As a means of mitigating the financial hardships faced by many small and medium sized businesses due to the coronavirus pandemic, the Federal Reserve earmarked $75 billion from the CARES Act to go towards its Main Street Lending Program. The goal of the program is to provide financial support in the form of loans for those companies that are ineligible for other lending markets.

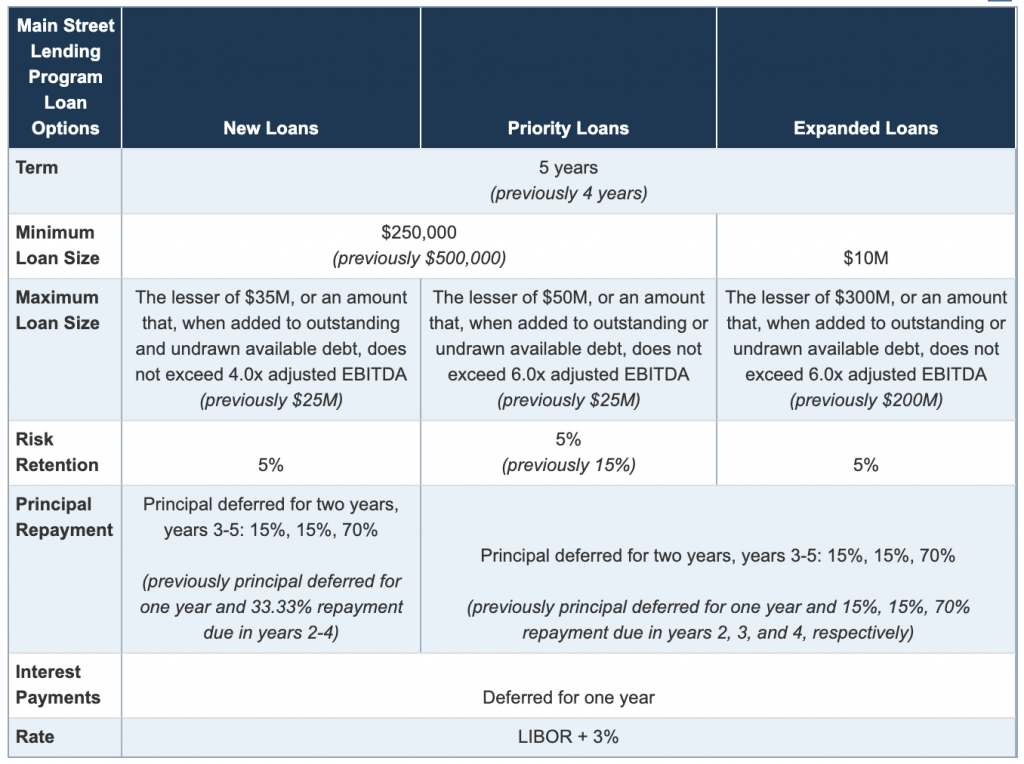

Although the Fed ran into some difficulties when it first unveiled the program, the central bank has since decided to expand upon the eligibility criteria as a means of allowing more small to medium sized businesses the financial help they need. Initially, the minimum loan size was $500,000, but the Fed decided to lower it to $250,000; the term of each loan option was previously four years, but will now be increased to five years; and principal repayments can now be delayed up to two years, instead of one year.

The Fed has also announced it will be increasing the maximum size of all of the loan facilities available through the program, as well as increasing the central bank’s participation rate to 95% of each eligible loan. Businesses that applied for financial aid prior to the lending program’s updated terms will have their application upgraded if it is funded before June 10, 2020.

Information for this briefing was found via Bloomberg and the Federal Reserve. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.