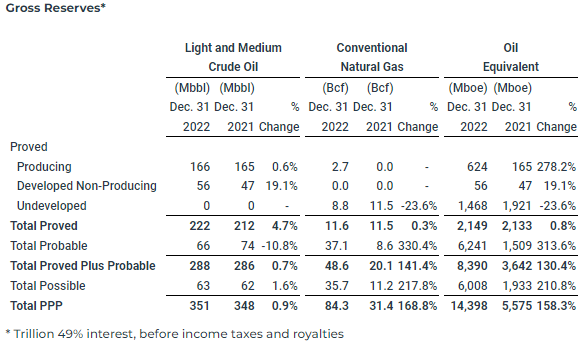

Trillion Energy (CSE: TCF) has seen a significant increase in the value of its reserves, as per a 2022 year-end reserve report published by the company this morning. The net present value of P2 natural gas reserves, net to Trillion, is said to have increased by 426% on a year over year basis.

The massive increase comes as the firms proved and probable (2P) natural gas reserves have a reported net present value of US$432 million, net to Trillion, based on a 10% discount. The figure represents a substantial increase from the reported 2021 figure of US$82 million. The figure, as per the company, is said to represent US$1.12 per basic common share.

The figure follows proven and probably conventional natural gas reserves increasing to 48.6 BCF, net to Trillion, versus the prior figure of 20.1 BCF. Proved reserves alone (P1), are said to have improved from US$40.4 million to US$123.8 million, which again is a net present value utilizing a 10% discount.

Proved, probable, and possible reserves, or P3, meanwhile are said to have increased to US$731 million net to Trillion, a 433% increase from the US$137 million reported in 2021.

“We are very pleased that our 2022 exploration and development efforts have paid off resulting in very substantial increases in reserves and values during the year. It is our plan to realize the reserves value through a development program extending throughout 2023 and beyond. We expect that our 2023 drilling program will further increase our reserves and cash flows. Our reserves values represent a substantial intrinsic value to shareholders,” commented CEO Arthur Halleran.

WATCH: Trillion Energy: 4 For 4 On Well Development Success at SASB — With Arthur Halleran

The report was compiled independently by GLJ Ltd in a report dated March 15, 2023.

Trillion Energy last traded at $0.40 on the CSE.

FULL DISCLOSURE: Trillion Energy is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Trillion Energy on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.