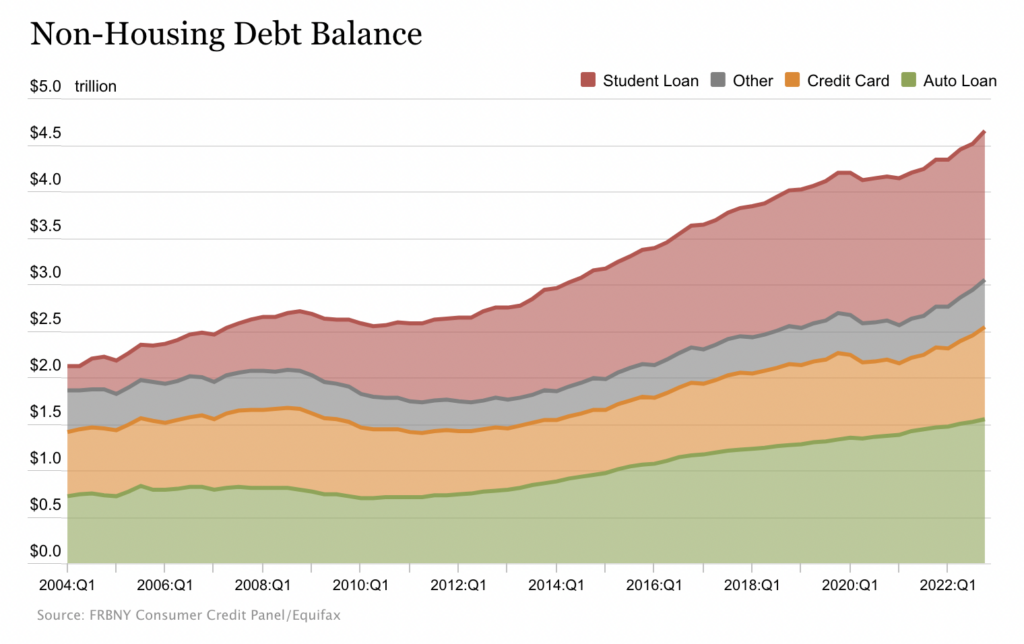

The latest report from the New York Fed’s Center for Microeconomic Data indicates that US credit card debt ballooned to $986 billion in the fourth quarter of 2022, the highest total since the New York Fed began tracking in 1999. The figure went up by $61 billion from the previous quarter — the largest observed increase in the history of their data.

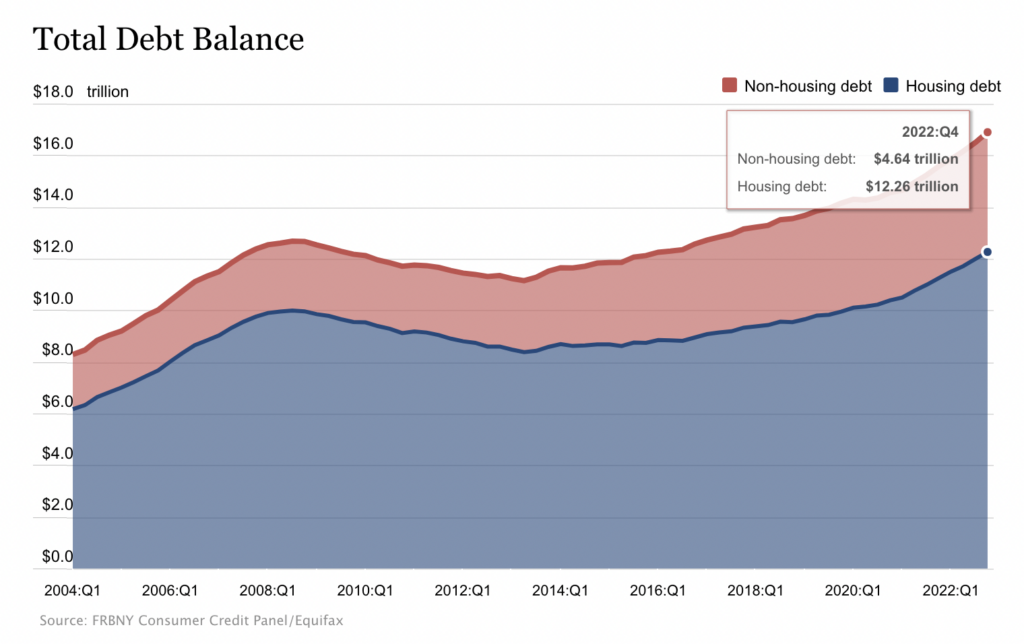

Total household debt balances grew by $394 billion in the fourth quarter of 2022, marking the largest nominal quarterly increase in twenty years. The largest portion and biggest driver of debt remains to mortgage balances which gained $254 billion in the last quarter of 2022.

