the form of money printing. “They call it quantitative easing, but that’s inflation. Government is getting bigger and bigger, and families across America are going to have to bear that burden through higher prices.”

Making matters worse, though, has been the Fed’s role in artificially suppressing interest rates for decades, which has now “really screwed up this economy.” Instead, the cost of borrowing should be set by free markets, and not “price-fixing by the government.” Now, the American consumer will be forced to pay the price when it comes to unwinding those mistakes in the form of a financial crisis that is “going to be worse than the one we had in 2008.”

Although the Fed has raised interest rates 75 basis for the past two consecutive meetings, it is not enough to tame runaway prices. “That’s still much too low. That’s an inflationary highly stimulative rate when you have the rate so far below inflation.” In fact, according to Schiff, America’s inflation problem is a lot worse than CPI figures suggest, and given the amount of money the Fed has printed over the past several years, the US economy is most likely headed for “an inflationary depression.”

“If we want a real economy then we’re going to have to experience a real recession to get there.”

Information for this briefing was found via Schiffgold.com. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.