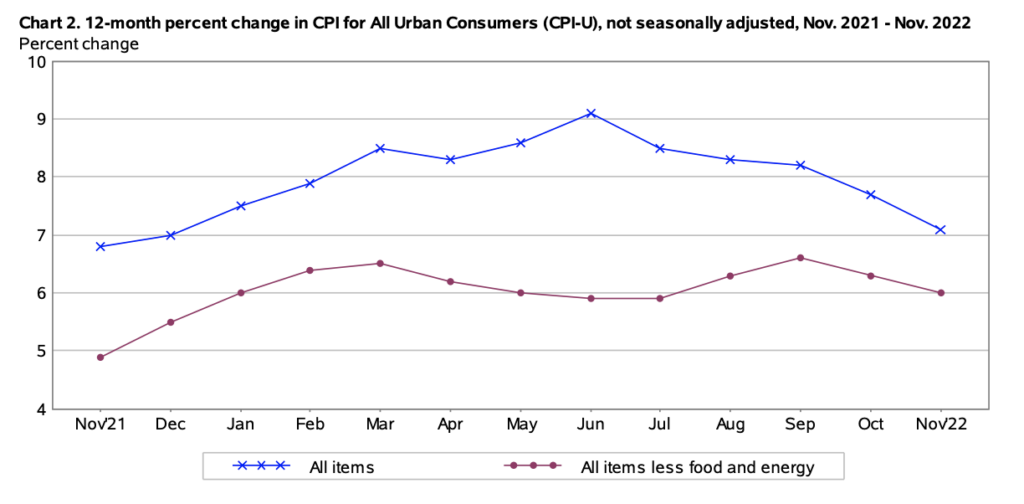

US consumer prices came in lower than expected— albeit still more than three times higher than the Fed’s target range. Real wages, meanwhile, continued their downward slide for the 20th consecutive month.

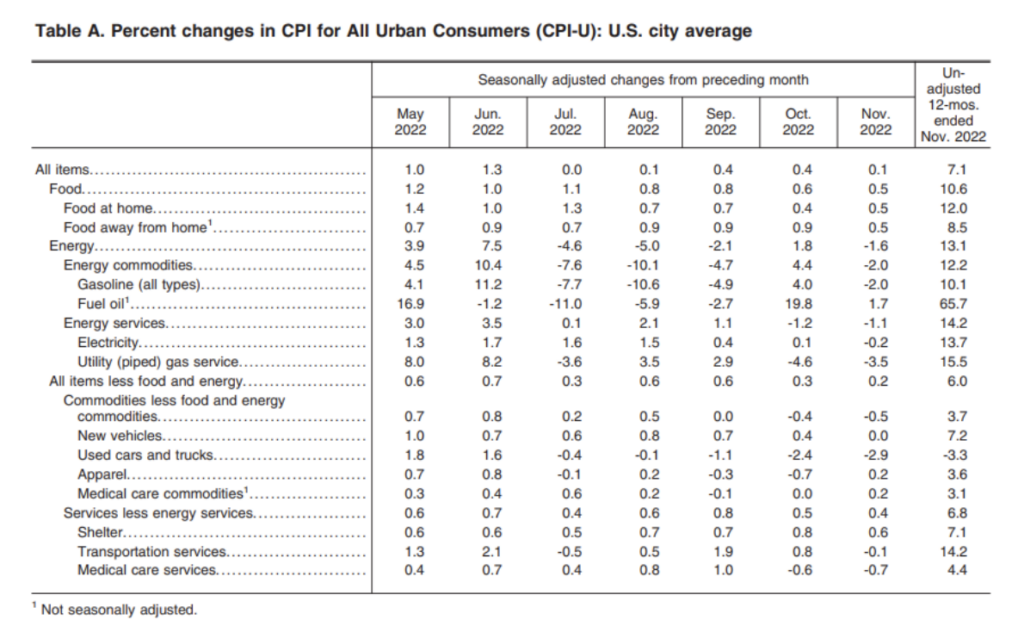

Americans paid 0.1% more for goods and services between October and November, as prices remained 7.1% higher compared to the same period one year ago. The figure follows October’s 7.7% annual increase, and is surprisingly lower than the 7.3% consensus among economists. Core CPI, which does not account for food and energy, rose 0.2% month-over-month to an annualized 6%, against last month’s reading of 6.3% and less than the forecast of 6.1%.

Last month’s inflation decline was largely driven by the ongoing month-over-month drop in energy prices and used vehicles, while the shelter and rent index continued to rise at an annualized 7.1% and 7.9%, respectively. Americans continued to pay more for food in November, as the category rose 0.5% month-over-month.

Although there are signs the US economy may be running into disinflation aside from a few volatile components (evidently still the categories everyone actually needs), Americans’ wages continued to slide for the 20th month in a row, falling 1.9% from November 2021. Now, all eyes will be on the Fed’s interest rate move on Wednesday, with markets poised for a smaller hike on the back of weakening inflation pressures.

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.