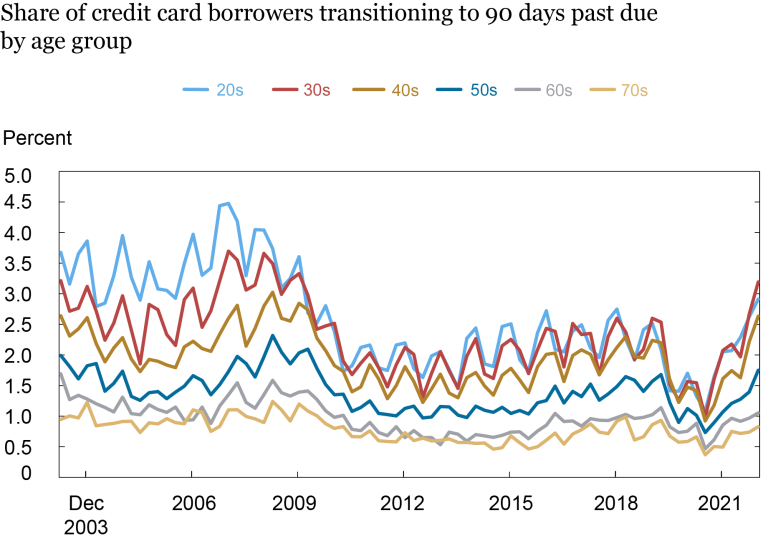

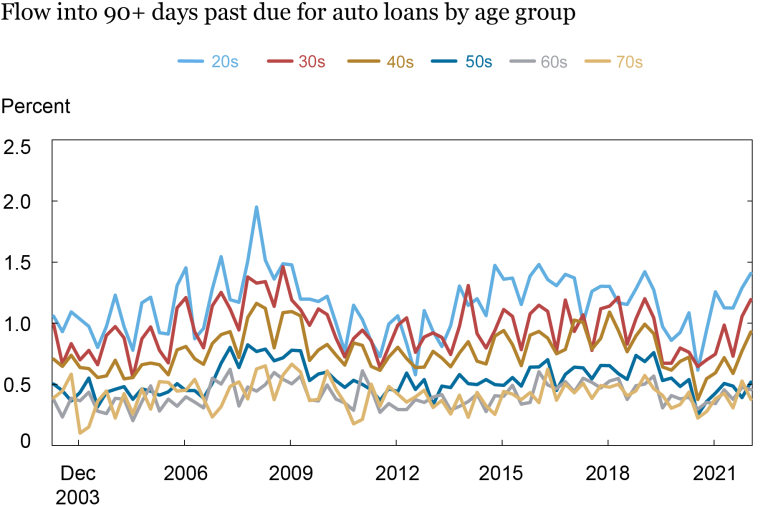

There has been a rise in delinquency transition rates for credit cards and auto loans. This increase in delinquency rates is particularly evident among younger borrowers who have surpassed pre-pandemic rates, while rates are rising for older borrowers but have not yet reached pre-pandemic levels.

The report cites a few possible culprits for the increase in delinquency rates: rising interest rates, potentially worsening underwriting standards (but they noted this is unlikely), the end of pandemic support, and of course, inflation.

With higher interest rates, borrowers end up with higher minimum monthly payments for credit card balances. The relatively higher interest rates of credit card debt than auto loans are consistent with the pattern of delinquencies rising faster for credit cards than for auto loans.

Prices are up everywhere, including the cost cars, which inflation has hit particularly hard. The average auto loan jumped from $17,000 at the end of 2019 to almost $24,000 in the last quarter of 2022.

Inflation skyrocketed in 2021 and 2022, peaking at a forty-year high in the third quarter of last year. With prices of everyday essentials becoming higher, and with incomes still not being able to match inflation especially for younger borrowers, more Americans may be using their credit cards to pay for groceries, gas, and other goods to keep up with monthly expenses.

Information for this story was found via the New York Fed, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.