Thursday night, on October 7th, Tesla (NASDAQ: TSLA) held their annual general meeting, where Elon Musk announced a consortium of recent developments for the company. Some such developments include:

- Moving Tesla’s headquarters to Austin Texas

- Cybertruck likely to start production in 2022 and reach volume production by 2023

- Telsa has no plans to issue a stock dividend

- Expects to increase production at the Fremont facility by 50%

- Telsa won’t start producing 4680 cells in Texas this year, but will see volume production by 2022

- Will announce a new plant next year

Currently, there are 40 analysts covering Tesla with an average 12-month price target of $692.76, or a downside of 13%. Out of the 40 analysts, 11 have strong buys, 6 have buys, 13 analysts have hold ratings, 6 have sells and 4 have strong sell ratings. The street high sits at $1,591 from Elazar Advisors while the lowest comes in at $67.

After the annual general meeting, Canaccord Genuity raised their 12-month price target to $940 from $768 and reiterated their buy rating on the stock, saying “Tesla shareholder supports our Energy Ecosystem thesis, and delivery mix increases margin.”

They say that during the AGM, Elon touched on some of Canaccord’s key investment points, which are centered around Tesla creating an “Apple-esque brand and ecosystem of energy products.” Elon Musk said that Tesla is founded on three pillars: renewable energy generation, battery storage, and electrified transport.

Canaccord touches on Tesla’s / Musk’s comments on the 4680 cell production, saying that by the end of 2022, 4680 cells will be in high enough production to supply cells for all of Giga Texas Model Y’s at full production. This will free up the 2170 cells for the Powerwall and Megapack production.

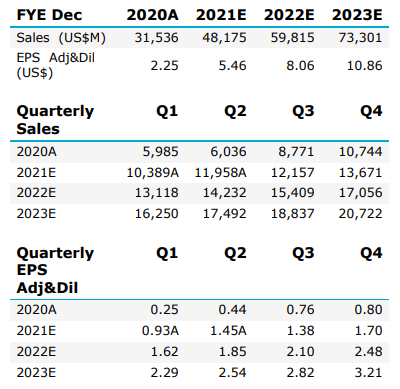

Below you can see Canaccord estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.