Tyson Foods (NYSE: TSN) today published its earnings report for the second quarter and spoiler alert: more food inflation.

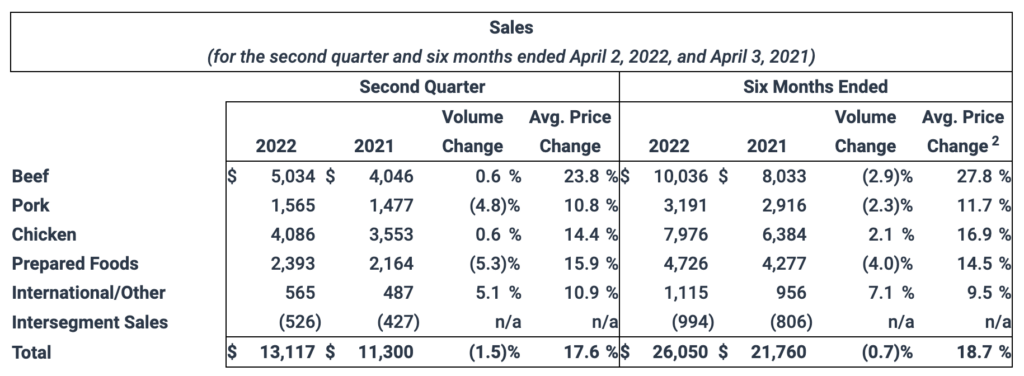

The company reported sales of $13.1 billion in the second quarter 2022, marking a 1.5% year-over-year increase. Operating margins stood at 8.8%, up from the 6.4% noted during the same period one year ago. Earnings per share were also favourable for investors, rising 75% from Q2 2021 to $2.28 last quarter. However, what is likely the most pivotal aspect of Tyson’s financial results are the staggering increases in the price of meat, including beef, pork, and chicken.

Since the second quarter of last year, the price of beef jumped 23.8%, while pork and chicken prices rose 10.8% and 14.4%, respectively. Other segments of Tyson’s earnings snapshot also saw substantial price increases, such as prepared foods, which were up 15.9% on a year-over-year basis.

Tyson highlighted a number of factors behind the sharp increase in prices for each of the segments, namely being higher labour, freight, and transportation costs, as well as elevated input costs. Further exasperating the problem is an increase in consumer demand, coupled with severed supply chains that are putting substantially higher pressure on input costs.

Going forward, Tyson cited subdued meat production forecasts, with a less than 1% increase in domestic beef production during the fiscal 2022. Likewise, chicken production is expected to rise about 1% as well, while the USDA anticipates that pork production will fall approximately 3% compared to fiscal 2021.

Information for this briefing was found via Tyson Foods. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.