You know what they say, never let a good conflict go to waste!

With Russia actively at war with Ukraine and Europe’s energy future in peril, the US has found itself in a lucrative position to ship some of its natural gas supplies overseas— but just how good of a deal is it?

Europe, which up until February relied on Russia for 40% of its natural gas, is now left in a vicious scramble to either cut back consumption in an effort to refill significantly depleted reserves ahead of winter, or source its energy needs from elsewhere. The US has been happy to provide assistance, but before we go applauding the White House for its heroic efforts, let’s not forget that there is no such thing as a free lunch.

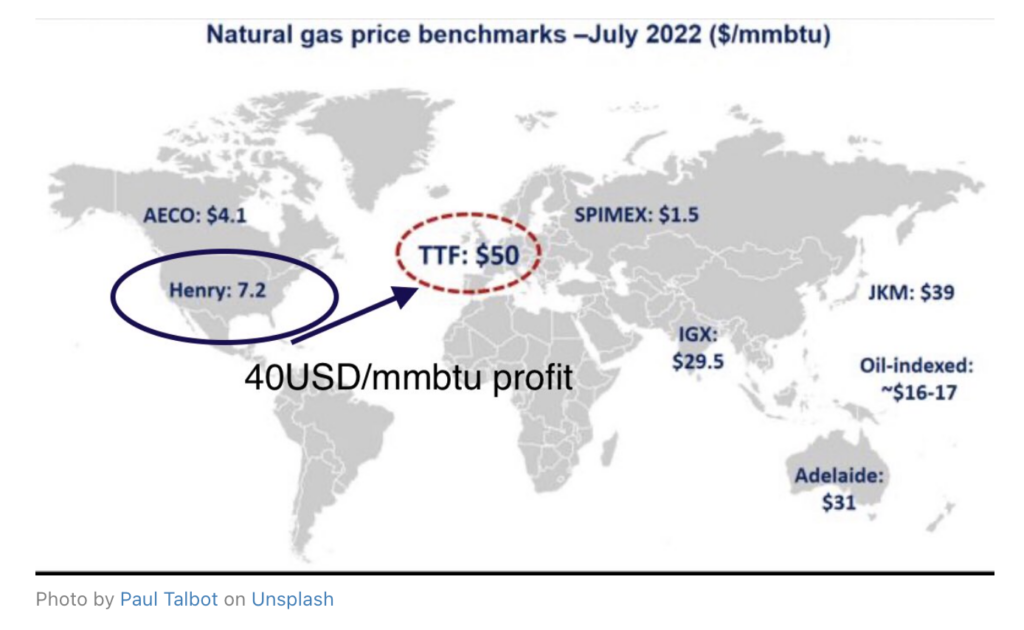

Before Russia invaded Ukraine on February 24, Europe’s economic powerhouses such as Germany relied on Russia for large and cheap quantities of natural gas— prices on the St Petersburg Mercantile Exchange were around US$1.5 per million British Thermal Units (mmbtu). But, such a low price is only possible due to the close proximity of Russia and the EU— shipping natural gas from North America is a lot more complicated and time-consuming.

In the northwestern region of Europe, natural gas is sold via the TTF hub in the Netherlands, which is where the majority of pipelines meet and the commodity trades hands, thus setting the price that EU customers will end up paying. But, with Russia reducing natural gas flows via Nord Stream 1, supply has been very tight, sending prices soaring to as much as US$50 per mmbtu.

At such high prices, logically, the natural gas that would otherwise be traded at other regions around the world is finding an increasing number of European buyers. The US has an equivalent trading hub called the Henry Hub, which sets natural gas prices for domestic markets, as well as LNG prices for international markets. At this trading hub, natural gas is currently priced at US$8.01 per mmbtu, thus presenting a grand arbitrage opportunity whereby it could theoretically be sold for US$50 per mmbtu, meaning a massive spread is available.

But, the volume of natural gas in a pipeline is measured differently than its liquified counterpart, which is cooled and then turned into a liquid state for easier transportation. Once it becomes a liquid, it is referred to as LNG, and is measured in mass rather than volume, such as cubic meters. When slated for international markets, the LNG is transported via ships that on average, have a capacity of anywhere between 150,000 to 200,000 cubic meters (M3).

According to Twitter user Chuck Petras’ summarized calculations using an approximate conversion factor of 30 mmbtu per M3, a ship carrying about 170,000 M3 of LNG coupled with a spread of US$40 per mmbtu gives a gain of around $204,000,000.

Who could have thought natural gas could be so lucrative, right?

Ok, I got it.

— Chuck Petras (@Chuck_Petras) July 31, 2022

A LNG Carrier can have a capacity of between 150,000 to 200,000 cubic meters (M3) or more. He used a conversion factor of 30 MMbtu/M3 (approximate). So assuming a ship with 170,000 M3 of LNG, and $40/MMbtu spread, this gives about $204,000,000.

Information for this briefing was found via Twitter and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Good luck finding pipeline capacity to get to a US export facility. Also, most of the export facilities are max’d out and have zero room left, further tankers are booked for many, many months. Then you need to find a delivery terminal with capacity.