America’s GDP grew by less than expected in the third quarter, further strengthening narratives that stagflation is tightening its grip on the US economy.

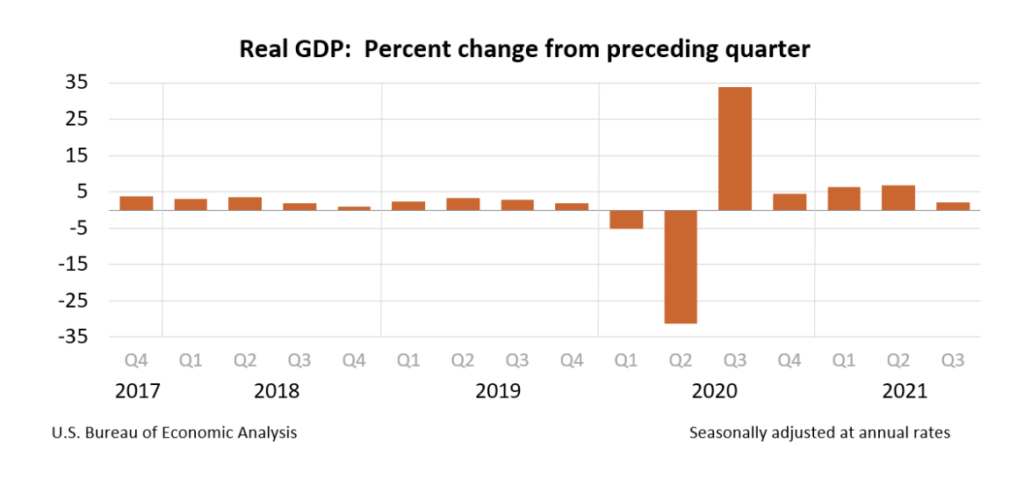

According to preliminary estimates released by the Commerce Department on Thursday, economic output rose by an annualized 2% in the third quarter, following a 6.7% increase in the prior quarter. The latest figure falls below the consensus estimate of 2.6% growth, which was forecast by economists polled by Bloomberg.

The latest GDP figures mark the slowest growth pace since the beginning of the economic recovery, as global supply chain disruptions and a continued resurgence in Covid-19 cases caused a decline in spending and investment. The deceleration in output was largely the result of a sharp drop in personal consumption, which only expanded 1.6% after increasing 12% in the second quarter.

The third quarter saw Americans spend less on both goods and services amid ongoing supply shortages, logistics bottlenecks, surging prices, and rising delta variant cases. The latest figures highlight the implications that supply constraints pose to the US economy, which has been struggling with labour shortages, lack of raw materials, and a surge in demand that significantly exceeds supply.

To underscore the true severity of the supply chain disruptions, the core PCE index, which excludes energy and food prices and is closely monitored by the Federal Reserve, jumped by an annualized 4.5% in the last quarter, after increasing 6.1% in the prior quarter. “The risks are clearly now to longer and more persistent bottlenecks and thus to higher inflation,” confessed Fed Chair Jerome Powell last week. “We now see higher inflation and the bottlenecks lasting well into next year.”

Also making matters worse is the pull-back in business investment, which slumped in the third quarter after rapidly accelerating during the beginning of the economic recovery. Non-residential fixed investment increased by only 1.8%, as outlays for equipment and structures fell lower after adjusting for inflation.

Information for this briefing was found via the BEA and Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.