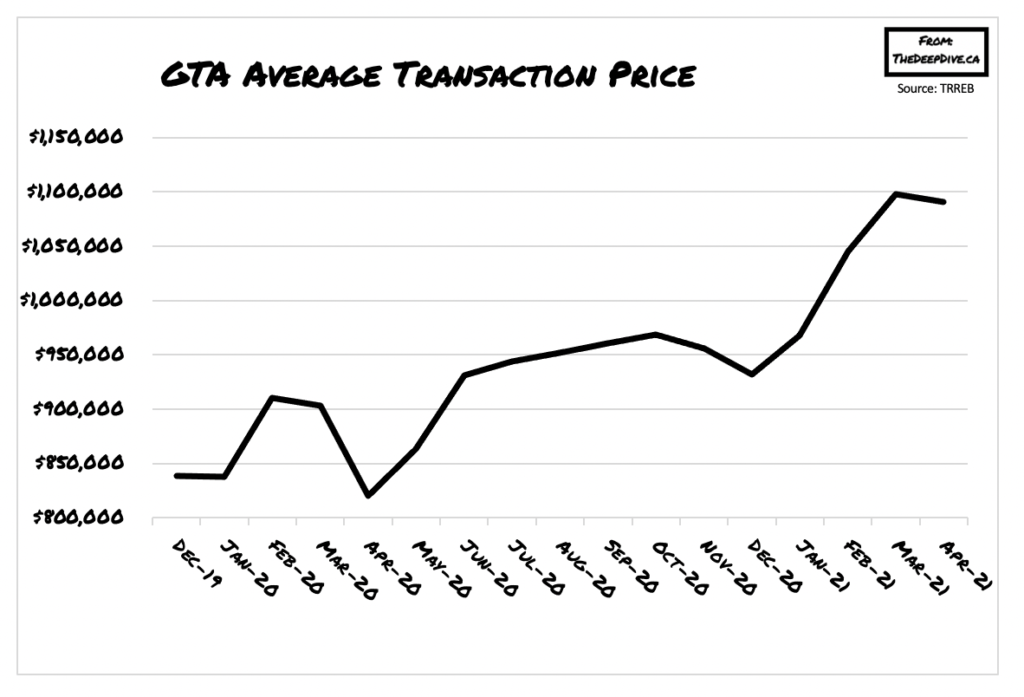

Toronto’s skyrocketing home sales activity showed signs of cooling off last month, as an increasing number of prospective buyers found themselves priced out of the real estate market.

According to Toronto Regional Real Estate Board (TRREB), a total of 13,663 properties traded hands in April, marking a 362% surge from year-ago levels when the economic impact of the Covid-19 pandemic was the most pronounced. Even when compared to the 10-year sales average for the period between April 2010 and April 2019, housing sales last month were up 36.6%. However, when compared on a month-over-month basis, home sales in the Greater Toronto Area (GTA) actually declined 12.7% from March 2021, suggesting that real estate activity may be starting to slow down.

New listings followed an identical trend, as there were more than triple the amount of new listings relative to April 2020. Similarly, when compared to the 10-year new listings average, last month’s figures were 18.3% higher. Despite the historically elevated trend, nw listings fell 8.4% from the previous month, further attesting to a housing market deceleration. “We’ve experienced a torrid pace of home sales since the summer of 2020 while seeing little in the way of population growth. We may be starting to exhaust the pool of potential buyers within the existing GTA population,” explained TRREB President Lisa Patel.

In the meantime, the MLS Home Price Index Composite benchmark rose 17.8% from April 2020, while also increasing on a month-over-month basis. The average selling price of a home in the GTA soared 33% from year-ago levels to $1,090,992, but when compared to March 2021, the figure remained relatively flat. This marks a contrast compared to historic data, when in the past the average selling price typically increased between March and April.

Information for this briefing was found via TRREB. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.