Trulieve Cannabis (CSE: TRUL) revealed in a filing last night that it is using the lack of interest in the cannabis sector to its advantage by repurchasing a number of senior secured notes which are publicly traded.

The company collectively repurchased $57.0 million worth of face value notes for a figure of $47.6 million, a 16.5% discount to par plus accrued interest. The notes, which trade under the symbol “TRUL.NT.U” on the Canadian Securities Exchange, are due October 6, 2026.

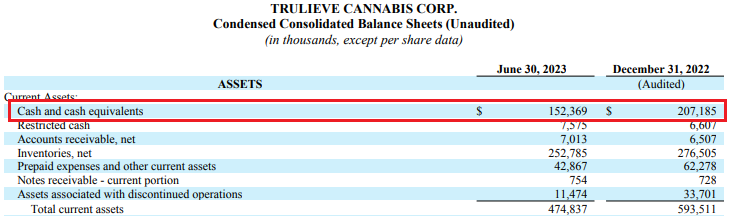

While the repurchase of the notes at a discount is a positive for Trulieve, with a cash balance of $152.4 million (excluding restricted cash of $7.6 million) as of June 30, it’s curious why the company elected to repurchase notes due in two years time.

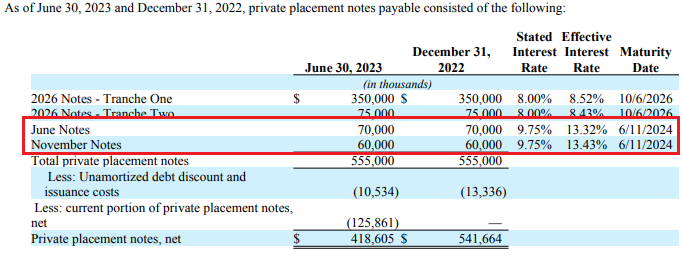

Notably, the company currently has $130.0 million in face value notes coming due on June 11, 2024 – meaning they have less than a year to maturity.

READ: Trulieve Reveals Former CFO Was Reimbursed Up To $400k In Personal Expenses

With the firms cash position now depleted by a further $47.6 million to (at least) $104.8 million, and a business that has generated negative $23.1 million in operating cash flows year to date, in short it means the company will likely be forced to raise funds in some manner over the next nine months.

That is, of course, unless noteholders are willing to extend the maturity of the debt – likely for a fee.

Trulieve Cannabis last traded at $8.53 on the CSE.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.