The European Central Bank finally decided to jump on the bandwagon of monetary policy panic, realizing the colossal money printing of the Covid-19 era may have been too excessive for too long.

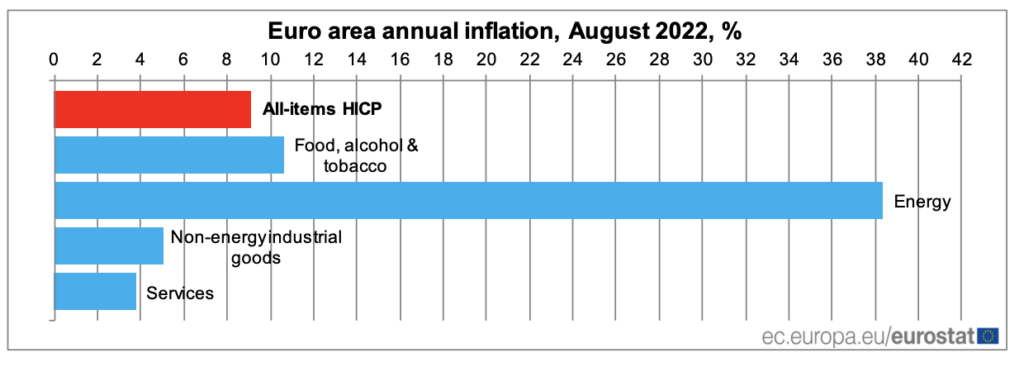

On Thursday, policy makers delivered a front-loaded 75 basis-point hike, marking the largest increase in borrowing costs in more than a decade. However, there is just one problem: the increase brings interest rates from 0% to 0.75%, which is paltry compared to a record-high inflation print of 9.1%, and a substantially delayed policy response given an EU economy that is barreling towards a recession— if not a full-blown depression.

To put things into perspective: The 75 basis point rate hike is the largest in the #ECB's history. But the ECB is still way behind the curve. While #Inflation is at a record 9.1%, ECB deposit rate w/0.75%, light years away from a high. pic.twitter.com/wYWlyT8u1b

— Holger Zschaepitz (@Schuldensuehner) September 8, 2022

Nonetheless, the ECB described its latest move as a “major step” in reaching a more neutral territory, which will likely be followed by further rate hikes in the coming months in order to “dampen demand and guard against the risk of a persistent upward shift in inflation expectations,” because “Inflation remains far too high and is likely to stay above target for an extended period.” The bank’s policy makers, whom are awful are predicting the future of the economy to begin with, failed to reveal the size of upcoming rate hikes, only alluding they will be dependent upon incoming economic data and “follow a meeting-by-meeting approach.”

To further attest to the rapidly-deteriorating economic situation in Europe, the ECB significantly downgraded and upgraded its growth and inflation forecasts, respectively, compared to its June predictions. Euro area GDP expansion is now expected to fall from 3.1% in 2022 to 0.9% next year, down from a previous projection of 2.1%. Inflation levels have been considerably upgraded from 6.8% to 8.1% this year, followed by a revised 5.5% in 2023, up from June’s prediction of 3.5%.

Astonishingly, the ECB is still committed to imminent rate hikes despite simultaneously warning of a “substantial slowdown in euro area economic growth,” as surging energy prices erode away at Europeans’ purchasing power and the geopolitical situation in Ukraine continues to dampen businesses’ and consumers’ confidence. In other words, policy makers have blindly fallen so far behind the inflation curve they have no other choice but to hike rates into a recession, in an attempt to get four-fold runaway prices back to the 2% target range.

It aged as milk 👇 ECB credibility summarized pic.twitter.com/vGP9ODS20z

— Michael A. Arouet (@MichaelAArouet) September 8, 2022

Information for this briefing was found via the ECB and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.