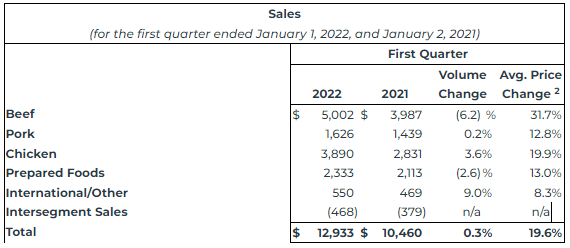

Tyson Foods (NYSE: TSN) on Monday morning filed its first quarter 2022 financial results. While the company posted Q1 sales of $12.9 billion, an increase of 19.1% on a year over year basis, the real story from the earnings appears to be the rising cost of food itself.

While investors appear to approve of the rising margins being exhibited by Tyson, there are concerns for the every day consumer. As part of the earnings data released by the company, the firm includes the average price change on a year over year basis seen by its segments – which include beef, pork, chicken, prepared foods, and international/other.

On a year over year basis, here’s how things shook out, courtesy of a snapshot from the firms earnings announcement.

On a year over year basis, the price of beef has seen an increase of a staggering 31.7%, while chicken and pork have risen 19.9% and 12.8%, respectively. The company points to a number of factors for the rising price of meat, which is slightly different for each of the segments.

- Beef: “Average sales price increased as input costs such as live cattle, labor, freight and transportation costs increased and demand for our beef products remained strong.”

- Pork: “Average sales price increased as input costs such as live hogs, labor, freight and transportation costs increased and demand for our pork products remained strong, partially offset by unfavorable mix associated with labor shortages.”

- Chicken: “Average sales price increased due to the effects of an inflationary cost environment.”

- Prepared Foods: “Average sales price increased primarily due to the effects of revenue management in an inflationary cost environment.”

The short of it, is the company pointed to other segments of the value chain as the primary driver of rising costs – i.e., labor, freight, transportation, and the catch-all “inflationary cost environment.” In terms of Pork and Beef, it also pointed to the rising input costs of such meats, which is notable considering these are the two segments that see prices driven by a futures market.

Looking to the futures, cattle closed 2020 out at $115.025, while 2021 closed at $139.70, a 21.45% increase on a year over year basis. In the case of pork, which is dependent upon lean hog futures, the commodity closed 2020 out at $70.275, while 2021 closed out at $81.47, a 15.94% change on a year over year basis. Pork notably however had a rapid upswing in the final weeks of the year, having traded considerably lower for much of the quarter.

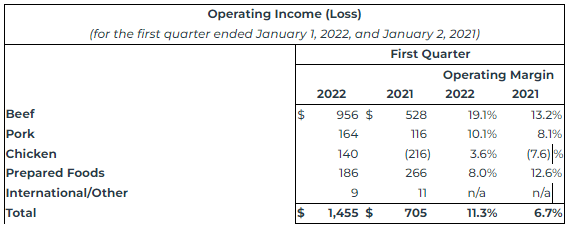

The impact of the futures market here appears to be a noteworthy aspect to the operating segments of Tyson Foods. It appears that the firm is able to point to such markets as a justification for its price rises. Despite the rising input costs, as well as rising supply chain costs, what’s noteworthy is these two segments represent the highest margin segments for the company as of the latest quarterly results.

In the case of Beef, margins rose from 13.2% to that of 19.1%, while Pork rose from 8.1% to 10.1%. Chicken, which has no futures market, was a loss leader in the year ago period at -7.6% gross margins, while the current quarter saw margins of just 3.6%.

What’s worse for consumers, is that the USDA is predicting domestic production of Beef and Pork will decline by 1% and 2%, respectively. Chicken production however is expected to increase by 2%. With tightening production, the company is expecting operating margin to fall in both Pork and Beef, while Chicken operating margin is expected to improve.

While the firm did not say it directly, this seems to imply that little respite can be expected for the rising average sales price of such meats – and for the pocketbooks of consumers.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.