Despite persistence from the Biden administration and the Federal Reserve that the US economy is NOT in a recession, consumers’ inflation expectations and labour market outlook may suggest otherwise.

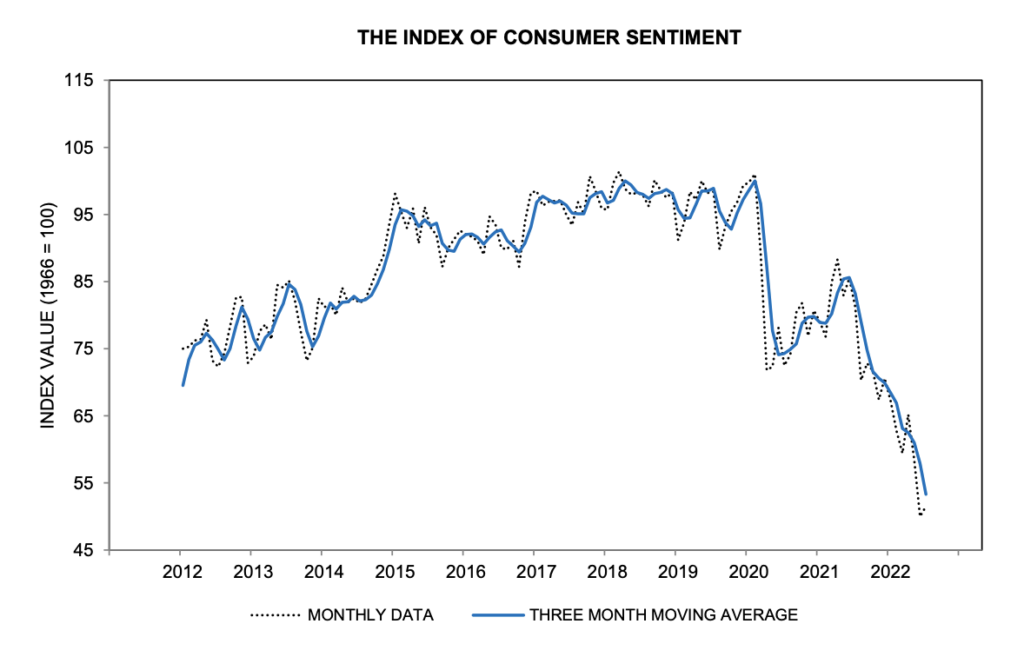

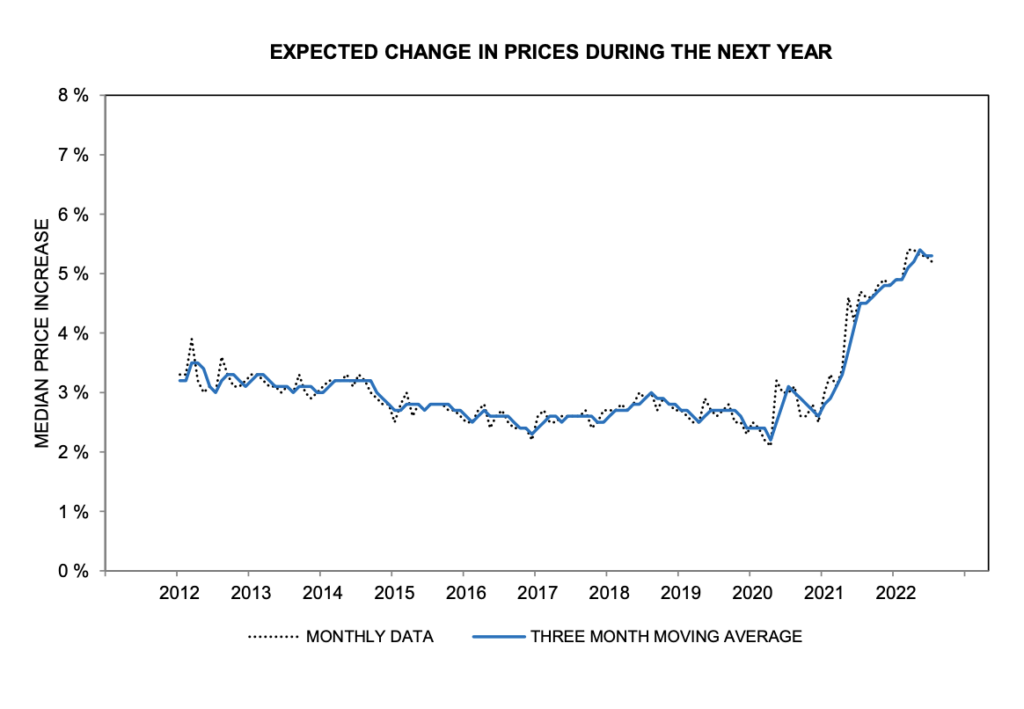

The latest University of Michigan consumer sentiment index rose slightly from June’s historic low of 50 to 51.1 in July, but the focal point was respondents’ views on rapidly rising prices, which rose to the highest in 11 years. Respondents now anticipate that inflation will rise 2.9% in the next five to 10 years, and expect costs over the next 12 months to increase 5.2%.

Almost half of the consumers surveyed said that inflation is causing substantial hardship on their personal finances— such a proportion has not been exceeded since 1951. The gauge of future expectations dipped from 47.5% last month to 47.3%— the lowest since 1980, while the index for current conditions jumped from 53.8 to 58.1— likely due to the decline in the price of gasoline.

