A week after the U.S. United Auto Workers (UAW) union initiated targeted strikes against one assembly plant owned by each of the Big Three auto makers – General Motors Company (NYSE: GM), Stellantis N.V. (NYSE: STLA), and Ford Motor Company (NYSE: F) – little tangible progress has been made.

About 12,700 of the UAW’s 146,000 U.S. members are on strike at these three facilities. Furthermore, some additional workers have already been furloughed by the Big Three at other locations due to the ripple effects of the strike. The impact could soon broaden as UAW President Shawn Fain has threatened to announce expanded labor walkouts on September 22.

READ: Auto Workers, Automakers Back To Negotiation Table As Firms Strike Back

Mr. Fain’s chief demand is for wage increases of around 40%. In response, the automakers have offered an average pay raise of only around 20%. This bid-ask spread has apparently narrowed little over the first seven days of the labor action.

From a public opinion perspective, perhaps the UAW’s chief advantage versus auto company managements is the ridiculous pay gap between the pay of the typical auto worker and the CEOs of the Big Three. GM’s CEO Mary Barra, Ford’s CEO Jim Farley, and Stellantis’ CEO Carlos Tavares each received compensation in 2022 that amounted to between 281 and 365 times the average pay their employees received.

| General Motors | Ford | Stellantis | |

| CEO Compensation in 2022 | ~US$29 million | ~US$21 million | ~US$24.8 million |

| Ratio of CEO Compensation to Pay of Average Worker at the Company | 362x | 281x | 365x |

As an aside, then-UAW President Raymond Curry earned US$270,000 in 2022, according to the U.S. Labor Department. Mr. Fain was an administrative assistant for the union last year.

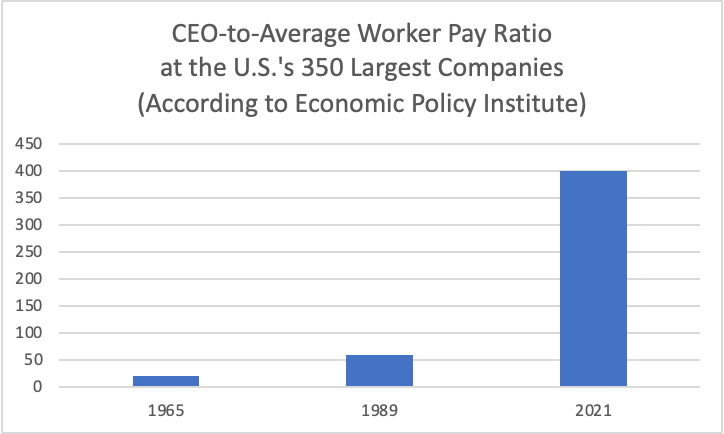

Of course, this huge CEO-worker pay disparity in the U.S. is not confined to the auto industry. The Economic Policy Institute calculates that CEOs at the country’s 350 largest companies received, on average, nearly 400 times the pay of a typical company worker in 2021, up dramatically from 59x in 1989, and just 20x in 1965. In most cases, (frequently unjustifiable) stock awards which supposedly align a CEO’s interest with those of shareholders account for this enormous spike in the pay ratio.

A tentative labor agreement in Canada reached on September 19th between Ford and 5,600 union workers represented by Unifor could have significant implications for the duration of the UAW strike and the terms of the labor agreement the UAW can ultimately reach with the Big Three. Unifor reached a three-year labor deal with Ford’s Canadian operations, but the specifics of that accord have not been released. Unifor workers have yet to vote on the deal.

Information for this briefing was found via NPR and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.