Renting a home in the US is about to get a lot more expensive. The biggest landlord of single-family dwellings in the US has decided to raise rents by 8% across the country, in response to robust demand for housing.

According to a statement published last week, Invitation Homes Inc. has announced it will raise rent prices on renewals by 5.8% and 14% on newly signed leases. The landlord, which owns over 80,000 single-family properties across the US, has seen its shares balloon by more than 35% since the beginning of the year, as an increasing number of young Americans look for new accommodations.

Invitation also revealed that its average occupancy rate has soared by more than 98% in the second quarter, allowing the landlord to boost rent prices higher, as Americans who cannot afford to purchase a home are succumbed to renting if they want more spacious housing. In the meantime, as numerous small landlords across the US are barred from collecting rent revenue for another 60 days, corporate landlords are eagerly waiting for the generous cash flow bonanza to begin.

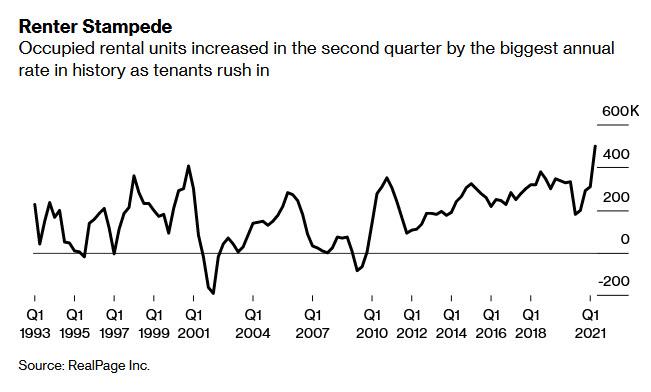

As the US emerges from the Covid-19 pandemic, a reverse migration back to cities and urban regions has begun; industry consultant firm RealPage found that the number of occupied units skyrocketed by 500,000 in the second quarter— the sharpest annual increase on records dating back to 1993. With wages on the rise, Americans are eager to move in, and some of Wall Street’s largest renting giants are not about to let a good pandemic go to waste.

Information for this briefing was found via Invitation Homes, the CDC, and RealPage. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.