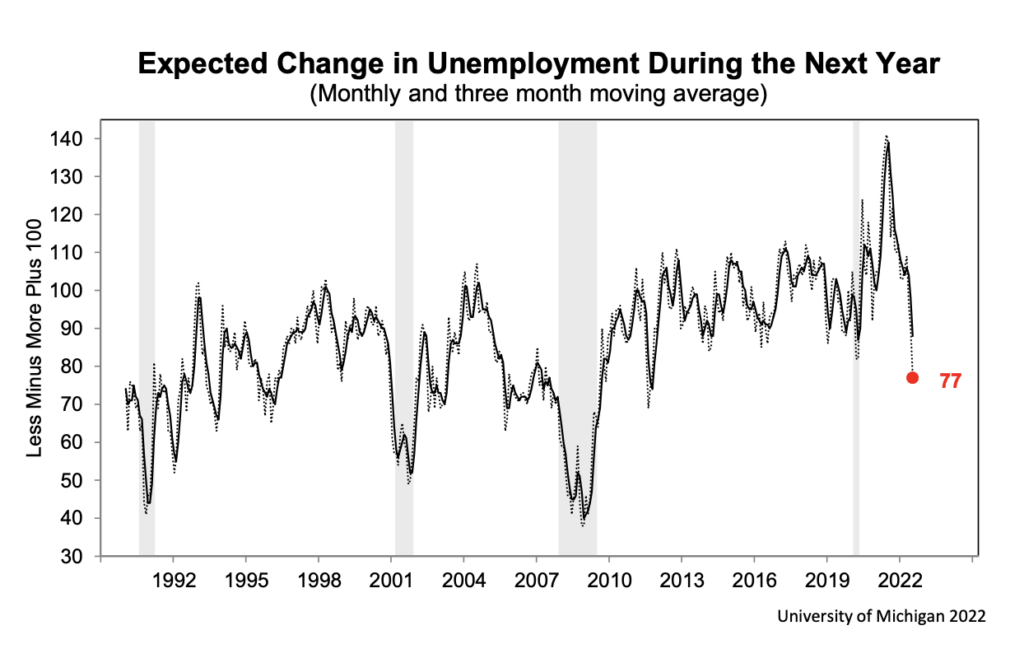

“Inflation continued to dominate consumers’ attention, and labor market expectations continued to soften,” said the survey’s director, Joanne Hsu. Indeed, despite Fed Chair Jerome Powell’s fixation on backward-looking data indicating strong job gains over the past several months, it appears that Americans are certainly not echoing the same sentiment.

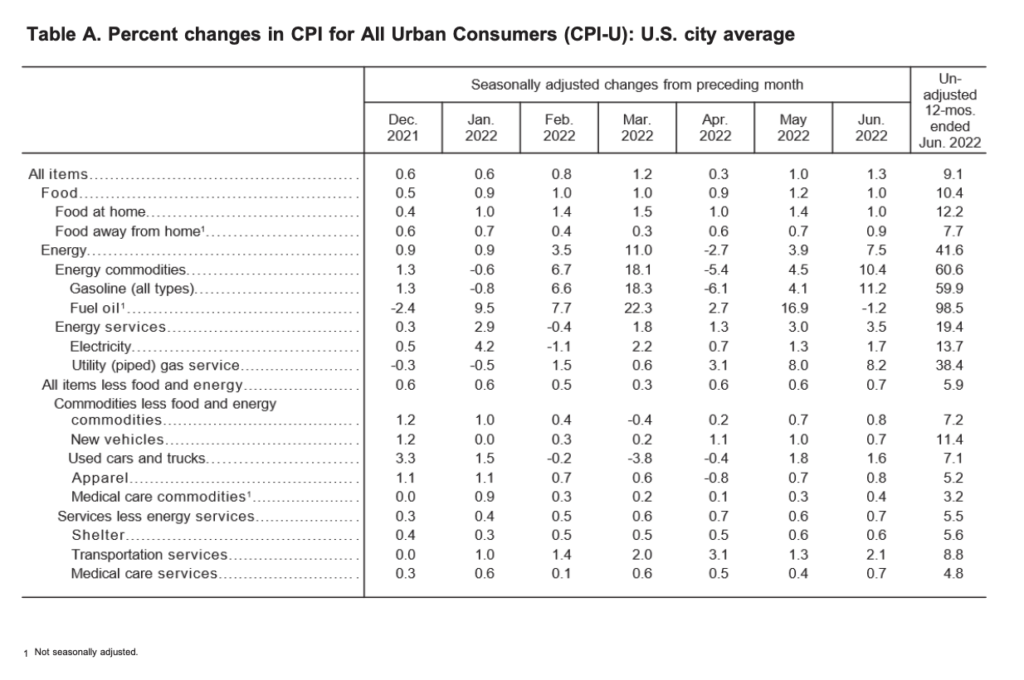

“Consumers are finding ways to cope by altering their spending patterns as high prices persist,” added Hsu. “Going forward, these behavioural adjustments are likely to grow.” Last month’s CPI data showed that consumers paid a staggering 9.1% more for goods and services, with all categories undergoing substantial and persistent price gains.

Information for this briefing was found via the University of Michigan and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.