Tilray Inc (TSX: TLRY) (NASDAQ: TLRY) announced that they would be reporting their Fiscal first-quarter results of 2021 on October 7th, this will be for the period ending August 31st. Ahead of this date, Haywood released a note outlining their estimates and gave a general preview.

Tilray currently has 20 analysts covering the stock with an average 12-month price target of U$15.72. Out of the 20 analysts, 2 have strong buy ratings, 3 have buys, 13 have holds and 2 have sell ratings. The street high comes in at U$27 while the lowest price target sits at U$1.27.

In Haywood’s note, they reiterate their hold rating but lower their 12-month price target on Tilray to $13.50 from $16.50. This quarter will be the first full quarter that shows the combination between Tilray and Aphria, Haywood is hoping that this quarter will show off the “synergistic value created in terms of both cost savings and revenue growth.” They also expect the earnings call to be heavily weighted toward the outlook of the companies individual segments as well as its recent Medmen Enterprises (CSE: MMEN) deal.

For the quarter ending August 31st, Haywood is expecting net revenues of $171.5 million, effectively 21% sequential growth. This is slightly below the $174.23 million consensus estimate. Gross margin for the quarter is expected to be just shy of 30% at 29.7%, slightly higher than the consensus. They expect adjusted EBITDA to come in at a pitiful $8.5 million, or a 5% EBITDA margin.

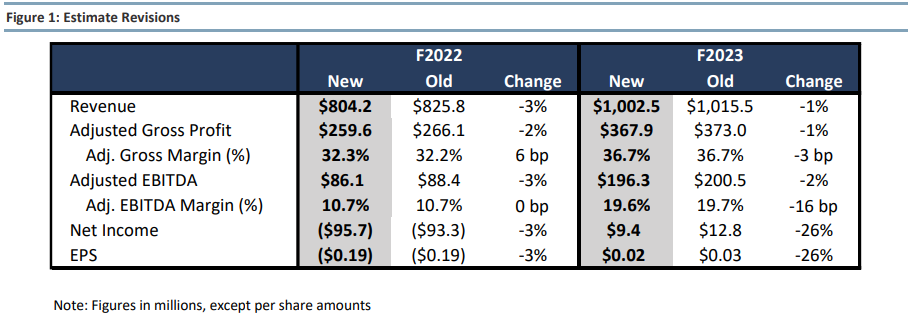

With the price target lowered, they have slightly lowered their 2022 and 2023 estimates. They say that they are lowering revenue estimates based on lower Canadian adult-use market share, as well as COVID-19 headwinds in the company’s international segments. Management noted that floods in Germany will impact CC Pharma’s first-quarter revenue and margins.

Haywood says that even after changing Tilray’s market share percent, they remain the market leader in Canada, but they “remain cautious on the overall Canadian landscape which drives the majority of its revenue growth opportunity in the near term.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.