Apparently, the supposed shade-throwing between these two crypto moguls is not yet over.

READ: The CZ-SBF Twitter Feud, Explained

FTX founder Sam Bankman-Fried recently tweeted a claim that a competitor is trying to go after the company with “false rumors”, while reassuring investors that the crypto platform “is fine.”

“FTX has enough to cover all client holdings. We don’t invest client assets (even in treasuries). We have been processing all withdrawals, and will continue to be,” Bankman-Fried tweeted.

2) FTX has enough to cover all client holdings.

— SBF (@SBF_FTX) November 7, 2022

We don't invest client assets (even in treasuries).

We have been processing all withdrawals, and will continue to be.

Some details on withdrawal speed: https://t.co/tSjhJW3JlI

(banks and nodes can be slow)

He then quote retweeted FTX’s post on updates about withdrawals on the platform, as some users are expressing concerns on the process.

ah sorry – to be clear:

— FTX (@FTX_Official) November 7, 2022

FTX is fine, withdrawals were slow as we refill hotwallets but have been processing all day

3: Stablecoins: processing. Banks are closed for the weekend, though; USD <> stablecoin creations/redemptions might be slower until wires clear tomorrow, especially for some coins/chains.

— FTX (@FTX_Official) November 7, 2022

Back to Bankman-Fried’s recent twitter thread, he reiterated that the company has “a long history of safeguarding client assets, and that remains true today.” While he did not allude as to who the “competitor” is in his tweet, he ended the thread with a shot at Binance CEO Changpeng Zhao, asking the latter to “work together for the ecosystem.”

4) I'd love it, @cz_binance, if we could work together for the ecosystem.

— SBF (@SBF_FTX) November 7, 2022

Bankman-Fried and Zhao have recently been embroiled in an apparent spat which activated crypto twitter on Monday. The China-based crypto exchange moved to liquidate its remaining FTT holdings after discovering “recent revelations.”

The FTX founder’s post on reassuring assets are being managed well, adding that they have “GAAP audits with [more than] $1 billion excess cash,” seems to be an answer to a report claiming FTX’s sister hedge fund, Alameda Research, is insolvent with only $134 million in cash at the end of the recent quarter, and most of its assets are tied to FTT tokens–the platform’s digital coin.

However, Bankman-Fried seems to be open in hashing out his differences with Zhao, and discuss crypto regulations in general.

I'm in; let's do it!

— SBF (@SBF_FTX) November 7, 2022

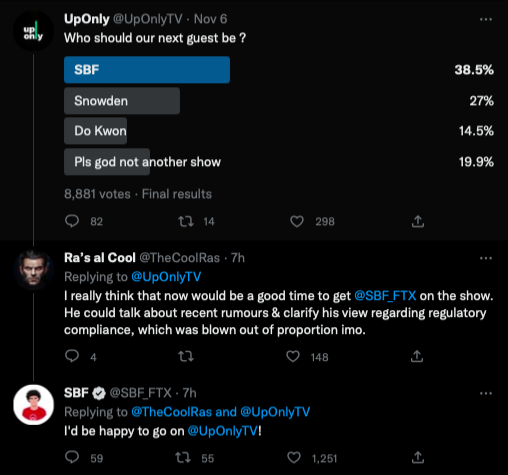

In the heat of the apparent feud, crypto podcast UpOnly posted a poll to ask who should be their next guest. The results yielded Bankman-Fried as the top choice, to which the FTX founder happily agreed.

However, as if fueling fire to the feud, FTX’s twitter account replied to a suggestion that Zhao can sponsor the podcast for twice what Bankman-Fried can offer, saying if the Binance chief is willing to double the apparent $1 billion per month sponsorship, they’d give the guesting slot to him.

If he's willing to 2x the current 1B/month then we'll have to let him have the UpOnly spot

— FTX (@FTX_Official) November 7, 2022

Information for this briefing was found via the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.