When someone causes investors to lose up to US$60 billion, you’d expect authorities to put prohibitive measures to keep it from happening again. Apparently, if it’s a cryptocurrency blockchain, it gets a warm “welcome back,” instead.

Not even a month has passed since Terra collapsed after its stablecoin, TerraUSD, lost its peg to the dollar, and yet the blockchain is back on a new chain.

1/ Block 1 of the brand new Terra blockchain (with a chain_id of “Phoenix-1”) has officially been produced at 06:00 AM UTC on May 28th, 2022!

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) May 28, 2022

Congratulations to the #LUNAtic community on this expeditious feat of collaboration 🎉

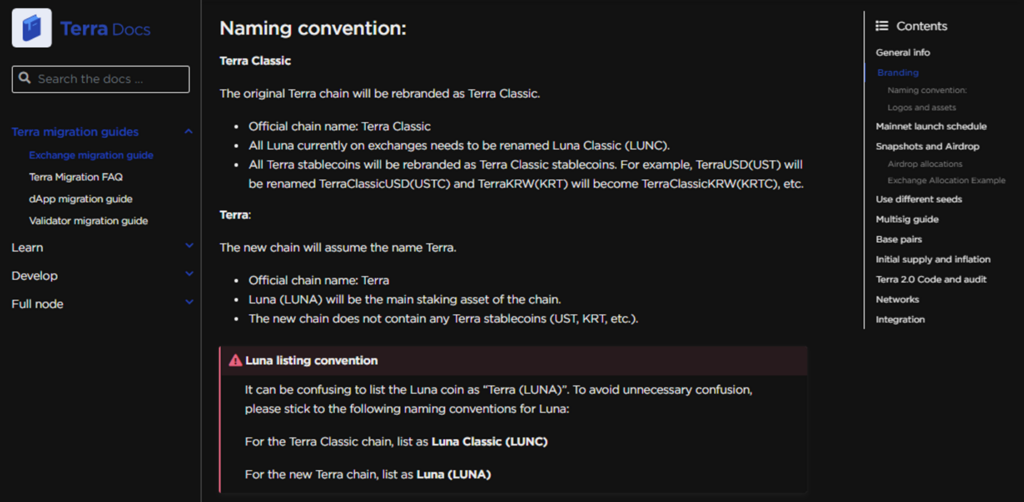

The so-called Terra 2.0 is still using the Luna coin, but made branding efforts to differentiate this from the Luna coin–now called Luna Classic–that also lost its value along with the Terra predecessor.

Nevertheless, confidence in the resurrected blockchain is still shaky. Starting at US$18.87 per coin on its opening day, the price crashed to US$5.96 after 24 hours. As of this writing, the value plays around US$6.50.

Why the return?

TerraUSD, or UST, differentiates itself from others as an algorithmic stablecoin. Instead of tying itself to a fiat currency or tangible asset, it relies on code and Terra’s crypto Luna to keep the dollar peg. It is designed in such a way that if its price falls to less than US$1, investors are motivated to exchange their UST tokens for Luna coins, thus eliminating UST from circulation. If the price rises above US$1, then the reverse occurs.

However, the stablecoin imploded as it lost its peg to the dollar, with the reason still being debated today. The crash caused the crypto to halt trading on the blockchain and is estimated to have cost its investors around US$60 billion.

In 2009, Bernie Madoff lost investors $60 billion. He was sentenced to 150 years in prison.

— Fintwit (@fintwit_news) May 29, 2022

In 2022, Do Kwon lost investors $60 billion after Luna collapsed to $0. He then created Luna 2.0. pic.twitter.com/CkCC8AKPVR

While the Terra community called the de-peg event an “attack,” International Monetary Fund Managing Director Kristalina Georgieva called stablecoins with no assets to back itself a “pyramid [scheme].”

Amid all these, the Terra community passed Proposal 1623 which aims to revive the blockchain, but not the stablecoin.

1/ Terra 2.0 is coming.

— Terra 🌍 Powered by LUNA 🌕 (@terra_money) May 25, 2022

With overwhelming support, the Terra ecosystem has voted to pass Proposal 1623, calling for the genesis of a new blockchain and the preservation of our community.

The crypto asset’s comeback has been widely received by digital exchanges, including Bybit, Kucoin, and Huobi. The largest crypto exchange Binance also said it plans to carry Luna on its platform on Tuesday.

However, it had mixed reactions from the crypto community on Twitter, many of whom are still reeling from the effects of the de-peg event.

terra gave the MSM 10 years worth of fantastic ammo to beat us up with. the dollar stable promise, retail losses, fintechs putting client assets in, VCs dumping the top and thumping their chests. it is what it is. historical L and yes we deserve it. totally failed to self-police.

— nic carter (@nic__carter) May 27, 2022

A brief introduction to $LUNA 2.0 pic.twitter.com/YmnbgL59n3

— Devchart 👨🏻💻 (@devchart) May 29, 2022

Bought my first lambo thanks to $LUNA pic.twitter.com/soryDjU8l9

— Ash WSB (@ashwsbreal) May 29, 2022

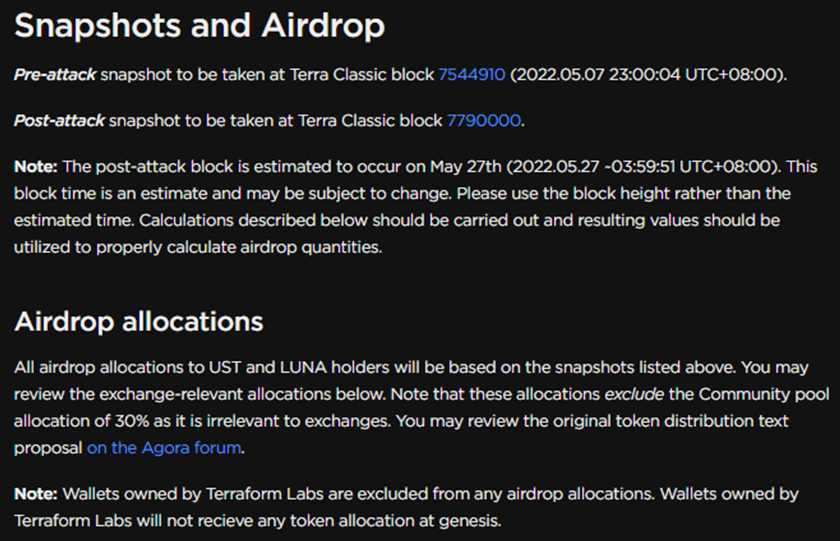

In an effort to win back its community, Terra is also distributing Luna tokens to holders that can show they held the Luna Classic and the UST during the “attack.” Through a process called “airdrop,” holders will receive varying percentages of their holdings if they can prove through snapshots that they held both the coin and the stable coin pre- and post-attack.

Information for this briefing was found via CNBC, The Wall Street Journal, and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.