On February 2nd, Stifel-GMP put out their fourth quarter 2021 earnings preview, calling it “The Calm Before the Storm.” They add that the wipeout of investor gains, which started roughly 1 year ago, suggests that there is little expectation in future federal reform. It additionally shows that investors are worried about the impact of potential New Jersey and New York recreational delays. For this reason, Stifel-GMP recommends investors focus on, “operators with access to attractive cost of growth capital, strong cash generation.”

Stifel says that it has “cloudy visibility” into the fourth quarter and expects growth to decelerate as they mention both the COVID restrictions and the stimulus was a “boon” for these cannabis companies, commenting that with lockdowns now almost all gone and new ways for consumers to spend their cash they see revenue falling. They said, during their channel checks, growth has slowed to 4% sequential growth. They write, “we see some risk of limited industry growth near-term as rising inflation and competition could pressure wallet share and company margins.”

Although this note was published before the end of the week, Stifel-GMP says that federal reform remains unlikely in this legislative session, but adds, “notably if Sen. Schumer introduces his bill in H1/22 before significant midterm election campaigns ramp up” then we would see increased stock volatility.

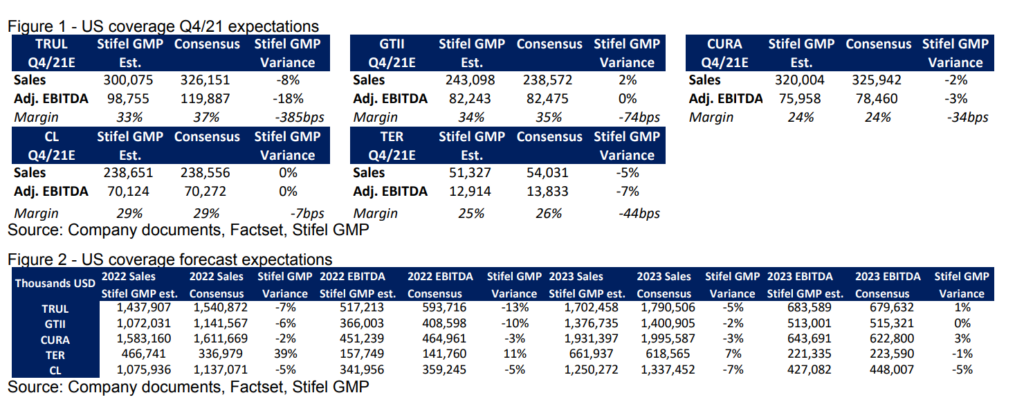

Due to the elevated risk for companies to miss fourth quarter estimates, Stifel-GMP says to stick to the highest quality names, naming Green Thumb (CSE: GTII) and Trulieve (CSE: TRUL) as their top picks. They expect Green Thumb to beat expectations with PA, NV, MA, and PA having solid sequential organic growth. They say that Trulieve might lose its streak of beating estimates as the business has lost market share in both PA and FL, which make up 70-75% of the sales post-acquisition close.

For Curaleaf (CSE: CURA), they write, “we believe the MSO performed slightly better than the industry and captured share most notably in PA while benefiting only slightly from M&A.” Lastly, they say that they believe Terrascend (CSE: TER) has finally turned the corner in its PA business.

Below you can see Stifel’s fourth-quarter expectations.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.